Energy Market Shock: API Reports Massive 11.1M Barrel Crude Draw

The energy markets received a major jolt on the evening of Tuesday, February 3, 2026, as the American Petroleum Institute (API) released its weekly inventory report. The data showed a staggering 11.1 million barrel decline in U.S. crude stockpiles for the week ending January 30—the largest single-week draw since June of last year.

At the GME Academy, we monitor these "inventory surprises" as primary volatility triggers. This massive draw, combined with rising tensions in the Arabian Sea, has created a "Perfect Storm" for oil prices as we move through the first week of February.

1. The Data Breakdown: A Tale of Two Stocks

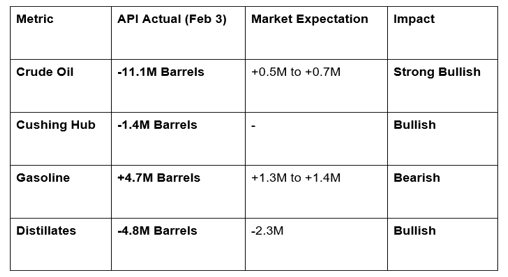

The API report presented a mixed but ultimately "bullish" (price-supportive) picture for crude oil, while signaling potential oversupply in the retail fuel market.

The Crude Plummet: The 11.1M barrel draw defied analyst expectations of a small build. This suggests that either U.S. exports have surged to record highs or domestic refinery demand is significantly higher than modeled.

The Gasoline Build: The 4.7M barrel build in gasoline suggests that while refineries are sucking up crude, the finished product isn't moving out to consumers as quickly, likely due to seasonal winter slowdowns in driving.

Distillate Draw: A 4.8M barrel drop in distillates (diesel and heating oil) reflects the ongoing cold snap across the U.S. Northeast, keeping heating demand elevated.

2. Market Reaction: Oil Reclaims $64

Following the 4:30 PM EST release, WTI Crude futures surged, jumping from $63.20 toward $63.77 in after-hours trading, eventually testing the $64.00 psychological resistance on Wednesday morning.

Geopolitical Tailwind: The inventory draw hit just as the U.S. military confirmed it shot down an Iranian drone in the Arabian Sea. This "Double-Header" of supply concerns and geopolitical risk has forced short-sellers to cover their positions rapidly.

EIA Confirmation: Traders are now bracing for the Energy Information Administration (EIA) official report due at 10:30 AM EST on Wednesday. Historically, if the EIA confirms a draw of this magnitude, oil could see a sustained rally toward $66.

Refinery Throughput: U.S. refineries are currently operating at a staggering 95.3% capacity, well above the 88–92% benchmark. This high activity explains why crude is being drawn down so quickly to be turned into fuel.

3. The "Cushing Factor."

The -1.4M barrel draw at Cushing, Oklahoma—the delivery point for NYMEX WTI—is particularly important. Cushing is the "heart" of the U.S. oil pipeline system. When stocks there drop, it creates immediate upward pressure on the "Front-Month" futures contract, as it signals tightening physical supply for immediate delivery.

The GME Academy Analysis: "Trade the Noise, Watch the Signal"

At Global Markets Eruditio, we teach our students to distinguish between "Tactical Skirmishes" and "Full-Scale War." While the shoot-down is dramatic, the fact that both sides are still signaling for Friday's meeting suggests that this is posturing, not a prelude to an invasion.

Are You Positioned for the Friday "Talks or Targets" Moment? Expect extreme volatility in WTI Crude and the USD as we approach the weekend. If the talks are canceled, oil could easily test the $70+ mark.

Join our FREE Forex & Commodities Workshop. Learn how to trade "Geopolitical Headline Shocks." We’ll show you how to use the Volatility Index (VIX) to time your entries during Middle East flare-ups and how to protect your portfolio from "Black Swan" events in the Strait of Hormuz.