Canada at a Crossroads: Governor Macklem’s Vision for a Restructured Economy

In a landmark address to the Empire Club of Canada in Toronto, Bank of Canada Governor Tiff Macklem laid out a sobering yet proactive roadmap for the nation’s economic future. His message was clear: Canada is no longer facing a temporary "rough patch," but a fundamental structural shift driven by a "triple threat" of US protectionism, the rise of Artificial Intelligence (AI), and a sharp decline in population growth.

For Forex traders and investors watching the CAD (Canadian Dollar), Macklem’s speech signaled that while the Bank remains committed to its 2% inflation target, the "old rules" of the Canadian economy are being rewritten in real-time.

1. Defining the "Structural Break".

Macklem differentiated between cyclical ups and downs (like oil price swings) and structural change, which permanently alters what an economy can produce. He identified three convergence points that are forcing Canada to pivot:

2The End of Open Trade: With the era of rules-based open trade with the U.S. fading, Canada is being forced to find new suppliers and reroute trade to avoid American tariffs.

The AI Revolution: Much like the internet in the 1990s, AI is seen as a transformative force that could either displace workers or spark a massive productivity boom.

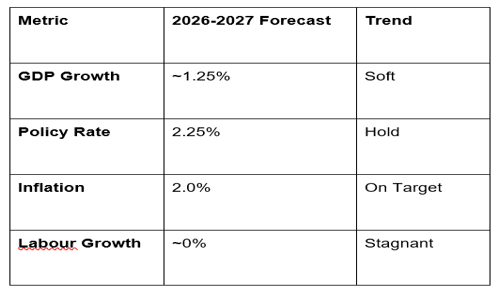

Demographic Drag: Canada’s labor force growth is expected to stall due to lower immigration and fertility rates, ending a 20-year streak of 1.5% annual growth.

2. The Economic Outlook: "Soft Growth" Ahead

The Bank of Canada held its policy rate at 2.25% last week, but Macklem warned that the outlook is clouded by high uncertainty.

GDP Growth: Forecasted to average only 1.25% over the next two years.

Trade Diversification: Early data shows a shift; imports from the U.S. are declining while goods from other global markets are rising. Similarly, exports to non-U.S. markets are slowly increasing, though they cannot yet offset the loss of U.S. demand.

Inflation: Expected to stay near the 2% target. While tariffs put upward pressure on prices, weak demand is currently keeping a lid on inflation.

3. The AI Impact on the Job Market

While AI adoption remains modest (only 12% of businesses significantly use it), the Bank is seeing early signs of disruption. Entry-level job vacancies are declining, and there is evidence that occupations with high AI-performing tasks are seeing slower hiring rates.

However, Macklem remained optimistic: "Productivity growth pays for higher wages." The goal is not to fight AI but to ensure the Canadian workforce has the skills to use it to boost national income.

4. Monetary Policy: A Supportive Role, Not a Cure

Macklem was firm that the Bank of Canada cannot fix structural problems with interest rates. "Monetary policy can't change the destination, but it can help smooth the journey," he noted.

For Forex Trading, this implies:

Careful Calibration: The Bank will not cut rates just to "make up" for lost efficiency from tariffs, as that risks stoking inflation.

Divergence: As Canada restructures, the CAD may face volatility compared to the US Dollar (USD), especially if U.S. protectionism continues to weigh on Canadian exports.

Data-Dependency: The Bank is moving toward "granular analysis," looking at how individual sectors—rather than just the national average—are coping with the transition.

The GME Academy Analysis: "Leaning Into the Pivot"

At Global Markets Eruditio, we view Macklem's remarks as a "call to action" for traders. The Canadian economy is in a "transition state." This typically leads to a weaker currency in the short term as the country finds its footing, followed by potential strength if productivity gains (from AI and new trade routes) actually materialize.

How to Position Your Portfolio:

CAD Currency Pairs: Watch the USD/CAD resistance levels. If Canada successfully diversifies its trade, the "Loonie" could become more resilient against U.S. policy shocks.

Investment Strategy: Lean into sectors that are embracing structural change—specifically Canadian tech and infrastructure projects aimed at internal market integration.

Join our FREE Forex Workshop at Global Markets Eruditio!

Are you ready to trade the "Structural Pivot"? We’ll show you how to analyze Bank of Canada speeches to predict CAD movements and how to hedge your Canadian assets against U.S. trade policy volatility.