Fed’s Goolsbee: "Peak Tariff" Hope vs. The Services Inflation Struggle

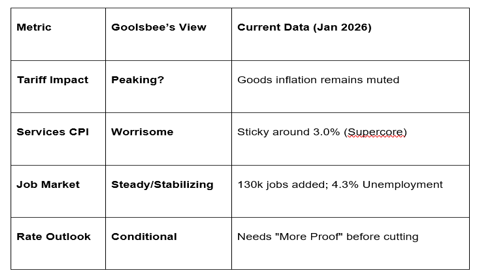

Following the release of the January inflation and employment data, Chicago Fed President Austan Goolsbee offered a nuanced take on the U.S. economy’s trajectory during an interview on February 13, 2026. While expressing optimism that the inflationary pressure from trade policies may be cresting, Goolsbee warned that "sticky" service prices and a robust labor market are complicating the path toward lower interest rates.

At the GME Academy, we view Goolsbee’s comments as a classic "Central Bank Pivot." He is shifting the focus away from goods-related inflation—which the Fed cannot control—and back toward domestic services and wages, which remain the primary drivers of current policy.

1. Tariffs: Have We Seen the Peak?

One of the most significant takeaways from Goolsbee’s remarks was his assessment of the Trump administration’s trade measures.

The "Peak Impact" Hope: Goolsbee noted that while tariffs certainly pushed up costs for specific goods throughout 2025, there are signs that these adjustments have already been "baked into" the data. "I hope we've seen the peak impact of tariffs," Goolsbee stated, suggesting that the initial shock to supply chains may be fading.

The Goods Gap: Because goods prices remain relatively contained despite the trade friction, the Fed is less concerned about a "Tariff-Wage Spiral" than they were six months ago.

The Risk Factor: However, he cautioned that any new escalations in trade policy could reset this clock, forcing the Fed to remain in a defensive stance.

2. The "Worrisome" Services Sector

Despite the cooling headline CPI (now at 2.4%), Goolsbee flagged the services sector as a persistent "trouble spot."

Not Tame: Goolsbee described services inflation as "pretty high" and "not yet tame." This aligns with the January data, which showed surges in airline fares (+6.5%) and personal care (+1.2%).

The 2% Goal: He emphasized that while the headline number is moving in the right direction, the "Supercore" (services excluding housing) is still tracking closer to 3.0%. "Right now we are not on a path back to 2%. We're kind of stuck at 3%," he warned during the Yahoo Finance interview.

3. A "Steady" Labor Market: The Green Light for Patience

The January jobs report, which showed a surprising 130,000 gain and a dip in unemployment to 4.3%, has given the Fed breathing room.

Modest Cooling: Goolsbee characterized the job market as "steady" with only "modest cooling."

Stability over Stimulus: Because the labor market isn't "falling off a cliff," the Fed feels no immediate pressure to cut rates to save jobs. This allows them to focus exclusively on the "inflation" side of their dual mandate.

The GME Academy Analysis: "Dovish Tone, Hawkish Action"

At Global Markets Eruditio, we analyze "Goolsbee-speak" to forecast the March 18 Fed Decision.

Trader's Takeaway for 2026:

Fed Watch: Goolsbee is a noted dove, yet even he is calling for "more proof" on inflation. This suggests a near-unanimous consensus for a Pause in March.

Yield Play: Treasury yields fell slightly after Goolsbee said rates "can still go down," but the long end remains elevated because he didn't provide a timeline.

Consumer Strength: Goolsbee called the U.S. consumer "the strongest thing in the U.S. economy." As long as the jobs market holds, we expect Retail Sales to remain resilient through Q1.

Join our FREE Macro Workshop at Global Markets Eruditio!

Are you ready for the "Neutral Rate" era? We’ll show you how to trade the USD/JPY as the Fed prepares for the first rate cut of 2026—potentially in June.