FOMC Minutes: The "Hawkish Hold" of 2026 – Balancing AI Growth Against Tariff-Driven Inflation

The Federal Open Market Committee (FOMC) released the minutes of its January 27–28, 2026 meeting, revealing a central bank in a state of "vigilant observation." While the Committee voted unanimously to maintain the federal funds rate at its current target range, the discussions painted a complex picture of an economy buffeted by technological booms and geopolitical friction.

For the GME Academy community, this meeting marks a transition from the "cooling" narrative of 2025 to a "resilient but risky" 2026. The Federal Reserve is clearly grappling with how to treat a surge in productivity led by Artificial Intelligence (AI) while simultaneously managing the inflationary "echo" of trade tariffs.

1. The Productivity Paradox: AI as a Disinflationary Force

One of the most significant themes in the January minutes was the role of technology in shaping the inflation outlook.

Automation vs. Labor Costs: Several participants noted that firms are increasingly automating operations to offset rising costs. This suggests that while wages remain firm, productivity gains might prevent those costs from being passed on to consumers.

Investment Boom: Business fixed investment remains robust, specifically in AI-related infrastructure. The Fed staff even revised the projected path of potential output upward, citing these technological advancements.

The "Supervisor" Shift: Consistent with recent Senate discussions, the Fed noted that while hiring remains low, the demand for higher-value skills to manage these new technologies is rising, potentially stabilizing the labor market at a higher "natural" rate.

2. The Inflation "Skew": Tariffs and Services

Despite the optimism around productivity, the Committee remains deeply concerned about the "skew" of inflation risks to the upside.

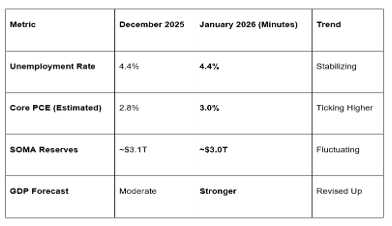

The Tariff Effect: Staff attributed a pickup in core goods inflation largely to the effects of higher tariffs enacted at the start of 2025. While these effects are expected to wane by mid-2026, they have kept PCE inflation "somewhat elevated" at 2.8%–3.0%.

Divergent Sectors: Disinflation is continuing in core services, led by a deceleration in housing. However, the Committee warned that if demand remains too resilient, reaching the 2% goal might be "slower and more uneven" than markets hope.

The "Rate Check" Mystery: The minutes clarified that recent "rate checks" on the USD/JPY exchange rate were conducted by the New York Fed solely on behalf of the U.S. Treasury, momentarily cooling speculation of a broader Fed intervention in currency markets.

3. Financial Stability: The AI "Opaque" Market

The Fed staff’s updated assessment characterized financial vulnerabilities as "notable," with a specific eye on the technology sector.

Equity Valuations: Public equity price-to-earnings ratios are at the upper end of their historical distribution, fueled by AI expectations.

Private Credit Warning: Participants highlighted the "opaque" private markets used to fund AI infrastructure. There is growing concern over the interconnections between private credit, life insurance companies, and banks.

Balance Sheet Health: Reserve Management Purchases (RMPs) are continuing, with reserves expected to fluctuate around the $3 trillion mark. The standing repo facility (SRF) is seeing increased utilization, which the Fed views as a sign of "economically sensible" market participation.

The GME Academy Analysis: "Two-Sided Risks"

At Global Markets Eruditio, we are focusing on the Committee’s move toward a "two-sided description" of future policy.

Trader's Takeaway for February 2026:

No Preset Course: The Fed has explicitly rejected the idea that it is on a "glide path" to lower rates. If inflation proves persistent due to tariffs, an upward adjustment (rate hike) is no longer a zero-percent probability.

Yield Curve Steepening: As shorter-term yields stay anchored by the "hold" but longer-term yields rise on growth optimism, we expect the 10Y-2Y Treasury spread to continue its steepening trend.

USD Outlook: The dollar may remain stronger for longer than private-sector consensus suggests, as the U.S. "growth exception" continues to outperform other G10 economies.

Join our FREE Macro Workshop at Global Markets Eruditio!

Is the Fed hiding a "Hawkish Pivot"? We’ll break down the January 2026 FOMC Attendance & Voting Record and show you how the new voting members (Hammack, Logan, and Kashkari) are shifting the Committee’s center of gravity.