The "Fine-Tuning" Phase: Why Barkin’s Balanced Outlook is the New Forex Compass

In the high-stakes world of central banking, words are chosen with surgical precision. This week, Richmond Federal Reserve President Thomas Barkin provided a masterclass in this "fedspeak," describing the U.S. economy as being in a "delicate balance."

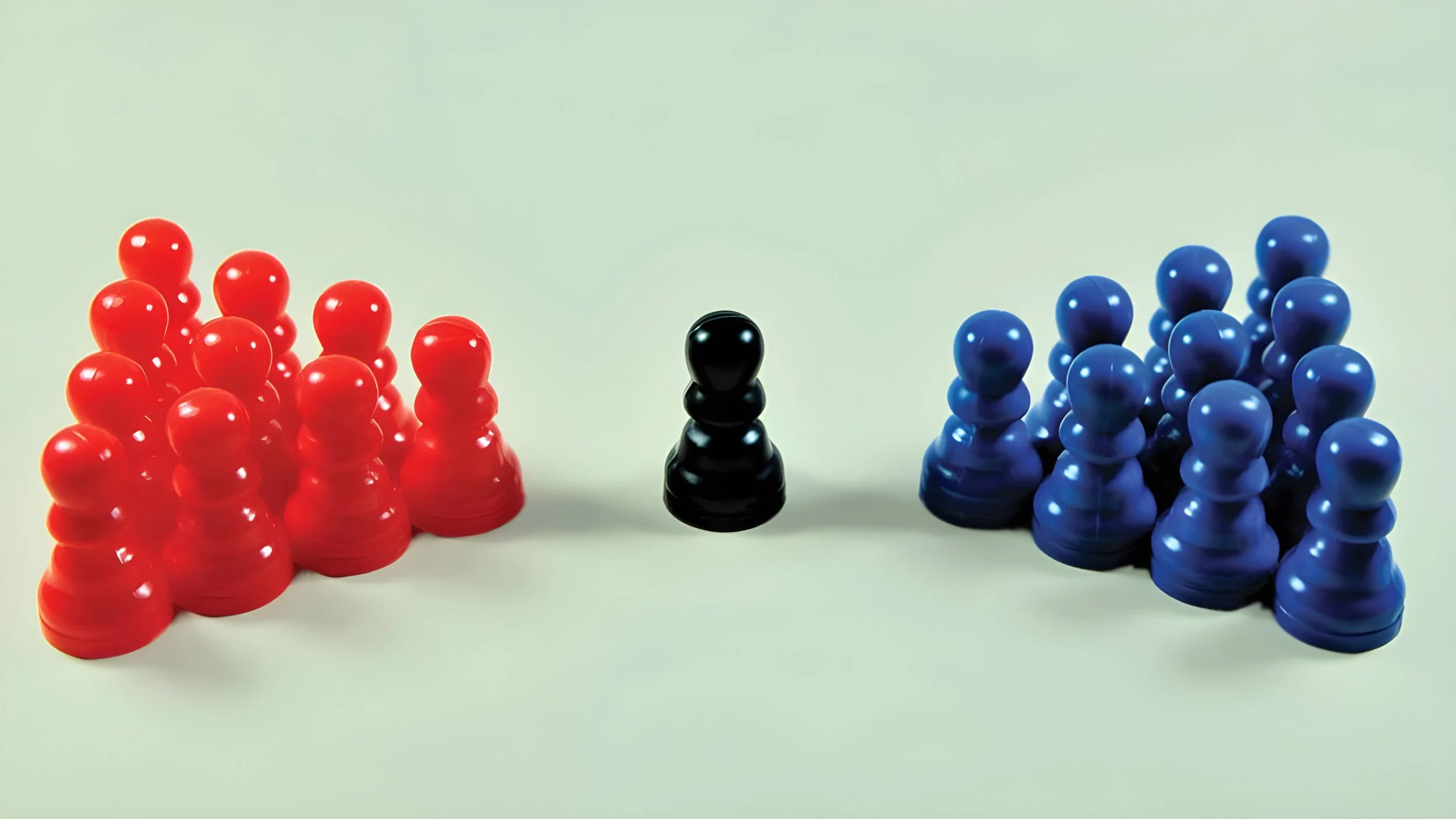

The Great Economic Tug-of-War: Trump Challenges the Fed as Oil Prices Slump

In a high-stakes week for the American economy, President Donald Trump has reignited his war of words with the Federal Reserve, calling for "meaningful" interest rate cuts while simultaneously promising to drive energy costs into the dirt.

The US Economy's Double-Edged Sword: Faster Growth Meets Fraying Price Stability

The latest economic signals from the United States have delivered a potent mix for global markets: accelerating economic expansion paired with an unwelcome intensification of price pressures.

