Resilience Amid the Rushes: Andrew Bailey’s 2026 Vision for the Global Economy

In February 2026, Governor of the Bank of England Andrew Bailey addressed the AlUla Conference for Emerging Market Economies. Speaking from the historic sands of Saudi Arabia, Bailey painted a "large canvas" of the global economic landscape, describing a world that is proving remarkably resilient but remains shadowed by structural headwinds and the unpredictable "rushes" of technological change.

At the GME Academy, we analyze these high-level remarks because they signal the direction of global policy and market sentiment. Bailey’s speech serves as a roadmap for understanding the interplay between AI-driven productivity, geopolitical tension, and the evolving role of Emerging Markets (EMEs) in a multi-polar world.

1. The Current Context: "Remarkable Resilience".

Bailey began by acknowledging the latest IMF World Economic Outlook (WEO). Despite higher policy uncertainty and the lingering impact of tariffs, the global economy has not buckled.

Adaptability: Economies have shown an impressive ability to adjust to a shifting landscape.

Inflation vs. Cost of Living: While headline inflation has stabilized, Bailey noted that the "cost of living"—the gap between price levels and incomes—remains a visceral concern for households worldwide.

Market Complacency: He warned of a certain "fear of missing out" (FOMO) in financial markets, particularly regarding AI valuations, which may be masking underlying risks.

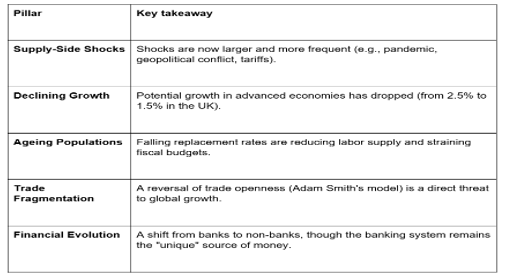

2. The Five Structural Pillars

Bailey outlined five broad areas that define our current structural backdrop. These pillars are essential for any trader or policymaker to monitor in 2026:

3. AI and the "Schumpeterian" Rush

Bailey, self-described as a "realistic optimist," leaned heavily on the theories of Joseph Schumpeter. He characterized the current era as waiting for the next General Purpose Technology (GPT)—AI and robotics—to move the dial on productivity.

"Innovation and diffusion are at the heart of the growth process known as creative destruction."

The Four Channels of AI Employment Impact:

Augmentation: Automating repetitive tasks to free up humans for higher-value work.

Displacement: Reducing demand for specific, easily automated jobs.

Reinstatement: Creating entirely new tasks and roles that were previously unimaginable.

Compositional Reallocation: Shifting jobs between sectors rather than reducing aggregate employment.

4. Imbalances in a Multi-Polar World

The Governor concluded with a sobering look at international cooperation. In a world where domestic cohesion is fraying, maintaining "economic openness" is becoming harder.

The Tension: There is a natural friction between global economic goals and national domestic objectives.

Multi-Polarity: The system is adjusting to a world with shifting "poles" of power (the US, China, and emerging blocs), which inevitably strains global finance.

Global Frameworks: Bailey argued against "variable geometry" (partnerships of only the willing) in finance, insisting that the benefits of international finance require a global, borderless institutional framework like the FSB and IMF.

The GME Academy Analysis: "Watch the Supply Side"

At Global Markets Eruditio, we take away a clear signal from Bailey’s remarks: The era of demand-side dominance is over. We are in a supply-driven world where productivity is the only true exit from the low-growth trap.

Strategies for 2026:

Bet on Productivity: Look for sectors effectively integrating AI into "task-based work"—this is where the early gains are being captured.

Diversify for Fragmentation: As trade becomes more polarized, "multi-polar" diversification (holding assets across different geopolitical hubs) is a necessity.

Monitor Fiscal Buffers: With public debt at elevated levels, fiscal stability is a primary risk factor to watch in Emerging Markets.

Join our FREE Forex Workshop at Global Markets Eruditio!

How do Central Bank speeches like Andrew Bailey's impact the GBP/USD and GBP/PHP? We’ll break down the "hawkish" and "bashful" signals in his language to help you anticipate the next move in interest rates.