The Great Revision: U.S. Labor Market Rewritten as 2026 Opens

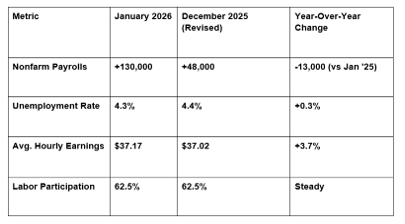

The U.S. Bureau of Labor Statistics (BLS) released the January 2026 Employment Situation report on February 11, 2026, delivering a mix of current resilience and historical shock. While the economy added a better-than-expected 130,000 jobs in January, the real headline was a massive downward revision that wiped out nearly 1 million jobs from previous 2025 estimates.

At the GME Academy, we focus on "Trend Integrity." This report proves that what looks like a "strong" market can often be a statistical illusion until the annual benchmark process reveals the truth.

1. January 2026: The Sector Split

Hiring in January was concentrated in just a few pockets of the economy, masking a broader stagnation in other industries.

● The Gainers: * Health Care (+82,000): Remains the primary engine of the U.S. economy, specifically in ambulatory services and hospitals.

Social Assistance (+42,000): Driven by individual and family services.

Construction (+33,000): Surprising strength in specialty trade contractors despite high interest rates.

● The Losers:

Federal Government (-34,000): Reflecting the continued impact of the Department of Government Efficiency (DOGE) initiatives. Total federal employment has dropped 10.9% since its late-2024 peak.

Financial Activities (-22,000): Marking a steady decline since May 2025 as the banking and insurance sectors consolidate.

2. The "Benchmark Bombshell": Revising 2025

The BLS annual benchmark process, which reconciles survey data with actual tax records, revealed that the "booming" labor market of 2025 was significantly overstated.

March 2025 Revision: The employment level for March 2025 was revised downward by 898,000 jobs.

The 2025 Narrative: Total job gains for the full year of 2025 were slashed from +584,000 to just +181,000.

The Impact: This means the U.S. economy added an average of only 15,000 jobs per month in 2025, rather than the 48,000 previously reported.

Note for Traders: Large downward revisions of this scale often precede shifts in Federal Reserve policy. The "re-basing" of 2025 data suggests the economy has been much more fragile than the Fed initially believed.

3. Household Data: The 4.3% Floor

While the "Establishment Survey" (payrolls) showed growth, the "Household Survey" (unemployment) remained steady.

Unemployment Rate: Held at 4.3%, up from 4.0% a year ago.

Long-Term Jobless: Now at 1.8 million, up by nearly 400,000 over the year. This indicates that once workers lose a job in 2026, they are finding it harder to re-enter the workforce.

Wage Growth: Average hourly earnings rose 0.4% in January to $37.17. Year-over-year, wages are up 3.7%, which is high enough to keep the Fed cautious about cutting rates too quickly.

The GME Academy Analysis: "A Fragile Stability"

At Global Markets Eruditio, we analyze the jobs report to determine the "Terminal Rate" for the Federal Reserve.

Trader's Takeaway for February/March 2026:

Fed Outlook: The 130k gain is "just enough" to keep the Fed from panicking, but the -898k revision to 2025 gives the "Doves" on the committee much more ammunition to argue for rate cuts later this spring.

Currency Impact (DXY): The U.S. Dollar (USD) initially rallied on the 130k "beat" but faced pressure as the market digested the massive 2025 downward revisions. Expect a Neutral-to-Bearish trend for the USD in the coming weeks.

Sector Watch: Focus on Healthcare-related stocks and REITs as these sectors continue to defy the broader economic cooling.

Join our FREE Forex Workshop at Global Markets Eruditio!

Are you confused by the "Revision Math"? We’ll show you how to look past the headline numbers to see the Real Economic Trend and how to position your trades before the next Fed meeting.