The "V-Day" Proposal: Kremlin’s Bold Pitch for a Dollar-Based Partnership

In a stunning reversal of years of "de-dollarization" rhetoric, an internal Kremlin memo has surfaced detailing a massive economic pitch to the Trump administration. The document, reviewed by Bloomberg on February 12, 2026, suggests that Russia is willing to rejoin the U.S. dollar settlement system in exchange for a sweeping partnership in energy, minerals, and fossil fuels.

At the GME Academy, we view this as the "Geopolitical Black Swan" of the decade. For years, the move toward the Chinese Yuan was considered Russia's permanent exit from Western finance. This memo indicates that the Kremlin may be ready to trade its alliance with Beijing for a "fossil-fuel first" alliance with Washington.

1. The Seven-Point Plan: A "Fossil Fuel First" Strategy

The memo, drafted by Putin’s envoy Kirill Dmitriev, outlines a convergence of interests that seems specifically tailored to President Trump’s "Energy Dominance" agenda.

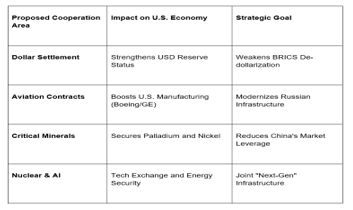

Return to the Dollar: The center of the pitch is Russia's return to the U.S. dollar for commercial and energy transactions. This would stabilize the Ruble and reconnect Russia to global liquidity.

Energy Joint Ventures: Russia proposes joint ventures in oil and LNG, including offshore Arctic fields. Crucially, the plan offers a way for U.S. firms to recover losses from their 2022 exits.

Critical Minerals: Cooperation on lithium, copper, nickel, and platinum—the building blocks of the next industrial era—to ensure the U.S. is not dependent on Chinese supply chains.

Modernizing the Skies: Long-term contracts for U.S. firms (like Boeing) to modernize the Russian aviation fleet.

2. The "Dividing Europe" Tactic

Western officials note that the memo appears designed to drive a wedge between the U.S. and its European allies.

Anti-Green Ideology: The document explicitly pitches a joint U.S.-Russia front to promote fossil fuels as an "alternative to the climate ideology" favored by the EU and China.

The "Yalta 2.0" Comparison: Some European diplomats have compared these proposed energy deals to a modern version of the 1945 Yalta Conference, where the world's great powers divided spheres of influence without consulting smaller nations.

3. Market Shock: Gold Plummets as Dollar Rallies

The financial markets reacted instantly to the news of a potential "US-Russia Economic Thaw."

Gold Prices: The "Safe Haven" trade took a massive hit, with Gold prices tumbling 4% in a single session. If Russia rejoins the Dollar system, the need for a non-dollar hedge diminishes.

The Ruble: The Russian currency surged to 78 per Dollar, its strongest level since before the 2022 invasion, as traders bet on the lifting of financial sanctions.

The GME Academy Analysis: "Watch the Yuan-Ruble Pair"

At Global Markets Eruditio, we believe the true story is the potential fracture in the Russia-China axis.

Trader's Takeaway for 2026:

USD/JPY & USD/CNY: If the U.S. and Russia align on energy, the Dollar's dominance becomes near-absolute. Expect the Yuan (CNY) to weaken as its "reserve currency" aspirations take a back seat.

Energy Stocks: Keep a close eye on Exxon (XOM) and Chevron (CVX). If the "Recouping Losses" clause of the memo becomes reality, these companies could see massive balance sheet restorations.

Sanctions Volatility: This memo is a "pitch," not a signed treaty. Until the Office of Foreign Assets Control (OFAC) actually signals a roll-back of sanctions, the market remains in a high-risk "Headline Trading" mode.

Join our FREE Forex Workshop at Global Markets Eruditio!

Is the "BRICS De-dollarization" dream dead? We’ll show you how to trade the USD/RUB and Gold as these secret negotiations become public policy.