Economic Stagnation or Stabilization? Decoding December 2025 Retail Sales

In the financial ecosystem of 2026, few indicators carry as much weight as the Advance Monthly Sales for Retail and Food Services. Released on February 10, 2026, the latest report from the U.S. Census Bureau provides a sobering snapshot of the American consumer at the close of 2025.

At the GME Academy, we teach that retail sales are the "lifeblood" of the U.S. economy, representing roughly two-thirds of GDP. When these numbers stall, the market doesn't just watch—it reacts.

1. The Headlines: Flatlining in December

The headline figure for December 2025 came in at $735.0 billion, which was virtually unchanged (0.0%) from November. For context, economists had forecasted a growth of 0.4%.

Year-Over-Year (YoY): While the month-on-month (MoM) data was flat, sales were still up 2.4% compared to December 2024.

Annual Growth: For the full year of 2025, total sales increased by 3.7% over 2024.

The November Revision: The previous month’s growth was left unrevised at 0.6%, suggesting that the holiday shopping "spree" happened early, leaving December drained.

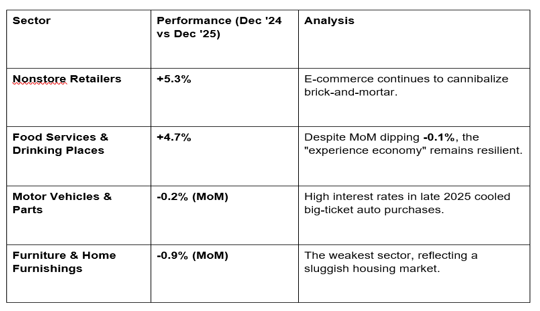

2. Winners and Losers: A Two-Speed Economy

Beneath the flat headline number, a significant reshuffling of consumer priorities occurred. In 2026, we are seeing a clear "bifurcation"—higher-income households continue to spend, while lower-income cohorts are pivoting toward value.

3. Market Impact: The Dollar’s "Hard Stop"

As of February 11, 2026, the Forex and Equity markets are still digesting this data. The "flat" reading sent immediate ripples through the global desk.

The US Dollar (DXY): The Dollar Index fell below 97.0 following the release. Weak retail data strengthens the case for the Federal Reserve to implement rate cuts earlier in 2026 than previously expected.

Equities: While the Dow Jones hit record highs, the S&P 500 and Nasdaq showed caution. Investors are worried that "consumer fatigue" could lead to a broader earnings slowdown in Q1 2026.

The "Canary in the Coal Mine": Many analysts, including Chris Zaccarelli of Northlight Asset Management, warn that this could be the first sign of a more serious economic cooling.

4. 2026 Outlook: Tax Refunds and the "Wealth Effect"

Despite the dour December data, some economists remain optimistic for the current quarter.

The $50 Billion Surge: Estimates suggest that tax refunds in early 2026 will be roughly $50 billion higher than last year due to the "One Big Beautiful Bill Act" adjustments. This could provide a much-needed "second wind" to consumer spending.

The Wealth Effect: Continued strength in the stock market (S&P 500 nearing 7000) keeps the "wealth effect" alive for upper-income households, who account for over 50% of total U.S. spending.

The GME Academy Analysis: "Trade the Trend, Not the Tick"

At Global Markets Eruditio, we remind our traders that one flat month does not equal a recession. However, it does signal a shift in market sentiment.

Trader's Takeaway for 2026:

Watch the Core: "Core" retail sales (excluding autos and gas) dipped -0.1%. This is the metric most closely tied to GDP. If this trend continues into January 2026, expect significant USD weakness.

The Fed Watch: The probability of an April rate cut has risen to nearly 37%. Keep a close eye on the upcoming CPI (Inflation) and Jobs data later this week to see if they confirm the "cooling" narrative.

USD/PHP Context: A stalling U.S. economy generally puts downward pressure on the Greenback. For Philippine traders, this could offer a window of Peso strength, though this may be offset by local inflation concerns.

Join our FREE Forex Workshop at Global Markets Eruditio!

Want to see how we trade the "Fundamental Divergence" between retail sales and Fed policy? We’ll break down our "Economic Calendar Playbook" and show you how to position yourself for the next big US data release.