NZ Services Sector Slips to 50.9: A Slow Grind Toward Recovery

New Zealand’s services sector—the engine room of nearly three-quarters of the national economy—remained in expansion territory at the start of 2026. However, the latest BNZ–BusinessNZ Performance of Services Index (PSI) suggests the road to a robust recovery remains long and uneven.

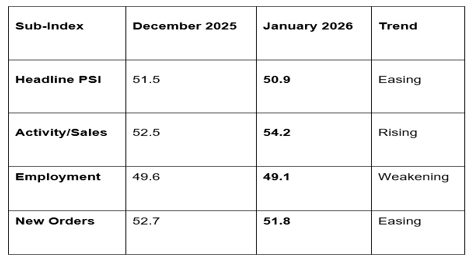

The PSI eased to 50.9 in January, down from 51.5 in December. While any reading above 50.0 signals growth, the result landed significantly below the long-term survey average of 52.8, highlighting that the sector is essentially "treading water" rather than surging ahead.

1. The Growth Engine: Sales vs. Sentiment

The January data revealed a stark contrast between actual activity and business confidence.

Activity & Sales (54.2): This was the clear standout, showing that turnover is actually increasing for many firms.

New Orders (51.8): While slipping from December’s 52.7, demand remains in expansion, providing a much-needed silver lining for forward-looking revenue.

The Sentiment Gap: Despite these positive activity marks, 58.7% of comments from business owners were negative. Respondents frequently cited the "post-holiday lull," high operating costs, and a general lack of consumer confidence.

2. The Labor Market Lag

The most concerning takeaway for many economists is the persistent weakness in hiring.

Employment (49.1): The employment sub-index dropped further into contraction. This suggests that even as sales pick up, businesses are hesitant to add headcount, preferring to wait for more concrete evidence of a sustained upturn.

Stocks & Inventories (49.7): Inventories also fell back into contraction, signaling that firms are keeping lean "just-in-case" stocks rather than building up for a boom.

3. The "Composite" Picture: Stabilization is the Theme

When combined with the Performance of Manufacturing Index (PMI), which stood at a robust 55.2, the Performance of Composite Index (PCI) remains at 52.5.

According to BNZ Senior Economist Doug Steel, the "big question" of late 2025—whether the economy had finally turned a corner—has been answered with a cautious "yes." Two consecutive months of PSI expansion (the first since mid-2023) suggest that while the growth isn't fast, it is finally becoming persistent.

The GME Academy Analysis: "Trading the Kiwi (NZD) in a Pause"

At Global Markets Eruditio, we are tracking how this "softer" expansion impacts the Reserve Bank of New Zealand (RBNZ).

Trader's Takeaway for February 2026:

NZD/USD Impact: The softer PSI reading has tempered some of the immediate bullishness for the Kiwi. However, because activity and orders are still positive, it discourages the market from pricing in aggressive rate cuts. Expect NZD/USD to remain range-bound near 0.6050 in the near term.

RBNZ Watch: With headline inflation creeping back to 3.1% in the December quarter and services activity holding its ground, the RBNZ is likely to keep the Official Cash Rate (OCR) steady at 2.25% for the foreseeable future.

The "Wait and See" Trade: Watch for the February 25 RBNZ Monetary Policy Statement. If the bank acknowledges the "stabilizing" services sector, it could provide a floor for the NZD against the AUD and JPY.

Join our FREE Macro Workshop at Global Markets Eruditio!

Is the Kiwi ready for a breakout? We’ll analyze the RBNZ February Statement live and show you how to navigate "the grind" in the NZD pairs.