RBNZ Holds OCR at 2.25%: A "Steady Hand" Policy Amid the Nascent Recovery

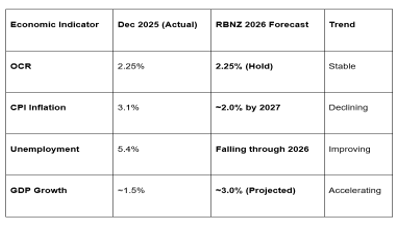

In its first policy meeting of the year on February 18, 2026, the Reserve Bank of New Zealand (RBNZ) kept the Official Cash Rate (OCR) unchanged at 2.25%. The decision reflects a central bank that is cautiously optimistic about an emerging economic recovery while remaining vigilant against "sticky" domestic inflation.

At the GME Academy, we are calling this the "Wait-and-See Pivot." Governor Anna Breman, in her first major statement since taking the helm, signaled that while the heavy lifting of rate cuts is likely over, the door for hikes isn't swinging open just yet.

1. The Growth Engine: Dairy, Meat, and Tourism

New Zealand’s economy is showing signs of life after a stagnant 2025.

Export Windfall: High global prices for dairy and meat have significantly boosted incomes for the primary sector. This "commodity tailwind" is providing the liquidity needed for regional New Zealand to reinvest.

Tourism Resurgence: A surge in international visitors has fueled a 0.7% quarterly rise in core retail spending, particularly in the hospitality sector.

Low-Rate Support: The cumulative effect of past rate cuts is finally trickling down to households. The average yield on mortgages has fallen to 5.4%, with nearly 40% of fixed-rate loans due to reprice even lower by mid-year.

2. The Labor Conundrum: 5.4% Unemployment

The labor market remains the primary point of friction in the RBNZ’s dual mandate.

Decade High: The unemployment rate rose to 5.4% in the December quarter—the highest level since 2015.

The "Participation Paradox": Surprisingly, the RBNZ views this as a sign of stabilization rather than collapse. More people are entering the workforce (participation is at 70.5%), but job creation hasn't quite caught up to the influx of seekers.

Wage Cooling: Annual wage growth has slowed to 2.0%, which the Committee noted is "consistent with inflation trending back towards 2%."

3. Inflation: The 3.1% Hurdle

While headline inflation sits at 3.1%—just outside the 1–3% target band—the RBNZ is confident that a "return to target" is imminent.

Tradables vs. Non-Tradables: Higher food prices and overseas travel costs have kept "tradables" (imported) inflation high. Conversely, "non-tradables" (domestic) inflation is falling, but is being propped up by "administered prices" like council rates and electricity.

Spare Capacity: The output gap remains at -1.5%, meaning there is still enough "slack" in the economy to prevent a renewed price spiral.

Forecast: The RBNZ expects inflation to return to the 2.0% midpoint within the next 12 months.

The GME Academy Analysis: "Watch the September Shift"

At Global Markets Eruditio, we are focusing on the RBNZ's subtle change in tone regarding the "rate track."

Trader's Takeaway for February 2026:

NZD/USD Impact: The Kiwi dollar slipped to 0.6050 following the announcement. While the hold was expected, the RBNZ's insistence that policy will remain "accommodative for some time" disappointed those looking for an immediate hawkish pivot.

The September Hike? While the RBNZ didn't explicitly signal a hike, several bank economists (including BNZ and Westpac) are now pricing in a 25bp increase in September 2026 if the recovery broadens too quickly.

Mortgage Strategy: For those on floating or short-term fixed rates, the "Goldilocks" period of 2.25% OCR is here. However, the market consensus suggests that the "bottom" for mortgage rates is likely behind us.

Join our FREE Macro Workshop at Global Markets Eruditio!

Is the Kiwi Dollar ready to fly? We’ll break down the RBNZ February Meeting Minutes and show you how to trade the NZD/AUD as the two central banks move in opposite directions.