The Great Rebalancing: China Urges Banks to Curb US Treasury Exposure

In a significant regulatory shift on February 9, 2026, Chinese financial authorities issued a directive to the nation’s largest banks, advising them to limit new purchases of US Treasuries and gradually reduce existing holdings. The move, framed strictly as a measure to mitigate "market risk" and "asset concentration," has sent ripples through global bond markets.

At the GME Academy, we view this not as a sudden "dumping" of debt, but as a calculated effort by Beijing to insulate its commercial banking sector from the increasing volatility of American sovereign debt and shifting geopolitical tides.

1. Why Now? The Rationale Behind the Nudge

According to reports, the guidance—delivered via oral consultations—targets the investment portfolios of commercial banks rather than China’s official state foreign exchange reserves. The primary concerns cited by regulators include:

Concentration Risk: Regulators are wary that having too much capital tied up in a single foreign asset class makes Chinese banks vulnerable to unilateral shocks.

Market Volatility: With US 10-year yields climbing toward 4.25% and 30-year yields hitting 4.88% following the news, the unpredictability of US fiscal policy has made Treasuries a less "stable" safe haven than in decades past.

Geopolitical Insurance: While officials emphasized diversification over politics, the timing—just ahead of a planned summit between President Xi Jinping and President Donald Trump in April 2026—suggests a desire to reduce financial leverage that could be used against China in future trade negotiations.

2. China's Decade of De-Dollarization

This directive is part of a much longer trend. China, once the largest creditor to the United States, has been steadily trimming its Treasury stockpile for over ten years.

2013 Peak: China held roughly $1.32 trillion in US Treasuries.

2025/2026 Reality: Holdings have fallen to approximately $683 billion, the lowest level since 2008.

Ranking Shift: China now ranks third among foreign holders, trailing behind Japan and the United Kingdom.

3. Market Reaction: Yields Up, Dollar Softens

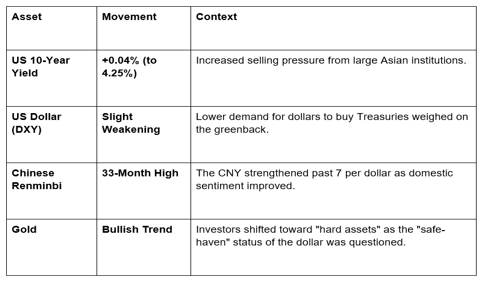

The immediate reaction in Asian and European trading sessions was a "sell-off" in US government bonds, leading to a spike in yields (which move inversely to prices).

4. Domestic Focus: Turning the Credit Tap On

While curbing US exposure, Beijing is simultaneously pushing banks to support the domestic economy. In January 2026, Chinese banks issued a staggering 5 trillion yuan ($721 billion) in new loans.

By pulling capital out of foreign debt and pushing it into local infrastructure, tech, and consumer credit, the government hopes to counter persistent deflation and the ongoing property sector crisis.

The GME Academy Analysis: "A Defensive Wall"

At Global Markets Eruditio, we believe this directive acts as a "defensive wall." By encouraging banks to diversify, China is reducing the systemic risk that could bleed into its balance sheets if US diplomatic tensions escalate into a broader trade conflict or trigger a violent sell-off in American bonds.

Trader's Takeaway for 2026:

Watch the "Shadow" Holdings: Some analysts suspect China is moving its US debt into custody accounts in Belgium and the UK to hide its true exposure. Watch the "International Public Finance" flows for clues.

Yield Volatility: Expect higher "tail risk" in US Treasury auctions. If the world's third-largest holder is on the sidelines, the US Treasury must offer higher yields to attract other buyers.

USD/CNY Correlation: The strengthening of the Renminbi suggests that China is comfortable with a stronger currency if it means a more stable, self-reliant financial system.

Join our FREE Forex Workshop at Global Markets Eruditio!

Is the dollar losing its "Reserve Currency" crown? We’ll analyze the USD/PHP and USD/CNY pairings to show you how to profit from these massive structural shifts in global capital.