The Silent Watch: Japan’s Mimura Signals "Close Contact" with U.S. on Yen Volatility

In the high-stakes world of currency markets, sometimes what isn't said is just as important as what is. On February 12, 2026, Japan’s Vice Minister of Finance for International Affairs—and chief currency diplomat—Atsushi Mimura, issued a brief but calculated update on the Ministry’s stance regarding the Japanese Yen (JPY).

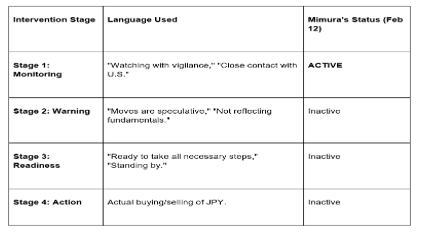

At the GME Academy, we classify these statements as "Verbal Intervention Level 1." Mimura is not yet threatening to "act," but he is ensuring the market knows that Japan and the United States are watching the charts together.

1. The "U.S. Connection": Coordinated Vigilance

The most significant takeaway from Mimura’s remarks was the confirmation of "ongoing communication" with U.S. Treasury authorities.

Why it matters: In the past, Japan has preferred coordinated intervention (where both the BoJ and the Fed buy/sell) over unilateral action. By highlighting his dialogue with Washington, Mimura is subtly reminding traders that Japan has the diplomatic backing to protect the Yen if it weakens too rapidly.

The "Line in the Sand": Markets have been testing the 152.00 – 155.00 level on the USD/JPY. In 2026, with the U.S. Federal Reserve maintaining a "Neutral" stance, any sudden Yen weakness is seen as a speculative move rather than a fundamental one.

2. Refraining from the "Price Game"

Mimura notably refrained from commenting on specific foreign exchange levels. This is a classic diplomatic tactic used to avoid "trapping" the government into a specific price point.

Strategic Ambiguity: By not saying "150 is too high," Mimura keeps speculators guessing. If he were to name a price, traders would "front-run" that level, causing even more volatility.

Focus on "Stability": Japan’s official policy remains that exchange rates should reflect economic fundamentals and move "stably." Rapid, one-sided moves are what trigger the Ministry of Finance to order the Bank of Japan to step into the market.

3. The JPY Context in 2026

The Yen remains under pressure in early 2026 due to the "Yield Curve Divergence" we often discuss at Global Markets Eruditio.

The Carry Trade: With U.S. rates still at 3.50% – 3.75% and Japanese rates significantly lower, investors continue to borrow Yen to buy Dollars.

The Mimura Factor: As the successor to the legendary Masato Kanda, Mimura has been more reserved in his public appearances. Traders are still learning his "tells"—the subtle linguistic shifts that indicate intervention is imminent.

The GME Academy Analysis: "Don't Short the Yen Near the Zero Hour"

At Global Markets Eruditio, we advise our students to be extremely cautious when the "Chief Diplomat" starts mentioning the U.S. authorities.

Trader's Takeaway for 2026:

USD/JPY Outlook: We are currently in a "Watch and Wait" zone. If USD/JPY spikes toward 155.00, the rhetoric will likely shift from "monitoring" to "decisive action."

The "Weekend Risk": Intervention often happens during thin market hours or over weekends to maximize the "shock" to speculators. Avoid holding high-leverage short JPY positions over the coming weekend.

Watch the 10-Year Yields: If U.S. Treasury yields continue to climb while the BoJ stays stagnant, Mimura’s "vigilance" will be tested.

Join our FREE Forex Workshop at Global Markets Eruditio!

Want to learn how to spot "Intervention Candles" before they happen? We’ll show you how to track BoJ Balance Sheet changes and how to trade the USD/JPY during periods of high-level government verbal intervention.