ECB’s Kazimir: The "Balanced" Tightrope and the Fragile Baseline

On February 9, 2026, Peter Kažimír, the Governor of the National Bank of Slovakia and a prominent "hawk" on the ECB Governing Council, released a blog post that set a clear tone for Eurozone monetary policy: Steady as she goes, but keep your eyes on the exit.

His remarks come just days after the ECB opted to hold interest rates at 2.0% for the fifth consecutive meeting. At the GME Academy, we analyze these statements because they provide the "subtext" for the Euro's performance in 2026—moving away from the rapid rate cuts of 2024/2025 into a period of watchful maintenance.

1. "The Baseline Holds"—But It’s Fragile

Kažimír’s central message was one of "confidence without complacency." He noted that the Eurozone has entered 2026 in an "orderly, even slightly boring" fashion, with no major surprises to derail the current policy.

The Baseline Scenario: The ECB’s current plan assumes inflation will hover around its 2% target throughout the year.

The Threshold for Change: Kažimír emphasized that it would take a "major departure" from this forecast for him to consider changing interest rates.

Fragility: Despite the stability, he described the situation as "fragile," citing exceptionally high uncertainty and the likelihood of continued market volatility.

2. Balanced Risks: The Tug-of-War

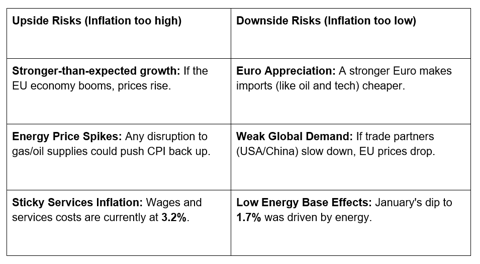

For the first time in several months, the ECB views inflation risks as "balanced." This means the threat of inflation being too high is roughly equal to the threat of it falling too low (undershooting).

3. The "Bone-Hard Fact": Exchange Rates are Not a Target

One of the most viral snippets from Kažimír’s remarks was his stance on the Euro’s value: "The Euro exchange rate is not a target for ECB policy."

While the Euro recently hit its highest level against the US Dollar since 2021, the ECB maintains that it does not manipulate interest rates to "fix" the currency's price. However, Kažimír added a crucial caveat:

"Any further appreciation will have to be evaluated against... our medium-term inflation target."

In plain English: The ECB won't move rates just because the Euro is expensive, but if a strong Euro makes imports so cheap that inflation stays permanently below 2%, they will be forced to act.

4. Policy Outlook for 2026: No "Fine-Tuning".

Kažimír, consistent with his hawkish reputation, warned against "overengineering" policy. He argued that the central bank should not react to "tiny deviations" from the target. This suggests that even if inflation dips to 1.6% or rises to 2.3% for a month or two, the ECB intends to keep rates at 2.0% for the foreseeable future.

Market Expectations: Investors are now pricing in steady rates for the remainder of 2026, with the next possible move (likely a hike) not expected until 2027.

Next Meeting: All eyes are now on the March 19, 2026, meeting, where the ECB will release its updated economic projections.

The GME Academy Analysis: "Watch the Supply Side"

At Global Markets Eruditio, we take away a clear signal from Bailey’s remarks: The era of demand-side dominance is over. We are in a supply-driven world where productivity is the only true exit from the low-growth trap.

Strategies for 2026:

Bet on Productivity: Look for sectors effectively integrating AI into "task-based work"—this is where the early gains are being captured.

Diversify for Fragmentation: As trade becomes more polarized, "multi-polar" diversification (holding assets across different geopolitical hubs) is a necessity.

Monitor Fiscal Buffers: With public debt at elevated levels, fiscal stability is a primary risk factor to watch in Emerging Markets.

Join our FREE Forex Workshop at Global Markets Eruditio!

How do Central Bank speeches like Andrew Bailey's impact the GBP/USD and GBP/PHP? We’ll break down the "hawkish" and "bashful" signals in his language to help you anticipate the next move in interest rates.