Political Aftershocks: Elections, Referendums, and Currency Spikes

In the world of Forex, if central banks are the navigators, then elections and referendums are the unpredictable weather systems. In 2026, political risk has evolved from localized "flare-ups" into a primary source of global market volatility. Whether it is a nationwide vote or a high-stakes public referendum, these events don't just move pips—they reshape entire economic trajectories.

At the GME Academy, we teach that a currency is a "share" in a country’s future. When leadership is in question, the value of that share becomes a battleground of speculation, fear, and opportunity.

https://images.squarespace-cdn.com/content/619b666b5842697e2af69258/a9d57b27-4fad-4532-874a-89133d6a85bc/P477.02.jpg?content-type=image%2Fjpeg

https://images.squarespace-cdn.com/content/619b666b5842697e2af69258/a9d57b27-4fad-4532-874a-89133d6a85bc/P477.02.jpg?content-type=image%2Fjpeg

1. The Anatomy of an Election Spike

Elections rarely cause a single move; instead, they trigger a three-stage volatility cycle:

Stage 1: Pre-Election "Pricing-In"

Weeks before the first ballot is cast, markets begin to react to polling data. If a "market-friendly" candidate (favoring deregulation or fiscal discipline) leads, the currency may strengthen. Conversely, if a candidate advocating for radical spending or trade isolationism gains ground, the currency often faces a "risk premium" sell-off.

The 2026 Context: Analysts at ActivTrades note that political risk in 2026 is no longer confined to emerging markets; it is now a core driver for G10 currencies as well.

Stage 2: The "Election Night" Flash

This is where the true "spikes" occur. As exit polls and early returns trickle in, high-frequency trading (HFT) algorithms react in milliseconds.

The Gap: Because these results often come in while major exchanges are thin (e.g., late-night Sunday in New York), liquidity can dry up, causing "gaps" where the price jumps dozens of pips without any intermediate trades.

Stage 3: Post-Election Repricing

Once the winner is declared, the market moves from "uncertainty" to "policy assessment." If the result is a divided government (e.g., the U.S. Midterms resulting in a split Congress), markets often rally on the prospect of "gridlock," which prevents major, disruptive policy shifts.

2. The Referendum: The Ultimate "Binary" Risk

Unlike elections, where multiple candidates might offer a spectrum of outcomes, a referendum is a binary "Yes/No" choice. This creates the most violent spikes in the FX market.

Historical Echo (Brexit): The 2016 UK Referendum remains the gold standard for referendum-driven spikes. The GBP/USD saw a historic collapse of over 10% in a single day—a move that usually takes years to unfold.

Why Spikes are Sharper: Referendums often touch on structural identity (e.g., leaving a trade bloc or changing a constitution). If the result is a "surprise" (not what the polls predicted), the "repricing" is instantaneous and often permanent.

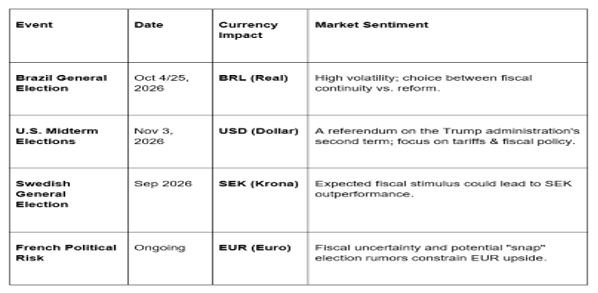

3. Major Political Catalysts in 2026

This year, several key events are keeping traders on high alert:

https://images.squarespace-cdn.com/content/619b666b5842697e2af69258/a9d57b27-4fad-4532-874a-89133d6a85bc/P477.02.jpg?content-type=image%2Fjpeg

https://images.squarespace-cdn.com/content/619b666b5842697e2af69258/a9d57b27-4fad-4532-874a-89133d6a85bc/P477.02.jpg?content-type=image%2Fjpeg

4. Safe-Havens vs. "Risk-On" Reactions

How a currency reacts depends on its global status:

Safe-Havens (USD, JPY, CHF): These usually spike upward during political chaos. If an election looks like it will lead to civil unrest or a constitutional crisis, capital flees "Risk-On" currencies (like the AUD or MXN) and floods into the Dollar or Yen.

Commodity Currencies (AUD, CAD): These are sensitive to Trade Policy changes. If an election winner is expected to impose tariffs, these currencies often spike downward.

The GME Academy Analysis: "Trade the Reaction, Not the Prediction"

At Global Markets Eruditio, we have a cardinal rule: Never bet on the pollsters. Polls in the 2020s have been notoriously unreliable.

Trader's Takeaway for 2026:

Wait for the Second Wave: The first move after an election headline is often "noise"—driven by algorithms. The "cleaner" trend usually develops 2 to 8 hours later, once institutional managers have had time to digest the policy implications.

Manage Your Leverage: Spikes can blow through stop-loss orders. Into a major vote (like the U.S. Midterms), reduce your position size by 50-75% to account for wider spreads and slippage.

The "Gridlock" Play: If you see a split government result in a major economy, look for a "relief rally" in that country's stock market and currency, as markets price out the risk of extreme legislative changes.

Join our FREE Forex Workshop at Global Markets Eruditio!

Want to see how to set up an "Election Dashboard"? We’ll show you which Implied Volatility (IV) metrics to watch and how to use the VIX (Fear Index) to time your entries during the 2026 political cycle.