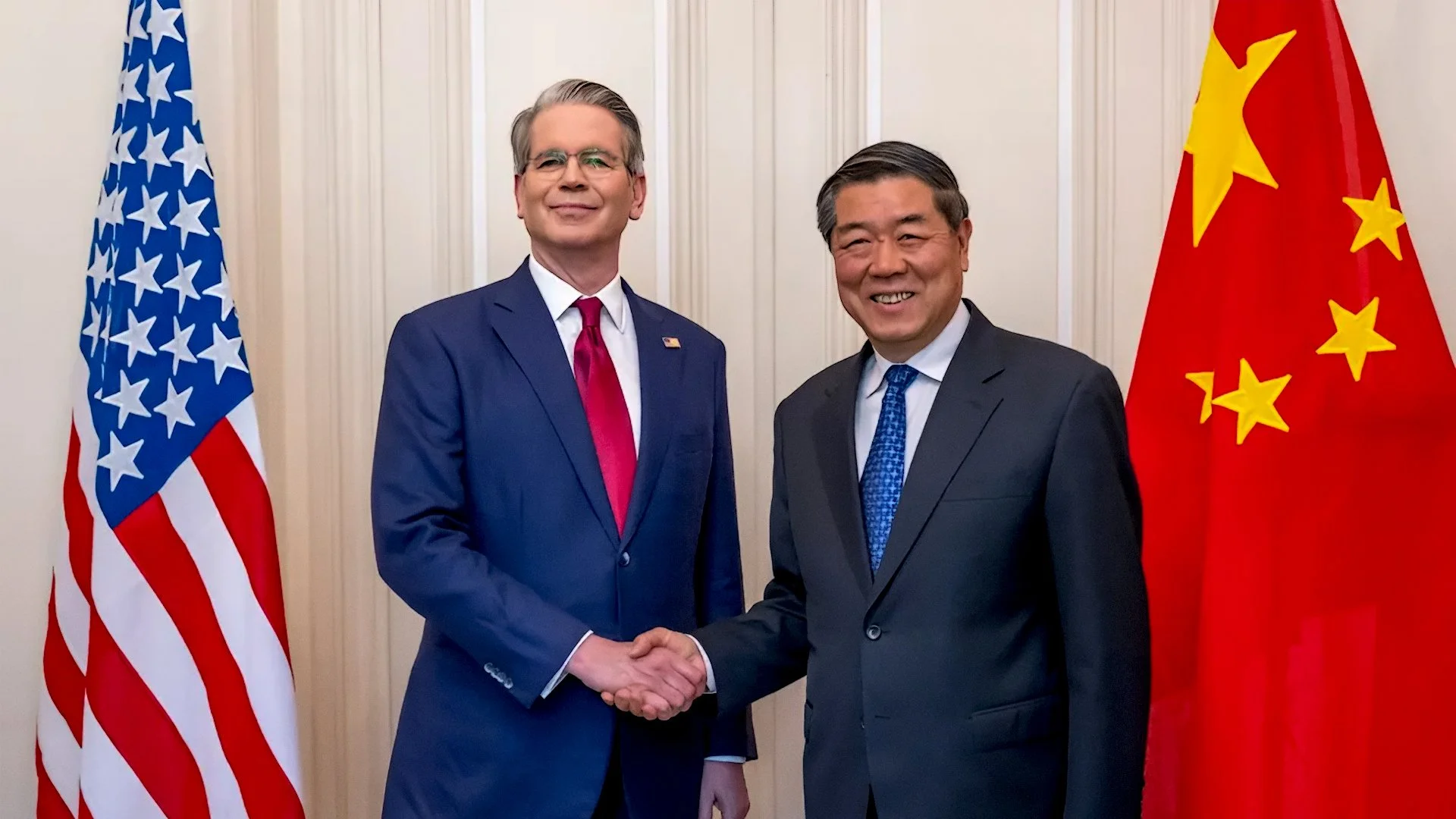

Deal or No Deal? Scott Bessent Says China Is Ready to Make a Trade Pact

Why This Matters

In recent remarks, Treasury Secretary Scott Bessent revealed that the People’s Republic of China may be ready to reach a trade agreement with the United States — a development that carries significant implications for global markets and the Federal Reserve’s monetary stance.

For those studying at or following the teachings of GME Academy, this is a key moment in understanding how major fundamental events can influence currencies like the U.S. Dollar (USD) and others impacted by U.S.–China trade.

What the Deal Looks Like

According to reports, several components of the proposed deal include:

A “very substantial framework” has been formed between the U.S. and China to avoid imposition of additional 100% tariffs on Chinese goods.

China has agreed to defer export-controls on rare earths and other strategic items — a major U.S. concern.

The U.S. has secured commitments on increased Chinese purchases of U.S. agricultural products and cooperation on addressing precursor chemicals tied to fentanyl trafficking.

The previously threatened 100% additional tariff on Chinese goods is now “effectively off the table”, a signal that tensions may be easing.

Why Forex Traders Should Care

For forex trading and Forex Trading for Beginners, this deal signals a shift in global risk and currency flows. Here’s how:

USD Strength/Weakness: If a deal eases trade tensions, the USD may weaken slightly as safe-haven demand falls. But if the deal leads to stronger U.S. growth (via exports or lower tariffs), USD could strengthen.

Commodity Currencies: Countries whose economies depend on Chinese demand (like Australia or Canada) could benefit if China increases purchases — strengthening their currencies.

Risk Sentiment: A deal favours risk-on environments, which often means weaker USD in pairs such as EUR/USD or stronger AUD/USD.

Interest Rate Outlook: If trade stability improves, inflation pressure might rise (due to more activity) — prompting the Fed to act. Forex traders should monitor for shifts in interest-rate expectations.

How Ordinary Citizens Are Affected

You might be wondering: “What does a trade deal between the U.S. and China have to do with me in the Philippines?” A lot, actually.

Imported goods could become cheaper if tariffs fall, meaning lower prices on electronics, appliances, and everyday items.

Exporters from the Philippines tied to Chinese supply chains or U.S. buyers may see increased demand, which can boost jobs and incomes.

For OFWs sending remittances: global currency dynamics shift when big economies change course. The USD-Peso exchange rate could be indirectly affected.

As part of your financial literacy toolkit — especially if you’re learning via GME Academy — this deal shows how geopolitical events ripple down to wallets, jobs, and household budgets.

Possible Outcomes & What to Watch

1. Deal Signed Quickly

What Could Happen: Reduced tariffs, China boosts U.S. buys

Market Implication: Risk-on sentiment → USD slightly weaker; commodity currencies stronger

2. Delay or Partial Deal

What Could Happen: Some issues unresolved, tariffs remain

Market Implication: Mixed sentiment → higher volatility; USD may strengthen as safe-haven

3. No Deal / Escalation

What Could Happen: Tariffs go up again, export controls enforced

Market Implication: Risk-off → USD stronger, commodity currencies weaker

Key indicators to watch: announcements from the U.S. and China, changes in U.S. Treasury yields, commodity currency pairs (like AUD/USD, USD/CAD), and central-bank commentary.

Final Thoughts

Scott Bessent’s remarks suggest that a U.S.–China trade deal is within reach. For traders, students of forex, and everyday individuals alike, this is more than rhetoric — it’s an event that could reshape markets, influence currencies, and affect economic decisions for months ahead.

If you’re ready to dive deeper into how fundamental events like this translate into trading opportunities, join our FREE workshop at GME Academy. Learn how to interpret trade-talks, inflation reports, and central-bank cues — and translate them into confident trading decisions.

Reserve your spot now and turn global headlines into actionable insights.