The Takaichi Tsunami: LDP Secures Historic Supermajority in Japan

In a political earthquake that has reshaped the landscape of East Asia, Prime Minister Sanae Takaichi and her Liberal Democratic Party (LDP) have secured a historic two-thirds "supermajority" in Japan’s Lower House. According to final projections from public broadcaster NHK on February 9, 2026, the LDP-led coalition won 352 seats in the 465-member chamber, a landslide victory that gives Takaichi an almost unprecedented mandate to overhaul Japan’s economic and defense policies.

At the GME Academy, we view this result as a major "Risk-On" signal for Japanese assets, but one that comes with significant implications for Forex Trading and regional stability.

1. The Numbers: A Mandate for Change

The scale of the victory has stunned even seasoned observers. The LDP alone secured 316 seats, regaining a standalone majority just months after the party appeared crippled by funding scandals and the loss of its majority in late 2024.

The Coalition: Together with the Japan Innovation Party (JIP), the bloc now controls 352 seats.

The "Supermajority" Power: With more than 310 seats (two-thirds), the coalition can now override vetoes from the Upper House. This effectively removes the legislative "gridlock" that has hampered previous Japanese administrations.

The Opposition Collapse: The "Central Reform Alliance," a fragile pact between the CDP and Komeito, saw its seats slashed to just 49, leaving the opposition in total disarray.

2. "Takaichinomics" and the Forex Market

For Forex Trading for Beginners, the election result immediately triggered a "Sell the News" reaction followed by a sharp recovery in the Japanese Yen (JPY).

Prime Minister Takaichi, a self-described admirer of Margaret Thatcher, campaigned on a platform of expansionary fiscal policy and a temporary suspension of the 8% consumption tax on food. While this "Takaichinomics" approach is aimed at ending decades of sluggish wages, it raises concerns about Japan's massive debt-to-GDP ratio.

The Market Reaction:

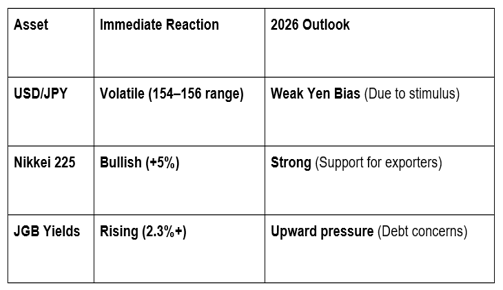

Nikkei 225: Jumped as much as 5% on Monday morning as investors cheered the prospect of stability and fresh stimulus.

USD/JPY: The Yen initially weakened toward 156 on fears of aggressive spending but rebounded as markets priced in the possibility that a stronger economy might allow the Bank of Japan to hike interest rates sooner.

3. A New Security Era: The End of "Strategic Ambiguity."

Perhaps the most significant impact of Takaichi’s supermajority is in foreign policy. Japan's first female Prime Minister has pledged to:

Double Defense Spending: Reaching 2% of GDP by the end of 2026.

Constitutional Reform: Using the supermajority to potentially amend Article 9, allowing Japan a more proactive military stance.

Taiwan Support: Takaichi has been vocal about Japan’s role in a "Taiwan contingency," a stance that has already drawn sharp rebukes from Beijing but earned a "Complete and Total Endorsement" from the U.S. administration.

The GME Academy Analysis: "Leaning into the Landslide"

At Global Markets Eruditio, we believe the USD/JPY and EUR/JPY pairs will be the primary battlegrounds for traders in the coming months. The Takaichi landslide provides the "Political Stability" that Japan has lacked, but her fiscal ambitions could put her on a collision course with the Bank of Japan’s desire to normalize rates.

The Strategy: Traders should look for opportunities in Japanese equities (Nikkei) as the "Takaichi Stimulus" rolls out, but remain cautious of the JPY volatility. If the government successfully suspends the food tax without issuing massive amounts of new debt, the Yen could see a surprise surge in mid-2026.

Join our FREE Forex Workshop at Global Markets Eruditio!

Are you ready to trade the "Japan Supermajority"? Our experts will break down how Takaichi’s budget will impact USD/JPY price action and show you how to navigate the risks of trading in a high-interest-rate environment.