The Disinflation Dilemma: China’s January Price Data Misses the Mark

In the complex economic theater of 2026, China continues to grapple with a "mismatch" between its industrial might and its domestic appetite. On February 11, 2026, the National Bureau of Statistics (NBS) released data showing that while consumer prices are technically rising, the momentum is far weaker than markets had hoped.

At the GME Academy, we view China’s current state as a "tug-of-war" between state-driven investment and a cautious consumer. The latest figures suggest that without a more aggressive "demand-side" boost, the world’s second-largest economy remains anchored by deflationary gravity.

1. CPI: A Muted Recovery

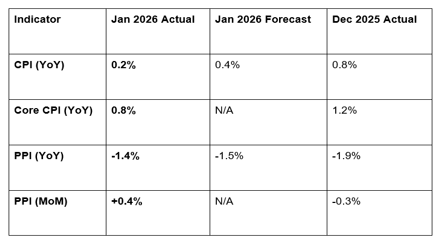

China’s Consumer Price Index (CPI) rose by 0.2% year-on-year in January 2026. While any positive number is a reprieve from the outright deflation seen in previous years, the result fell short of the 0.4% increase expected by economists.

The Core Issue: Core CPI (which excludes food and energy) slowed to 0.8%, down from 1.2% in December. This indicates that the underlying demand for services and non-essential goods is cooling.

Holiday Distortions: Analysts from eToro and Pinpoint Asset Management noted that the data is "noisy" due to the timing of the Lunar New Year. Since the holiday falls in mid-February this year (compared to January last year), the year-on-year comparison lacks the usual holiday spending surge.

The "Combined Read": Professional traders are looking at January and February as a single block of data to get a true sense of the consumer's pulse.

2. PPI: The 40-Month Deflationary Streak

While consumer prices struggle to rise, Producer Prices (PPI) continue to fall. The PPI declined 1.4% in January, marking the 40th consecutive month of factory-gate deflation.

Overcapacity and "Involution": The persistent drop in producer prices is driven by "involution"—a state where too many firms are chasing too little demand, leading to aggressive price-cutting to survive.

Margin Squeeze: For manufacturers, this is a "profitability trap." As they cut prices to clear inventory, their margins collapse, often leading to wage freezes or layoffs, which in turn weakens consumer spending.

A Glimmer of Gold: On a month-on-month basis, producer inflation actually rose 0.4%, partially supported by the recent global surge in gold prices, which boosted the mining and precious metals sector.

3. The Macro Debt Trap

A major concern highlighted by Morgan Stanley is the widening gap between China’s growth drivers and its debt burden.

Debt-to-GDP Soars: While the U.S. federal debt-to-GDP ratio sits at 124% for 2025, China’s total public debt-to-GDP has expanded rapidly, reaching 116% in 2025 (up from 76% in 2019).

Nominal vs. Real GDP: In 2025, China's real GDP grew by 5%, but nominal GDP only grew by 4%. At Global Markets Eruditio, we teach that when nominal growth is lower than real growth, it’s a red flag for "Debt Deflation." It means it is becoming harder for companies and local governments to pay back debts with their current income.

The GME Academy Analysis: "Watch the PBOC Pivot"

The People's Bank of China (PBOC) has signaled that it is ready to move toward "appropriately loose" monetary policy to prevent a deflationary spiral.

Trader's Takeaway for 2026:

Stimulus is Coming: Expect further cuts to the Reserve Requirement Ratio (RRR) and interest rates following the National People's Congress next month. Beijing is shifting focus from "Investment Only" to "Investment + Consumption."

Global Deflation Export: If China cannot stimulate domestic demand, it will continue to export its deflation to the rest of the world via low-cost goods. This helps lower inflation in the U.S. and Europe but puts pressure on global manufacturing competitors.

Yuan (CNY) Outlook: Soft inflation data usually pressures the Yuan. For our students trading USD/CNH, we are watching for a potential retest of the 7.30 level as the PBOC allows for a weaker currency to boost exports while they wait for domestic consumption to wake up.

Join our FREE Forex Workshop at Global Markets Eruditio!

Want to know how to trade the "China Link"? We’ll show you how to correlate Chinese inflation data with AUD/USD and Commodity prices, and provide you with our "2026 Global Macro Heatmap."