Python for Backtesting: Building Your Forex Laboratory

In the world of Forex Trading, "backtesting" is the process of testing a trading strategy against historical data to see how it would have performed in the past. While platforms like TradingView or MetaTrader offer built-in testers, Python is the industry standard for 2026. It allows for complex simulations, machine learning integration, and high-speed optimization that basic retail platforms simply can't match.

At the GME Academy, we teach Python-based backtesting because it empowers traders to prove their "edge" with statistical certainty before risking a single dollar of capital.

https://images.squarespace-cdn.com/content/619b666b5842697e2af69258/a9d57b27-4fad-4532-874a-89133d6a85bc/P477.02.jpg?content-type=image%2Fjpeg

https://images.squarespace-cdn.com/content/619b666b5842697e2af69258/a9d57b27-4fad-4532-874a-89133d6a85bc/P477.02.jpg?content-type=image%2Fjpeg

1. The Two Backtesting Paradigms

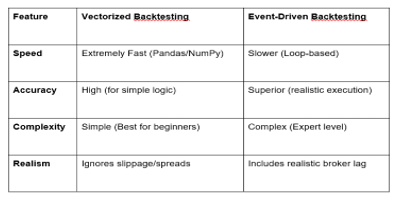

When building a backtester in Python, you must choose between two primary architectures:

https://images.squarespace-cdn.com/content/619b666b5842697e2af69258/a9d57b27-4fad-4532-874a-89133d6a85bc/P477.02.jpg?content-type=image%2Fjpeg

https://images.squarespace-cdn.com/content/619b666b5842697e2af69258/a9d57b27-4fad-4532-874a-89133d6a85bc/P477.02.jpg?content-type=image%2Fjpeg

Vectorized is ideal for rapid prototyping (e.g., "Does a 50/200 MA cross even work?"). Event-Driven is necessary when you are ready to simulate real-world conditions like bid-ask spreads and partial fills.

2. Essential Python Libraries for 2026

To build a robust Forex backtester, you don’t need to reinvent the wheel. The Python ecosystem provides specialized tools:

Pandas & NumPy: The "bread and butter" for handling OHLCV (Open, High, Low, Close, Volume) time-series data.

Backtesting.py: A lightweight, beginner-friendly library that offers interactive visualizations and built-in metrics like the Sharpe Ratio.

Backtrader: The "Swiss Army Knife" of backtesting. It supports multiple assets, broker integration, and detailed slippage modeling.

Vectorbt: A high-performance library that can run thousands of strategy variations in seconds using vectorized operations.

TA-Lib: The industry standard for calculating over 150 technical indicators (RSI, MACD, Bollinger Bands) with C-speed efficiency.

3. The 5-Step Backtesting Process

Data Acquisition: Gather at least 3–15 years of clean M1 (1-minute) or D1 (Daily) data. In 2026, sources like yfinance, Polygon.io, or your broker’s API (Oanda/IBKR) are standard.

Logic Implementation: Define your "Entry" and "Exit" rules.

Example: Buy if RSI < 30 and Close > SMA(200)Cost Integration: Crucial Step. You must factor in spreads (the cost to enter) and commissions. A strategy that looks profitable on paper often fails in live markets due to these "transaction leaks."

Performance Analysis: Look beyond the "Total Profit." Check your Maximum Drawdown (how much did you lose at your worst point?) and your Profit Factor.

Out-of-Sample Testing: Always test your strategy on data the "bot" hasn't seen before. If it works on 2020–2024 data but fails on 2025 data, you have overfitted your strategy.

The GME Academy Analysis: "Don't Trust the Equity Curve"

At Global Markets Eruditio, we warn students about "Look-Ahead Bias"—a common coding error where your algorithm accidentally uses future information to make a past decision. A backtest that shows a "perfect" 45-degree equity curve is almost always a bug.

Pro-Tips for 2026:

Use Log Returns: For long-term Forex backtests, log returns are more mathematically accurate for compounding.

Monte Carlo Simulations: Run your strategy through 1,000 "shuffled" versions of history to see if your success was just luck.

Focus on the Sharpe Ratio: Aim for a Sharpe Ratio above 1.5. This indicates you are getting good returns relative to the "stress" (volatility) the strategy puts on your account.

Join our FREE Forex Workshop at Global Markets Eruditio!

Ready to code your first bot? We’ll provide you with a pre-built Python Backtesting Template and show you how to connect to real-time data to start validating your ideas today.