Super-Long Yields Surge: Analyzing the 30-Year JGB Auction Results (Feb 5, 2026

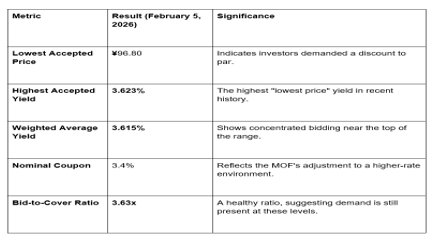

The Japanese bond market faced a critical test on February 5, 2026, as the Ministry of Finance (MOF) auctioned 30-year Japanese Government Bonds (JGBs). The results highlight a market in a "tug-of-war" between structural demand from domestic insurers and mounting fears over Japan's fiscal credibility and political shifts.

At the GME Academy, we track these "super-long" auctions as they serve as a confidence vote on Japan’s long-term economic stability. For the first time in over two decades, we are seeing yields at the 30-year end of the curve consistently breaching the 3.6% mark, a sea change for a market once defined by "zero-rate" stagnation.

1. The Auction Breakdown: Yields and Demand

The February 5 auction focused on Issue Number 89, with a maturity date stretching out to December 20, 2055.

2. The Political Catalyst: The "Takaichi Shock."

The primary driver behind these soaring yields is the upcoming snap election on February 8, 2026. Prime Minister Sanae Takaichi has signaled a massive fiscal impulse—centered on cost-of-living relief and pro-stimulus spending—which has spooked bond investors.

Fiscal Credibility: Markets are drawing parallels to the 2022 "Truss Shock" in the UK. Traders fear that unfunded spending pledges will swell Japan's already massive debt pile (the FY2026 budget stands at ¥122.3 trillion).

Yield Normalization: As the Bank of Japan (BOJ) retreats from its bond-buying program, the market is finally "discovering" prices. The 30-year JGB is no longer insulated from global shifts or local political risk.

3. Investor Dynamics: Who is Buying?

Despite the volatility, the auction was not a "failed" sale. Domestic "Liability-Driven" investors—specifically Life Insurers and Pension Funds—are stepping in.

The "Carry" Attraction: For a Japanese insurer, a 3.6% yield on a sovereign bond is the most attractive return they have seen in a generation.

The "Profit-Driven" Floor: While international hedge funds have been shorting JGBs (betting on higher yields), domestic institutions are "locking in" these rates to match their long-term payouts.

4. Forex Impact: The Yen’s Reaction

For USD/JPY traders, the JGB auction is now a high-impact event.

The Spread: Usually, higher JGB yields should strengthen the Yen. However, if yields rise because investors are fearing the government's debt (as seen in the "Takaichi Shock"), the Yen can actually weaken.

Current Levels: On the day of the auction, USD/JPY hovered around 156.81. The market is balancing the "higher yield" benefit against the "fiscal risk" downside.

The GME Academy Analysis: "Trading the Super-Long End"

At Global Markets Eruditio, we teach that super-long bonds are the "Canary in the Coal Mine." If the 30-year yield breaks above 3.8%, it could signal a deeper loss of confidence that the BOJ cannot easily fix with verbal intervention.

Are You Prepared for the February 8 Election Volatility?

The JGB market is currently in a "Fragile Transition." If the election results on Sunday favor aggressive, unfunded spending, expect another spike in yields and a volatile ride for the Yen.

Join our FREE Japanese Macro Workshop

Learn how to read the Ministry of Finance (MOF) Auction Calendar and how to correlate JGB yields with the USD/JPY. We’ll show you how to identify "Bond Crashes" and how to hedge your carry trades during political shifts