Resilience or Recurrence? Deciphering the UK’s November 2025 GDP Surprise

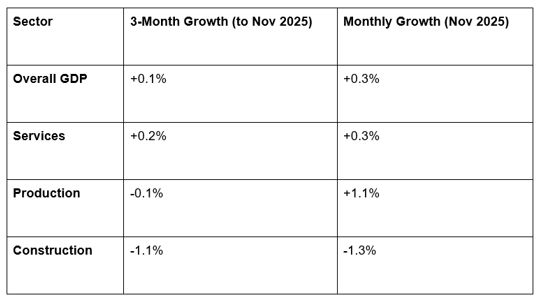

The British economy has long been a subject of scrutiny for traders and economists alike, often characterized by its "stop-start" nature. However, the latest GDP monthly estimate for November 2025 has provided a jolt of unexpected energy. While many analysts predicted a stagnant end to the year, the Office for National Statistics (ONS) revealed a headline growth of 0.3% for the month.

For those navigating the complexities of Forex trading for beginners, this report serves as a masterclass in why "headline numbers" only tell half the story. To truly understand the impact on currency pairs like GBP/USD or GBP/JPY, one must look beneath the surface at the shifting gears of the UK's industrial and service engines.

The Breakdown: A Tale of Three Sectors

The November growth was not a uniform rise across the board. Instead, it was a fragmented recovery driven by a rebound in specific niches while others continued to struggle.

1. Services: The Reliable Engine

The services sector, which makes up roughly 80% of the UK economy, grew by 0.3% in November. A significant portion of this growth was driven by professional, scientific, and technical activities. Interestingly, accounting and tax consultancy saw a sharp uptick of 4.6%, largely attributed to businesses preparing for the Autumn Budget.

2. Production: The Comeback Kid

Production output surged by 1.1% in November. While this sounds like a massive victory, context is key. Much of this "growth" was actually a recovery phase. The manufacture of motor vehicles jumped by 25.5% as Jaguar Land Rover finally resumed full operations following a disruptive cyber-attack earlier in the year.

3. Construction: The Heavy Anchor

Contrasting the optimism in services and production, the construction sector fell by 1.3%. This continues a worrying trend; the three-month growth measure for construction is at its lowest since March 2023. High borrowing costs and pre-budget uncertainty have clearly dampened the appetite for new building projects.

The Forex Perspective: Why the Pound Fainted

In the world of Forex, good economic news usually strengthens a currency. However, the British Pound (GBP) told a different story. Despite the 0.3% beat, GBP/USD saw immediate selling pressure, dipping toward the 1.3370 level.

Why the disconnect? Forex trading is often about "pricing in" the future rather than reacting to the past. Traders realized that November’s growth was heavily reliant on a one-off recovery in car manufacturing. Furthermore, robust data from the US Dollar (USD)—including lower-than-expected jobless claims—diverted investor interest back to the Greenback.

For a beginner, this highlights a crucial lesson: a country’s currency isn't just a reflection of its own health, but a comparison against its peers. Even with a 0.3% growth, if the US economy looks "leaner and meaner," the USD will likely win the tug-of-war.

Looking Ahead: The Three-Month Horizon

While the monthly jump was impressive, the "rolling three-month" figure offers a more sober perspective. In the three months to November 2025, real GDP grew by only 0.1%.

This suggests that while the UK has avoided a technical recession for now, the momentum remains fragile. At GME Academy, we often remind our students that volatility is the trader’s best friend, but only if you have the tools to interpret it. The subtle shifts in these ONS reports are exactly what professional traders at Global Markets Eruditio use to forecast long-term trends in the EUR/GBP or GBP/CHF pairs.

Master the Markets with Professional Insight

The UK's economic landscape is shifting, and with it come endless opportunities for those who know how to read the signs. Whether you are interested in the resilience of the British Pound or the dominance of the US Dollar, understanding macroeconomics is the first step toward becoming a consistent trader.

Don't let complex data intimidate you. We break down the world of finance into actionable insights that help you trade with confidence.

Ready to turn economic news into trading opportunities?

Join our FREE Forex Workshop Today! Learn the strategies used by the pros to navigate GDP releases, interest rate hikes, and market volatility.