Steady as She Goes: Lorie Logan on the Fed’s "Cautiously Optimistic" 2026 Strategy

In the quiet halls of the Asset Management Derivatives Forum in Austin, Texas, Dallas Fed President Lorie Logan delivered a clear message to the financial elite on February 10, 2026: The era of rapid rate cuts is on pause. Following a series of insurance cuts in late 2025, the Federal Open Market Committee (FOMC) has transitioned into a "watchful wait" phase.

At the GME Academy, we analyze these speeches not just for what is said, but for the underlying "policy pivot." Logan’s remarks signal that the Federal Reserve is currently sitting at the Neutral Rate—a delicate balance where the economy neither overheats nor freezes.

1. The Dual Mandate: Balancing Act in a Post-Shutdown World

The Fed's mission is simple in theory, yet complex in practice: Maximum Employment and Price Stability.

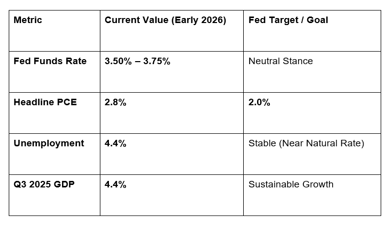

The Labor Market: After a volatile 2025 marked by government shutdowns and shifts in immigration policy, the labor market has stabilized. The unemployment rate ticked down to 4.4% in December, which Logan views as being near the "natural rate" of full employment.

Inflation Stagnation: While progress has been made, headline PCE inflation sits at 2.8%—well above the 2% target.

The "Insurance" Cuts: Logan justified the three rate cuts at the end of 2025 as "insurance" against a labor market crash. Now that the crash hasn't materialized, the risk has shifted back to inflation.

2. The Inflation Outlook: Why 2% Remains Elusive

Logan is "cautiously optimistic" but not "confident." She highlighted several factors that could keep prices stubbornly high throughout 2026:

Tariff Lag: Upward pressure from tariff rates is expected to fade, but the full "pass-through" to consumer prices may take most of the year.

Service Sector Stickiness: While housing rents are cooling due to increased supply, core non-housing services (like healthcare and education) remain flat and resistant to disinflation.

Upside Risks: Generative AI and deregulation are expanding the economy's "productive capacity," but the massive investment required to build these technologies can actually push prices up in the short term.

3. The "Neutral Rate" Puzzle

One of the most technical parts of Logan's speech involved the Neutral Interest Rate (r*). This is the theoretical interest rate that allows the economy to grow without fueling inflation.

Moving Goalposts: Estimates of the real neutral rate have climbed since the pandemic. Current models suggest it sits between 1.08% and 2.09%.

Policy Stance: With the current real fed funds rate at roughly 1.64% (nominal rate of 3.64% minus 2% inflation), Logan argues the Fed is already at "neutral."

The Takeaway: If policy is neutral rather than "restrictive," it provides very little "braking force" on inflation. This explains why the Fed is reluctant to cut rates further.

4. Policy Implementation: The "Ample Reserves" Regime

For the derivatives and asset management crowd, Logan touched on the "plumbing" of the financial system.

Ending the Runoff: In December, the Fed stopped shrinking its balance sheet after a $2.2 trillion reduction.

Reserve Management Purchases (RMPs): The Fed will now start buying securities again—not as stimulus, but to keep the supply of "bank reserves" ample.

The Indicator: Logan watches the TGCR (Tri-party General Collateral Rate) relative to the IORB (Interest on Reserve Balances). When these rates spread apart, it signals that banks are hungry for liquidity.

The GME Academy Analysis: "High for Longer" is Back

At Global Markets Eruditio, we believe Logan’s speech is a "hawkish hold." She is effectively telling the market: "Don't expect more cuts unless the labor market breaks."

Trader's Takeaway for 2026:

US Dollar Support: The Fed's hesitation to cut rates further, combined with strong GDP growth, provides a fundamental "floor" for the USD.

Yield Curve Watch: Expect the 10-year Treasury yield to remain sticky above 4.0% as the market realizes the Fed isn't in a hurry to reach a 2% nominal rate.

USD/PHP Context: For Bicolano and Filipino traders, a "Neutral" Fed likely means the Dollar will remain strong against the Peso for the first half of 2026. Watch the 56.50 – 57.00 range on USD/PHP as a key area of institutional interest.

Join our FREE Forex Workshop at Global Markets Eruditio!

Want to master the "Central Bank Playbook"? We’ll show you how to trade Interest Rate Differentials and decode the "Fed-speak" that moves the markets in 2026.