"Highest in History": Trump Hails Stock Market Records and Pivots to Coal

In a sweeping address from the White House on February 11, 2026, President Donald Trump celebrated a historic milestone for Wall Street while simultaneously signaling a massive shift in U.S. energy policy. Standing before a crowd of coal executives and miners, the President declared that the U.S. stock market has reached its "highest price in history," a rally he attributed to his administration's aggressive tariff and deregulation agenda.

At the GME Academy, we track these "Policy Pivots" as major market movers. The administration's move to subsidize the coal industry while the S&P 500 sits at record highs creates a unique "Barbell Economy"—one that pairs 19th-century energy with 21st-century AI-driven financial growth.

1. The Stock Market Record: A "Tariff Rally"?

The President noted that the S&P 500 and the Dow Jones Industrial Average have hit all-time highs as the U.S. enters the second year of his term.

The Trade Deficit Claim: Trump claimed the trade deficit has plummeted by 78% (referencing a 77.3% drop in the monthly deficit from January 2025 to October 2025).

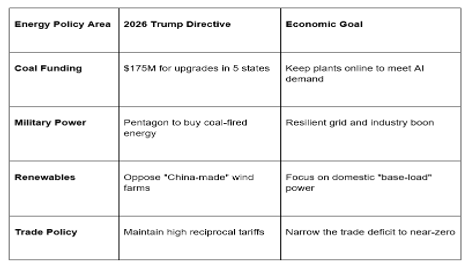

The Tariff Effect: He credited his "Liberation Day" tariffs for this reduction, arguing that they forced manufacturing back to the U.S. and reduced dependence on China.

Economic Reality: Analysts at Global Markets Eruditio note that while the monthly deficit did shrink as importers front-ran tariff deadlines, the overall annual deficit fell by a more modest 3.9% in 2025. However, the market remains bullish on the tax deductions and earnings boosts expected from the administration's fiscal policies.

2. The "Energy Emergency": Directing Funds to Coal

In a move that caught environmental groups off guard, Trump announced he is directing the Department of Energy (DOE) to issue $175 million in funds to coal plants in West Virginia, Ohio, North Carolina, Virginia, and Kentucky.

National Security: Citing a "National Energy Emergency," the President is utilizing Cold War-era authorities (the 1950 Defense Production Act) to keep aging coal plants online.

The "Pentagon Purchase": In a first-of-its-kind move, the Department of Defense (DoD) has been directed to prioritize the purchase of coal-fired electricity for military operations.

The AI Connection: Trump argued that "Coal is the most dependable form of energy," and is essential to power the massive energy-hungry AI data centers currently being built across the U.S.

3. "Crazy Windmills" vs. Clean Coal

The President did not hold back in his criticism of renewable energy, particularly wind power.

Anti-Wind Rhetoric: "I'm not a big fan of those crazy, China-made windmills," Trump stated, calling them "money-losing" and "ineffective."

The China Critique: He claimed that China manufactures turbines for export while avoiding their use domestically—a claim that fact-checkers note is at odds with China's status as the world leader in wind capacity (over 600 million kilowatts).

Dependability: By contrast, Trump praised coal for being "just as clean" due to recent environmental progress and far more reliable than weather-dependent sources.

The GME Academy Analysis: "Trade the Energy Divide"

At Global Markets Eruditio, we analyze how this shift affects the "Commodity Supercycle" of 2026.

Trader's Takeaway for February 2026:

Coal Stocks (BTU, ARCH): The direct infusion of DOE funds and guaranteed DoD contracts provide a significant "safety net" for the sector. We expect these stocks to outperform the broader market in the short term.

The "AI Power Play": Tech companies like Microsoft and Alphabet may face a PR challenge as they rely on a grid that is becoming increasingly coal-dependent to power their 2026 AI expansion.

DXY and Tariffs: If the trade deficit continues to show month-over-month declines, the U.S. Dollar (USD) will likely strengthen further. Watch the 105.50 level on the DXY for a potential breakout.

Join our FREE Forex Workshop at Global Markets Eruditio!

Is the "Coal Comeback" a real trend or a political bubble? We’ll show you how to trade Energy Policy Shifts and how to use Sentiment Indicators to stay ahead of the next Presidential Executive Order.