MetaTrader EAs: Pros, Cons, and the Myths of "Automated Wealth"

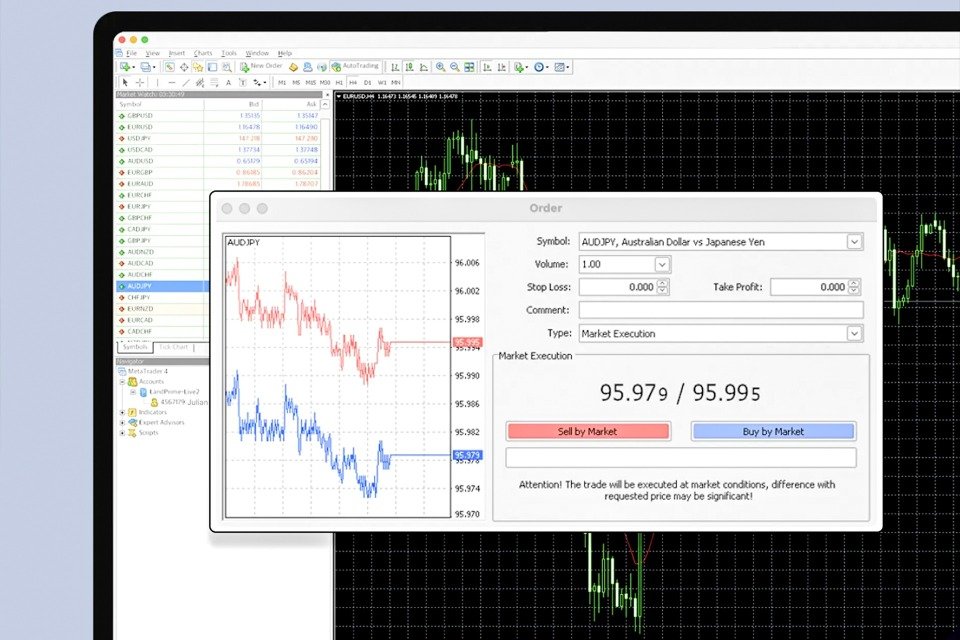

In the fast-paced markets of 2026, the dream of "trading while you sleep" has never been more popular. Expert Advisors (EAs)—the automated trading robots that run on MetaTrader 4 (MT4) and MetaTrader 5 (MT5)—are the primary tools for this automation.

At the GME Academy, we see many students view EAs as a "magic button." However, the reality of algorithmic trading is a mix of powerful advantages and significant hidden risks. Before you "let the bot loose," you need to separate the marketing hype from the technical facts.

https://images.squarespace-cdn.com/content/619b666b5842697e2af69258/a9d57b27-4fad-4532-874a-89133d6a85bc/P477.02.jpg?content-type=image%2Fjpeg

https://images.squarespace-cdn.com/content/619b666b5842697e2af69258/a9d57b27-4fad-4532-874a-89133d6a85bc/P477.02.jpg?content-type=image%2Fjpeg

1. The Pros: Why Traders Use EAs

The primary appeal of an EA is its ability to do what humans cannot: stay perfectly disciplined and work 24/7.

Emotionless Execution: A bot doesn't feel "revenge" after a loss or "greed" after a win. It executes the trade exactly when its mathematical conditions are met.

24/5 Market Monitoring: The Forex market never sleeps from Sunday night to Friday. An EA can catch a 3:00 AM breakout while you are resting.

Backtesting & Optimization: You can test an EA against 10 years of historical data in minutes. This allows you to see if a strategy actually has a statistical "edge" before risking real capital.

Speed: In a volatile 2026 market, prices can move in milliseconds. An EA can calculate entry, stop-loss, and take-profit levels and send the order to the broker faster than you can blink.

2. The Cons: The Risks of Automation

Despite their efficiency, EAs are not "set-and-forget" machines. They require constant supervision.

Technical Failures: A power outage, internet lag, or a platform crash can leave an open trade unmanaged. Most professional EA traders use a Virtual Private Server (VPS) to ensure their bot stays online 24/7.

Curve-Fitting (Over-Optimization): This is the biggest trap in algo trading. If you tweak a bot's settings until it looks perfect on past data, it often fails in live markets because it was tuned to "noise" rather than a real market pattern.

Market Regime Shifts: A bot designed for a "Trending Market" will likely lose money in a "Range-bound" market. Bots cannot "read the room" when major geopolitical news (like a sudden Central Bank intervention) changes the market's fundamental rules.

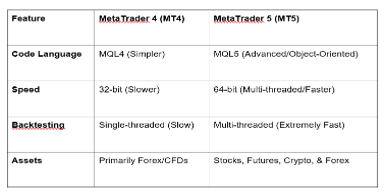

Incompatibility: An EA written in MQL4 (for MT4) will not work on MT5. In 2026, as more brokers migrate to the 64-bit architecture of MT5, many old EAs are becoming obsolete.

https://images.squarespace-cdn.com/content/619b666b5842697e2af69258/a9d57b27-4fad-4532-874a-89133d6a85bc/P477.02.jpg?content-type=image%2Fjpeg

https://images.squarespace-cdn.com/content/619b666b5842697e2af69258/a9d57b27-4fad-4532-874a-89133d6a85bc/P477.02.jpg?content-type=image%2Fjpeg

3. Common Myths vs. The Truth

Myth #1: "An EA is a 'Money Printing Machine'."

Truth: An EA is just a tool. If the strategy programmed into it is bad, the bot will simply lose your money faster than you could manually. Most "commercial" EAs sold online are "scams" that look good in backtests but fail in live accounts.

Myth #2: "You don't need to know how to trade to use an EA."

Truth: You actually need to be a better trader to manage a bot. You must know when to turn it off (e.g., during high-impact news) and how to monitor its "Drawdown" to ensure it doesn't blow your account.

Myth #3: "The most expensive EAs are the best."

Truth: Price does not equal performance. Some of the most successful institutional algos are simple, while expensive retail bots often use dangerous "Martingale" (doubling down on losses) strategies that lead to account blowouts.

The GME Academy Analysis: "Human-Led Automation"

At Global Markets Eruditio, we advocate for a "Cyborg" approach. Use an EA to handle the "grunt work"—monitoring 20 currency pairs at once and executing orders—but let the human trader make the "High-Level" decisions.

Our Pro-Tips for 2026:

Demo Test First: Never put an EA on a live account without at least 3 months of "Forward Testing" on a demo account.

Use a VPS: If you are serious about EAs, a dedicated server is mandatory to prevent "Execution Lag."

Check the "Strategy Tester" Quality: In MT5, ensure you are using "Every Tick Based on Real Ticks" for the most accurate backtesting results.

Join our FREE Forex Workshop at Global Markets Eruditio!

Are you looking for the right EA or thinking of building your own? We’ll show you how to audit any EA for "Curve-Fitting" and help you decide if an automated approach fits your current trading goals.