The Edge of Certainty: Why Successful Traders Think Like Probabilists

In the early stages of Forex trading for beginners, many newcomers share a common, albeit dangerous, misconception: they believe that being a "pro" means knowing exactly what the market will do next. They hunt for the "Holy Grail" indicator or the perfect signal that guarantees a win on the GBP/USD or USD/CAD.

However, at GME Academy, we teach a different reality. The most successful traders in the world don't possess a crystal ball; instead, they possess a probabilistic mindset. They understand that the market is an environment of uncertainty where any single trade has an essentially random outcome, yet a series of trades can produce a predictable, profitable result.

https://images.squarespace-cdn.com/content/619b666b5842697e2af69258/a9d57b27-4fad-4532-874a-89133d6a85bc/P477.02.jpg?content-type=image%2Fjpeg

https://images.squarespace-cdn.com/content/619b666b5842697e2af69258/a9d57b27-4fad-4532-874a-89133d6a85bc/P477.02.jpg?content-type=image%2Fjpeg

The Casino Secret: Edge vs. Outcome

To understand the probabilistic thinker, look no further than the casino industry. A casino doesn't know if the next person walking through the door will hit a jackpot or lose it all. On a single-hand basis, the casino is gambling. However, because they have a slight mathematical advantage (the "house edge"), they know with absolute certainty that over 10,000 hands, they will be profitable.

Professional traders at Global Markets Eruditio operate exactly like the house. They develop a strategy—an "edge"—and then execute it repeatedly. They don't get discouraged by a single loss, nor do they get overconfident after a single win. To them, one trade is just one data point in a set of hundreds.

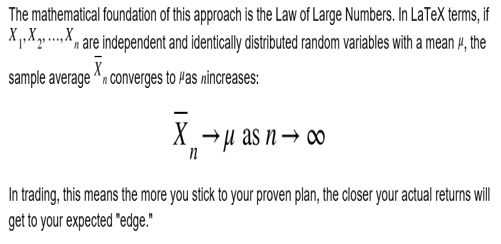

The Law of Large Numbers

https://images.squarespace-cdn.com/content/619b666b5842697e2af69258/a9d57b27-4fad-4532-874a-89133d6a85bc/P477.02.jpg?content-type=image%2Fjpeg

https://images.squarespace-cdn.com/content/619b666b5842697e2af69258/a9d57b27-4fad-4532-874a-89133d6a85bc/P477.02.jpg?content-type=image%2Fjpeg

Breaking the "Certainty" Habit

The human brain is wired to seek patterns and certainty. When a beginner sees a "Double Top" pattern on a EUR/USD chart, they feel a psychological need for that pattern to "work." If it doesn't, they feel betrayed by the market.

A probabilistic trader, however, thinks like this: "This pattern has a 60% historical success rate. This specific trade might be part of the 40% that fails, and that is perfectly fine."

By acknowledging the possibility of a loss beforehand, you neutralize the emotional sting. This is the cornerstone of Forex discipline. It allows you to trade volatile pairs like GBP/JPY without the physiological stress that leads to impulsive mistakes.

Risk Management: The Probabilist’s Shield

If you think in probabilities, Risk Management becomes your most important tool, not an afterthought. If you know that even the best strategy can have a "losing streak" of five or six trades due to simple variance, you realize that risking too much on any single trade is mathematical suicide.

Successful traders often use a fixed ratio, such as risking 1% to gain 2%.

Win Rate: 40%

Risk/Reward: 1:2

Result after 10 trades: 4 wins ($800) - 6 losses ($600) = $200 Profit

Even by being "wrong" 60% of the time, the probabilistic thinker ends up ahead. This is a concept we emphasize heavily at GME Academy because it shifts the focus from "being right" to "being profitable."

Implementing the Mindset in Your Daily Routine

How do you start thinking like a probabilist today?

Stop Predicting, Start Reacting: Don't say "The US Dollar will go up." Say, "If the USD breaks this resistance, there is a high probability of a bullish continuation."

Keep a Detailed Journal: Only by seeing your data over 50+ trades can you prove to your brain that your edge actually exists.

Detach from the Money: View your account balance as a scoreboard for your discipline, not a reflection of your self-worth.

The transition from a "prediction-based" trader to a "probability-based" trader is the single most important milestone in a trader's journey. It is the difference between gambling and running a sophisticated financial business.

Are You Ready to Find Your Edge?

Mastering the math of the markets is the key to long-term survival in Forex trading. If you are tired of the emotional rollercoaster and ready to start trading with the cold, calculated confidence of a casino owner, we are here to help.

The path to professional-grade trading starts with understanding the hidden numbers behind the charts.

Join our FREE Forex Workshop Today! Discover how to build a high-probability trading plan, manage your risk like a hedge fund manager, and finally master the mental game of trading.