Fed’s Hammack: “Financial Conditions Are Quite Accommodative” — What This Means for Forex Traders

At the 2025 Cleveland Fed Financial Stability Conference, Beth M. Hammack, President and CEO of the Federal Reserve Bank of Cleveland, delivered key insights on the current financial system and the risks that lie ahead. Her remarks are particularly important for those involved in Forex Trading, especially Forex Trading for Beginners, as they highlight how monetary policy, inflation, and financial stability can move major currency pairs like EUR/USD, USD/JPY, and GBP/USD.

Federal Reserve Rate Cut: What It Means for Forex Traders and the US Dollar

The Federal Reserve made waves in financial markets with its October 28–29, 2025 FOMC meeting, lowering the federal funds rate by 25 basis points to 3.75–4 percent.

The Case for Strong, Effective Banking Supervision: Why It Matters for the Economy

At a time of increasing pressure on financial oversight, Federal Reserve Governor Michael S. Barr delivered a compelling argument for the importance of strong, effective banking supervision.

U.S. Housing Market Distress: Are Rising Foreclosures a Red Flag for the Dollar?

The U.S. housing market is showing signs of stress, with foreclosure activity surging in October. For Forex traders, particularly beginners, these developments are more than just a housing story—they can signal potential shifts in the US Dollar (USD) and influence global currency markets.

Boston Fed Highlights Economic Outlook, Monetary Policy, and Banking Innovation

In a recent address at the Boston Fed’s 24th Annual Regional and Community Bankers Conference, a Federal Reserve official shared key insights into the U.S. economy, monetary policy, and trends in regional banking. These perspectives are especially important for Forex traders, as shifts in interest rates, inflation, and banking dynamics directly influence currency movements and trading opportunities.

U.S. Consumer Confidence Crumbles to 3-Year Low—What the Michigan Sentiment Slump Means for the Dollar and Forex Markets

The latest University of Michigan Consumer Sentiment Index for November 2025 has delivered a sobering picture of U.S. economic morale. The headline figure plunged to 53.6, the weakest reading since June 2022, marking a steep reversal from earlier optimism this year

U.S. Shutdown Nears Possible End: What a 34-Day Government Standoff Means for the Dollar and Global Forex Traders

After more than a month of political gridlock, the U.S. government shutdown—now one of the longest in history—finally shows signs of easing.

Dollar Surges on Rate Doubts and Safety Play While Pound Takes a Hit

The U.S. dollar rose to a four-month high against the euro, driven by uncertainty over further Federal Reserve rate cuts and a classic safe-haven move. After last week’s Fed rate cut, officials sent mixed signals about whether another cut will happen in December.

Powell Faces Final Fed Storm: Divisions Rise as His Term Nears End

U.S. Federal Reserve Chair Jerome Powell is entering the final stretch of his term under heavy pressure — not just from markets, but from within the Fed itself. As his leadership ends in May 2026, Powell is dealing with internal disagreements, political tension, and confused market expectations.

US Core CPI Holds at 3.0%: Is the Dollar Gearing Up for Its Next Big Move?

After being delayed by nine days due to the U.S. government shutdown, the Bureau of Labor Statistics (BLS) finally released the Consumer Price Index (CPI) data for September — and it didn’t disappoint traders looking for clues about the next move of the U.S. Dollar (USD).

U.S. Employment Costs Rise Slightly in July at 0.3 Percent

On August 1, 2025, the Bureau of Labor Statistics released its Employment Cost Index (ECI) report, showing that labor costs rose 0.3% in July. This matched market forecasts of 0.3% and edged slightly above the previous month’s 0.2%.

U.S. Services PMI Surges: Can the Dollar Keep Its Edge in Forex?

The U.S. services sector just gave traders something to think about. The Institute for Supply Management (ISM) reported that its Services PMI climbed to 52.0 in August, the highest since February.

U.S. Job Growth Stumbles in August: What Forex Traders Need to Know

The U.S. job market just sent a warning signal. According to the ADP National Employment Report, private employers added only 54,000 jobs in August—a sharp slowdown compared to earlier in the year.

Reading the Jobs Report Like a Fed Insider: Lessons from Waller

Every month, the U.S. Jobs Report lands like a market earthquake. Payrolls rise or fall, unemployment ticks up or down, and wages either cool or heat up. For the average citizen, it’s a snapshot of the labor market. But for the Federal Reserve, it’s one of the most important signals guiding monetary policy.

Businesses Hesitant on Hiring and Investment: The Fed’s Perspective

Across the U.S., businesses are showing signs of caution. Hiring is slowing, investments are being postponed, and expansion plans are on hold. For the Federal Reserve, these hesitations are more than corporate decisions—they’re critical signals about the health of the economy.

Private Sector Jobs Are Slowing – What This Means for Forex Traders

The private sector is the engine of most economies—it drives job creation, spending, and growth. But recent reports show that hiring is slowing down, with businesses adding fewer jobs than before.

Understanding Neutral Policy: What Waller Means by Moving Interest Rates Toward Neutral

Federal Reserve Governor Christopher Waller recently signaled that U.S. monetary policy is moving toward a neutral stance. But what does that really mean, and why should Forex traders—even beginners—pay attention?