The Mathematician’s Edge: Mastering the Kelly Criterion in Forex

In the high-stakes world of Forex trading, most beginners spend their time hunting for the "perfect" entry signal. They master support and resistance on the EUR/USD or follow momentum shifts on the GBP/JPY. However, the most successful traders—the ones who survive decades rather than months—know that how much you trade is often more important than what you trade.

Enter the Kelly Criterion. Originally developed in 1956 by John L. Kelly Jr. at Bell Labs, this mathematical formula was designed to optimize signal noise for telephones. It didn't take long, however, for gamblers and eventually Wall Street titans to realize its potential. Today, it stands as one of the most powerful tools for maximizing long-term wealth growth in the Forex market.

https://images.squarespace-cdn.com/content/619b666b5842697e2af69258/a9d57b27-4fad-4532-874a-89133d6a85bc/P477.02.jpg?content-type=image%2Fjpeg

https://images.squarespace-cdn.com/content/619b666b5842697e2af69258/a9d57b27-4fad-4532-874a-89133d6a85bc/P477.02.jpg?content-type=image%2Fjpeg

What is the Kelly Criterion?

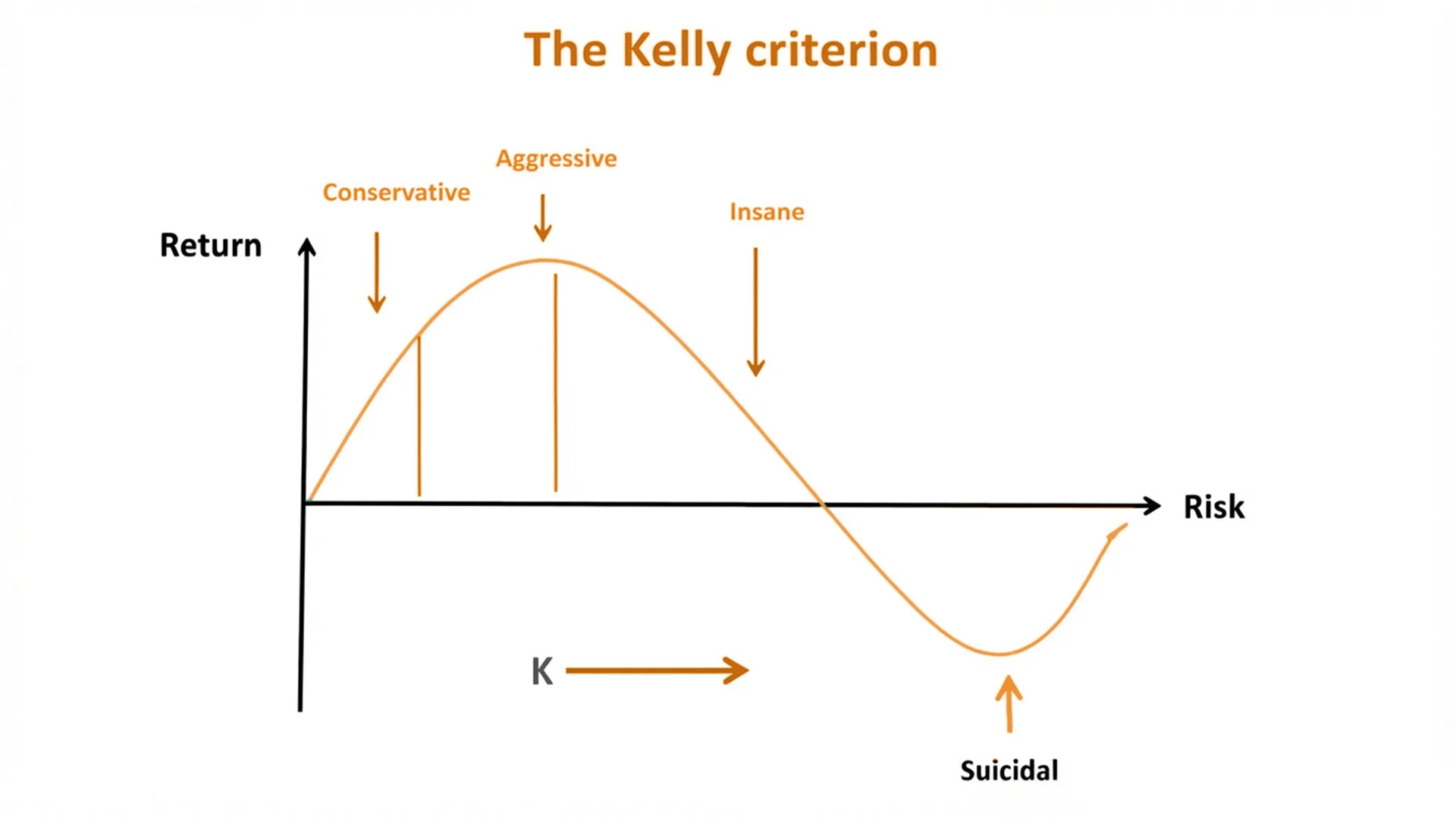

At its core, the Kelly Criterion is a formula for position sizing. It helps you determine the exact percentage of your account to risk on a single trade based on your "edge." In Forex trading for beginners, the standard advice is often to risk a flat 1% or 2% per trade. While safe, this "one-size-fits-all" approach doesn't account for the varying quality of setups.

The Kelly Criterion suggests that if you have a high-probability setup on the USD (US Dollar) with a massive potential payoff, you should risk more. If the edge is thin, you should risk less—or nothing at all.

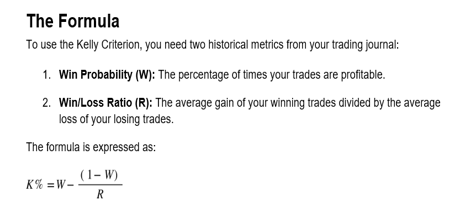

https://images.squarespace-cdn.com/content/619b666b5842697e2af69258/a9d57b27-4fad-4532-874a-89133d6a85bc/P477.02.jpg?content-type=image%2Fjpeg

https://images.squarespace-cdn.com/content/619b666b5842697e2af69258/a9d57b27-4fad-4532-874a-89133d6a85bc/P477.02.jpg?content-type=image%2Fjpeg

For example, if your strategy wins 55% of the time ($W = 0.55$) and your average win is twice your average loss (R = 2), the formula would suggest a K% of 32.5%.

