The Inflation Pivot: Why the RBA Just Shifted from Cuts back to Hikes

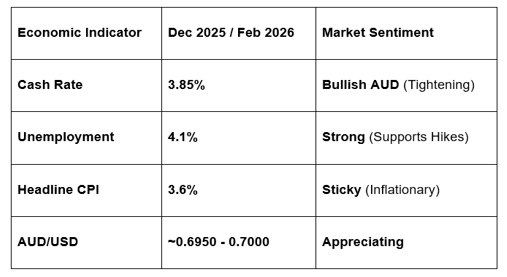

In a critical appearance before the House of Representatives Standing Committee on Economics on February 6, 2026, RBA Governor Michele Bullock delivered a clear and firm message: the "rate-cutting cycle" is officially over for now. Earlier this week, the Monetary Policy Board increased the cash rate by 25 basis points to 3.85%, a move that surprised some but was necessitated by a sharp reversal in Australia’s inflation trend.

For Forex Trading for Beginners, this "Hawkish Pivot" is a classic example of how central banks react when domestic demand outstrips the economy’s ability to supply goods and services.

1. The December Inflation Shock

The primary driver for the RBA's decision was the December 2025 quarter data. After dipping into the 2–3% target range earlier in the year, inflation came roaring back:

Headline Inflation: Jumped to 3.6% (from 3.4% in November).

Trimmed Mean (Underlying) Inflation: Increased to 3.4%, well above the RBA’s preferred midpoint.

The Cause: High service inflation, rising rents, and the expiration of state-level electricity rebates in Western Australia and Queensland (which saw electricity costs spike 21.5%).

2. Why the Economy is "Running Hot".

Governor Bullock noted that the world economy—and Australia's private demand—proved far more resilient than the Bank’s August 2025 forecasts suggested.

The AI Boom: Massive global investment in AI has boosted demand for chips and tech inputs from Australia’s Asian trading partners, supporting national income.

Labour Market Tightness: The unemployment rate fell to 4.1% in December. With 14.68 million Australians employed, the share of the population with a job is near a record high.

Capacity Constraints: Bullock warned that "excess demand" is pushing up against the economy's "speed limit." Without faster productivity growth, this demand will continue to fuel inflation.

3. Payments & Cash: A New Mandate

Beyond interest rates, the RBA is overhauling the way Australians pay for things.

Surcharge Ban Coming? The RBA is concluding its review of merchant card fees. A final report due in March 2026 may recommend removing surcharges on debit cards, which could save consumers $1.2 billion annually.

Cash is Still King: Despite the digital shift, the RBA is supporting new government mandates requiring large grocery stores and petrol stations to accept physical cash to ensure financial inclusion.

System Resilience: Following a major settlement outage on January 27, the RBA is conducting a full review to strengthen its "core settlement infrastructure" (RITS).

4. Forex Impact: The AUD/USD and Interest Rate Differentials

In the world of Forex Trading, the RBA’s hike has immediate consequences for the Australian Dollar (AUD).

While the Federal Reserve (Fed) in the US has moved toward easing, the RBA is now moving in the opposite direction. This widening "Interest Rate Differential" makes the AUD more attractive to investors. Following the news, the AUD/USD appreciated toward the 0.7000 level, as traders priced in at least one more hike by mid-2026.

The GME Academy Analysis: "Don't Fight the RBA"

At Global Markets Eruditio, we emphasize that central bank "forward guidance" is only as good as the next data print. The RBA’s pivot from a "insurance cut" stance in 2025 to a "persistent inflation" hike in 2026 shows how quickly the Forex landscape can change.

Traders should watch:

April Inflation Data: This will determine if the RBA hikes again in May or June.

Consumer Sentiment: If the 3.85% rate starts to crush household spending, the RBA may have to pause sooner than expected.

Join our FREE Forex Workshop at Global Markets Eruditio!

Are you confused by how inflation data in Australia affects your AUD trades? We simplify the complex world of central bank policy. Learn how to read the RBA "opening statements" and turn them into actionable trading strategies.