The Great Hiring Break: Private Jobs Add Only 22,000 in Lackluster January

The U.S. labor market hit a significant speed bump to start 2026, as private sector employment increased by a meager 22,000 jobs in January. The latest ADP® National Employment Report, produced in collaboration with the Stanford Digital Economy Lab, painted a picture of a "fragile" workforce where growth is now almost entirely dependent on a single sector.

At the GME Academy, we view the ADP report as the "primary radar" for the U.S. economy, especially this week as the official government jobs report faces delays. The data confirms a "Low-Hire, Low-Fire" environment that is forcing Forex and Bond traders to rethink the Federal Reserve’s interest rate path for the remainder of the year.

1. The Sector Split: Health Care vs. Everyone Else

The January report revealed a stark divergence between industries. If not for the "Meds and Eds" sector, the U.S. would have likely seen a net loss in private jobs.

The Standout: Education and Health Services added a massive 74,000 jobs, effectively propping up the entire national economy.

The Sinking Ship: Manufacturing continued its grim streak, losing 8,000 jobs. The sector has now contracted every single month since March 2024.

The Service Slump: Professional and Business Services—often a leading indicator for corporate health—shed 57,000 positions, its worst performance in recent years.

2. The 2025 Retrospective: A Dramatic Step Back

ADP Chief Economist Dr. Nela Richardson provided a sobering look at the long-term trend. Job creation has not just slowed; it has halved.

2024: 771,000 jobs added.

2025: 398,000 jobs added.

The Verdict: "Job creation took a step back in 2025," Richardson noted. "While we've seen a continuous and dramatic slowdown... wage growth has remained stable."

The Wage Paradox: Despite the hiring freeze, pay for "Job-Stayers" rose 4.5% year-over-year in January. This suggests that while companies aren't hiring new people, they are paying more to keep the ones they have to avoid total turnover.

3. Size Matters: Large Employers Leading the Cuts

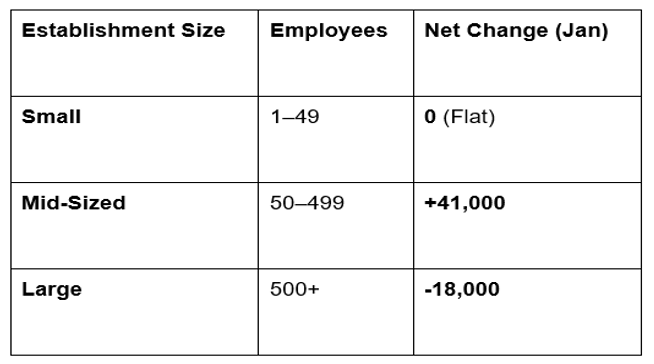

Hiring trends differed significantly based on the size of the company. In January, the "Middle" held the line while the "Top" and "Bottom" struggled.

Small businesses (1–49 employees) were a "net zero," as the gain of 30,000 in very small firms (1–19) was completely wiped out by a 30,000 loss in firms with 20–49 employees.

4. Market Impact: The "Dovish" Pivot

For Forex Trading, the "paltry" 22,000 print had an immediate cooling effect on the US Dollar (USD).

Fed Expectations: With the labor market "sputtering," traders are betting the Federal Reserve will be forced to cut interest rates by mid-year to prevent a recession.

Yield Drop: Treasury yields edged lower following the report, as investors moved toward the safety of government bonds.

The "Shutdown" Delay: Because the official Bureau of Labor Statistics (BLS) report is delayed until February 11 due to the recent government shutdown, this ADP data is currently the only major snapshot of the labor market, giving it twice the usual market impact.

The GME Academy Analysis: "Trading the Sputter"

At Global Markets Eruditio, we advise our students to look past the headline number. The real story is the Manufacturing decline and the Professional Services slump. If these sectors don't stabilize by Q2, the U.S. economy could enter a "Technical Recession."

Are You Prepared for the February 11 NFP Release?

The ADP miss has set a "Bearish" bar for next week’s official government report. If the BLS numbers confirm this 22k stagnation, expect the DXY (Dollar Index) to test new monthly lows.

Join our FREE Forex & Macro Workshop

Learn how to use ADP Pay Insights to predict inflation trends. We’ll show you how to trade the "NFP Gap" and how to position your portfolio for the Federal Reserve’s next move.