The "Breman Debut": RBNZ Governor Hints at Year-End Hike to Combat Sticky 3.1% Inflation

Following the February 18, 2026 Monetary Policy Statement, RBNZ Governor Anna Breman held her first major press conference, delivering a message of "hawkish patience." While the Bank held the OCR steady at 2.25%, Breman explicitly put a year-end interest rate hike on the table, signaling that the era of ultra-low rates may be coming to a close sooner than many anticipated.

At the GME Academy, we’re labeling this the "Insurance Hike" narrative. Breman is making it clear: if the economic recovery accelerates too quickly, the RBNZ will not hesitate to tap the brakes to protect the 2% inflation target.

1. The "Hold Now, Hike Later" Framework

Governor Breman outlined a specific set of conditions that would trigger the first rate increase of her tenure.

The Growth Trigger: No OCR increase is expected until the RBNZ sees "stronger, more broad-based growth." While exports are up, private consumption remains the "missing link" in the recovery.

Inflationary Persistence: Despite headline inflation being projected to dip into the 1-3% band soon, Breman noted that core inflation (3.2%) is proving more stubborn.

The Q4 Signal: In a move that surprised some dovish traders, Breman stated that a Q4 2026 hike is not yet fully factored into the published OCR path, but remains a "distinct possibility" depending on the data flow through the winter.

2. Quantitative Tightening: The "Quiet" Squeeze

Beyond interest rates, Breman confirmed that the RBNZ is not done with its balance sheet "diet."

Shrinking the Sheet: The Bank will continue to shrink its balance sheet via Quantitative Tightening (QT). By allowing bonds to mature without reinvesting the proceeds, the RBNZ is effectively removing liquidity from the banking system.

Liquidity Management: This process works in tandem with the OCR to ensure that monetary conditions remain "sufficiently restrictive" even while the headline rate stays at 2.25%.

The 2026 Bond Repurchases: As part of standard operations, the Bank will still assume responsibility for repurchasing government bonds maturing in May 2026 to ensure market stability, but the overall trend is one of contraction.

3. Market Reaction: The "Kiwi Slide" Paradox

Ironically, despite Breman’s hint at a potential hike, the New Zealand Dollar (NZD) actually weakened slightly after the speech.

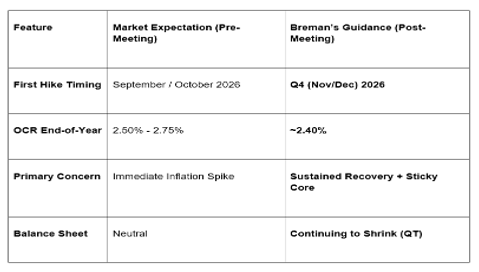

The Disconnect: Before the meeting, the market had priced in nearly 1.5 hikes by October. Breman’s "year-end" guidance was actually less hawkish than what some aggressive speculators were betting on.

Repricing the Track: The updated OCR path now shifts from 2.2% in March to 2.4% by December, a shallower tightening cycle than the "September Spike" some economists had predicted.

The GME Academy Analysis: "Trading the Shallow Hike"

At Global Markets Eruditio, we believe the "Breman Debut" establishes a high bar for actual tightening.

Trader's Takeaway for February 2026:

NZD/USD Outlook: The "Kiwi Slide" to 0.6020 presents a buying opportunity for long-term bulls. If the U.S. Fed starts cutting in June while Breman is talking about hikes in December, the yield differential will heavily favor the NZD in the second half of the year.

Fixed Income: JGBs and U.S. Treasuries are currently more volatile than NZ Government Bonds. Breman’s "no preset course" mantra suggests the RBNZ wants to be the "Anchor of Stability" in the Pacific.

Watch the April CPI: The next major "Reality Check" for this policy comes on April 20, 2026. If the Q1 CPI print remains stuck above 3%, expect Breman to shift from "Potential Hike" to "Imminent Action."

Join our FREE Macro Workshop at Global Markets Eruditio!

Is the "Breman Era" Bullish or Bearish? We’ll analyze the full press conference transcript and show you how to trade the NZD/JPY as the two "Islanders" fight for safe-haven status.