The UK’s "Sluggish Slog": GDP Edges Up 0.1% as Construction Hits Four-Year Low

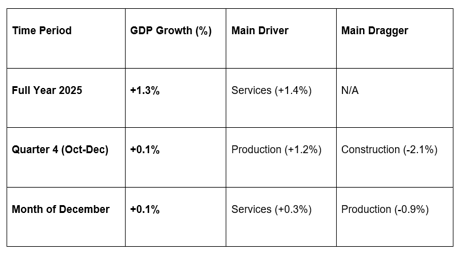

The British economy barely kept its head above water at the close of 2025. Data released on February 12, 2026, by the Office for National Statistics (ONS) showed that UK Gross Domestic Product (GDP) grew by a razor-thin 0.1% in the final quarter (October to December) of 2025.

At Global Markets Eruditio, we are tracking this as a "Confidence Vacuum." While the UK technically avoided a recession in 2025, the underlying sectors—particularly construction and services—are showing signs of severe fatigue as the market digests the long-term impact of the late-2025 Autumn Budget.

1. The Quarterly Breakdown: Production Saves the Day

The modest 0.1% quarterly growth was not a broad-based recovery. Instead, it was a "lopsided" performance driven almost entirely by one sector.

Production to the Rescue: Production output jumped 1.2% in Q4, propping up the entire economy. Without this boost (largely from manufacturing and energy), the UK would likely have entered a technical contraction.

Services Stagnation: The dominant services sector—representing roughly 80% of the economy—recorded zero growth (0.0%) for the third consecutive month on a three-monthly basis.

Construction Collapse: Construction output fell by 2.1% in Q4. This is the sector’s worst three-monthly performance since September 2021, signaling a deep freeze in both residential housebuilding and major infrastructure investment.

2. Monthly Pulse: December’s Services Rebound

Looking strictly at the month of December 2025, the story flipped. Monthly GDP rose by 0.1%, but the drivers were the opposite of the quarterly trend.

Services Rebound (+0.3%): After months of flatlining, services finally ticked up in December. This was led by transportation and storage (+2.0%) and administrative support (+1.4%), as holiday travel and business logistics peaked.

Production Pullback (-0.9%): The star of the quarter faded in December, with manufacturing and energy supply seeing widespread monthly weakness.

Construction Continuing Fall (-0.5%): The monthly decline in construction confirms that the sector’s woes were not just a one-off event but a sustained downturn.

3. 2025: A Year of "Firsts" and "Slow Lanes"

Despite the tepid end to the year, 2025 provided some rare positive milestones for the UK's long-term data.

Annual Growth: For the full year of 2025, the UK economy grew by 1.3%. This outperformed 2024’s 1.1% growth and made the UK the fastest-growing European member of the G7 for the year.

Production Landmark: 2025 marked the first annual rise in production output since 2021.

The Per Capita Problem: While the "Headline GDP" grew, GDP per head fell by 0.1% for the second consecutive quarter. In simple terms: the economy is getting bigger, but the average person is feeling slightly poorer.

The GME Academy Analysis: "Mind the Gap in the GBP"

At Global Markets Eruditio, we advise our traders to look past the "0.1% growth" headline and focus on the revisions.

Trader's Takeaway for February 2026:

Sterling Sentiment (GBP): The Pound dipped slightly following this release. The "0.1%" figure missed the consensus forecast of 0.2%, and downward revisions to November’s data (from 0.3% to 0.2%) suggest the BoE has more room to cut rates in March to stimulate growth.

Sector Play: The weakness in Professional and Technical Services (-1.1% in Q4) suggests that high-end business spending is being reined in. Conversely, the Travel and Reservation (+7.5% in Q4) surge shows that consumer "experience spending" remains the economy's last line of defense.

The "Budget Effect": Business investment fell 2.7% in Q4. Markets are clearly still cautious about the fiscal environment. Until investment picks up, any GDP growth will remain "fragile and anemic."

Join our FREE Forex Workshop at Global Markets Eruditio!

Is the UK heading for a "Spring Surge" or a "Stagnation Trap"? We’ll break down the ONS revisions and show you how to trade the GBP/USD during low-growth cycles.