The Schmid Signal: Why the Kansas City Fed Chief is Wary of More Rate Cuts

In a high-stakes address at the Economic Forum of Albuquerque on February 11, 2026, Kansas City Fed President Jeffrey Schmid delivered a firm defense of the Federal Reserve’s "restrictive" stance. Speaking on the 100th anniversary of Route 66, Schmid used the iconic highway as a metaphor for the American economy: a vast network with significant momentum that may still be running too hot for the Fed’s comfort.

At the GME Academy, we view Schmid’s remarks as a "Hawkish Anchor" for the 2026 outlook. While other officials have hinted at normalization, Schmid remains focused on the risk of inflation getting "stuck" above the 2% target.

1. The Supply vs. Demand Dilemma

Schmid presented a masterclass in macroeconomic diagnosis, asking a fundamental question: Is our current 4.4% GDP growth driven by supply or demand?

The Supply Case (Disinflationary): Schmid noted that labor productivity grew faster in late 2025 than at any point in the previous decade. This was attributed not to AI (yet), but to lower labor churn. As "low-hire/low-fire" conditions took hold, employees gained the experience necessary to produce more with less.

The Demand Case (Inflationary): Despite productivity gains, Schmid argued that demand is still winning the race. Between the AI infrastructure buildout and high-income households spending their record net worth, the "heat" in the economy suggests demand is outpacing the economy's productive capacity.

The Verdict: Because inflation remains closer to 3% than 2%, Schmid concludes that demand is the dominant force, requiring the Fed to keep the "brakes" on.

2. Monetary Policy: No More "Insurance" Cuts?

Schmid’s most pointed comments addressed the recent history of the Federal Funds Rate. After the cumulative cuts of 2024 and 2025, Schmid believes the Fed has reached a "Neutral" zone that may not be doing enough to cool the economy.

The "Price Shock" Lesson: Schmid explicitly rejected the idea that price shocks (like those from tariffs) are "intrinsically transitory." He argued that policy makes them transitory. If the Fed cuts rates too soon, a temporary price spike becomes permanent inflation.

A Policy Hold: Schmid supported the January 2026 decision to hold rates steady, warning that further cuts risk de-anchoring inflation expectations.

3. The Balance Sheet: Shrinking the "Footprint"

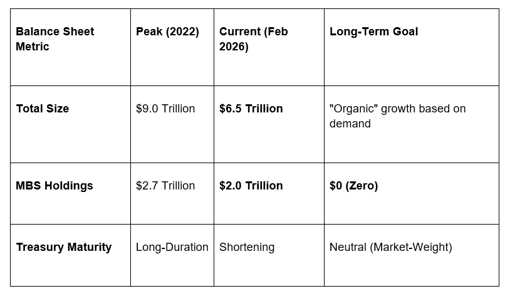

For the technical traders at Global Markets Eruditio, Schmid’s deep dive into the $6.5 trillion balance sheet was the highlight of the speech.

Resuming Growth: In December 2025, the Fed began growing its balance sheet again. Schmid clarified this is not policy easing; it is a "liquidity maneuver" to ensure banks have enough reserves to settle payments.

The "Footprint" Problem: Schmid is "sympathetic" to the view that the Fed has picked winners and losers by holding $2 trillion in Mortgage-Backed Securities (MBS). He remains committed to:

1. Exiting the Mortgage Market: Returning to an all-Treasury portfolio.

2. Shortening Duration: Buying Treasury bills instead of long-term bonds to stop "distorting" the yield curve.

4. Independence and Route 66

Schmid closed by linking the Fed’s regional structure to its independence. By reducing the Fed's "footprint" in mortgages and long-term debt, Schmid believes the Fed can better separate Monetary Policy from Fiscal Policy (government spending).

"The more the lines between monetary and fiscal policy become blurred, the greater risk that the Fed’s balance sheet is no longer viewed as solely a tool of monetary policy."

The GME Academy Analysis: "Trade the Hawkish Hold"

At Global Markets Eruditio, we analyze Schmid's stance as a reason to remain Bullish on the USD in the medium term.

Trader's Takeaway for 2026:

Yield Curve Implications: Schmid’s desire to stop "flattening" the yield curve by buying short-term bills instead of long bonds suggests that long-term Treasury yields may stay higher for longer.

USD/PHP Context: If the Fed remains "restrictive" while other central banks (like the BSP) consider cuts to offset local issues, the US Dollar will maintain its yield advantage. Look for 56.50 to act as a pivot point for the Peso.

AI as a "Wildcard": Schmid is optimistic but cautious. If we see a sudden jump in productivity data later in 2026 without a spike in inflation, that will be the signal that the "Supply-Driven Growth" Schmid hopes for has finally arrived.

Join our FREE Forex Workshop at Global Markets Eruditio!

Are you ready to trade the "Schmid Strategy"? We’ll show you how to use Fed Balance Sheet data to predict liquidity crunches and how to time your trades around Regional Fed President speeches.