The Reality Check: Full Kelly vs. Fractional Kelly

While 32.5% sounds mathematically "optimal," in the volatile world of Forex, it is often considered dangerously aggressive. A string of three losses at that size would nearly wipe out your account.

This is where the wisdom of the GME Academy comes into play. Professional speculators rarely use "Full Kelly." Instead, they use Fractional Kelly (typically Half-Kelly or Quarter-Kelly).

Half-Kelly: You take the formula's result and divide it by two.

The Benefit: It drastically reduces volatility and drawdowns while still capturing about 75% of the growth potential.

Whether you are trading a single-economy asset like the CAD (Canadian Dollar) or a volatile cross-economy pair like EUR/GBP, using a fractional approach ensures that a temporary market anomaly doesn't result in a permanent loss of capital.

Why Most Traders Fail with Kelly

The Kelly Criterion is only as good as the data you feed it. This is why Global Markets Eruditio stresses the importance of a rigorous trading journal. If you overestimate your win rate on the GBP/JPY, the formula will tell you to "over-bet," leading to a catastrophic account meltdown.

Furthermore, Kelly assumes that your "edge" remains constant. In Forex trading, market conditions change. A strategy that worked during a trending US Dollar market might fail during a period of consolidation.

Pro Tip: Only calculate your Kelly percentage after you have at least 50–100 trades in your journal. Anything less is statistically insignificant "noise."

Balancing Math with Psychology

The ultimate goal of the Kelly Criterion isn't just to make money; it's to provide a logical framework that removes emotion from Forex trading. When you know that your position size is mathematically backed by your own historical performance, the "fear of losing" begins to dissipate. You aren't just gambling; you are executing a proven mathematical advantage.

Ready to Find Your Mathematical Edge?

Position sizing is the "secret sauce" that separates the 5% of profitable traders from the 95% who lose. If you’re tired of the "guess and pray" method of trading, it’s time to level up your education.

Take control of your financial future and master the math of the markets.

Join our FREE Forex Workshop Today!