Xi’s Strategic Pivot: China Shields Economy with 1.4 Billion Consumers as Global Trade Tensions Peak

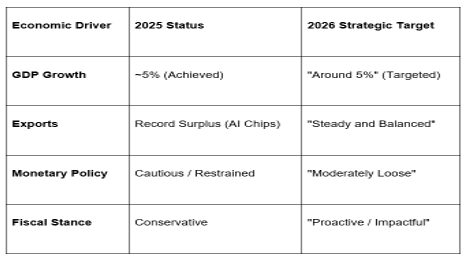

In a significant policy shift, Chinese President Xi Jinping has called for making domestic demand the "main driver" of China's economic growth for 2026. In a speech published on February 15, 2026, in the Communist Party’s flagship journal Qiushi, Xi signaled that Beijing is bracing for a more volatile global trade environment by pivoting away from its long-standing reliance on exports.

At the GME Academy, we are calling this "The Great Internalization." While China posted a record trade surplus in 2025, the underlying reality is a "lopsided" growth model that is increasingly vulnerable to Western tariffs and rising protectionism.

1. Anchoring Growth: The "Super-Large Market" Strategy

Xi’s blueprint focuses on fully leveraging China’s domestic market of 1.4 billion people to offset external risks.

Consumption Over Exports: Xi emphasized that growth must be anchored in domestic consumption and investment. This marks a departure from 2025, where 5% GDP growth was largely saved by strong semiconductor and high-tech exports while domestic spending remained cool.

The Income Injector: To boost spending power, the government plans to increase wages and basic pensions for both rural and urban residents.

Targeted Stimulus: Unlike the massive "bazooka" stimulus packages of the past, the 2026 plan is calibrated. It prioritizes "human capital" over just physical infrastructure, with investment projects more closely linked to public welfare and "livelihoods."

2. "Anti-Involution": Ending the Cut-Throat Price Wars

One of the more unique elements of Xi's speech was the call to curb "involution-style" competition.

The Problem: In sectors like Electric Vehicles (EVs) and green energy, internal competition has become so fierce that firms are slashing prices to the point of destroying profitability—a process known in China as neijuan (involution).

The Solution: Beijing is pushing for a "unified national market" and better coordination among regional governments to stop destructive price wars. This is intended to stabilize corporate margins and encourage firms to invest in high-quality development rather than just raw volume.

3. The Innovation Engine: "AI Plus" and Green Tech

Despite the shift inward, China is doubling down on its bid for technological supremacy.

New Quality Productive Forces: Xi pledged to accelerate "new growth drivers," specifically in Artificial Intelligence (AI), advanced manufacturing, and the green transition.

Strategic Hubs: New resources will be funneled into international tech centers in Beijing, Shanghai, and the Greater Bay Area to achieve "technological self-sufficiency" amid ongoing U.S. chip restrictions.

The GME Academy Analysis: "Trading the Yuan in a Holiday Lull"

At Global Markets Eruditio, we are closely watching how this "inward turn" affects the CNY (Chinese Yuan) and global commodity markets.

Trader's Takeaway for February 2026:

CNY Stability: Chinese markets are closed for the Lunar New Year (Feb 16–23). We expect a period of "forced stability" for the Yuan, but once markets reopen, watch for a potential rally if specific pension/payout details are released.

Commodity Divergence: Xi’s focus on "green industries" is bullish for metals like Copper and Lithium, but his call for "calibrated" (not massive) stimulus might disappoint those hoping for a sudden surge in Iron Ore demand.

Export-Linked FX: Currencies that rely on Chinese consumer demand (like the AUD and NZD) may see a slow recovery as the "Domestic Demand" shift takes months to filter through to actual spending.

Join our FREE Macro Workshop at Global Markets Eruditio!

Is the "China Discount" finally over? We’ll break down the 15th Five-Year Plan (2026-2030) and show you which consumer sectors are poised to benefit from Xi’s pension reforms.