Urgency in Tokyo: Top Diplomat Mimura Draws a Line for the Yen

In a swift attempt to contain currency volatility following a weekend of major political shifts, Japan’s top currency diplomat, Atsushi Mimura, issued a high-stakes warning to the markets on Monday, February 9, 2026. Speaking to reporters in Tokyo, the Vice Finance Minister for International Affairs stated that authorities are "closely watching currency movements with a high sense of urgency," a phrase historically used by the Ministry of Finance (MOF) to signal that direct market intervention is imminent.

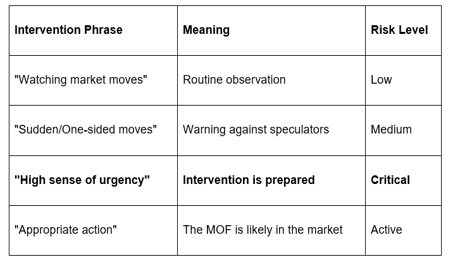

At the GME Academy, we recognize this as the "Intervention Red Zone." When Japanese officials shift their language from "watching" to "high sense of urgency," they are essentially putting the USD/JPY bulls on notice.

1. The Context: A Post-Election Slide

The urgency follows the landslide victory of Prime Minister Sanae Takaichi’s coalition over the weekend. While the victory provided political stability, it also fueled market expectations of aggressive fiscal stimulus and a potential delay in Bank of Japan (BOJ) rate hikes.

Market Reaction: The Japanese Yen (JPY) initially weakened toward 156.00 against the US Dollar (USD) early Monday morning as traders braced for "Takaichinomics."

Mimura’s Response: Within hours of the market open, Mimura’s verbal intervention helped the Yen rebound sharply, pushing the USD/JPY back toward the 154.50 level.

2. Why the Language Matters

In the world of Forex Trading, Japanese verbal intervention follows a specific hierarchy. Mimura’s use of "High Sense of Urgency" is the final stage before "Rate Checks" (where the BOJ calls banks to ask for price quotes) and actual Yen-buying operations.

3. The Trump-Takaichi Factor: Coordinated Intervention?

Adding to the tension is the growing speculation of coordinated action between Japan and the United States. Mimura emphasized that Japan remains in "constant dialogue" with international partners, specifically U.S. Treasury Secretary Scott Bessent.

Reports in late January 2026 suggested that the New York Federal Reserve had already conducted preliminary inquiries into Yen exchange rates. For Forex traders, a "Joint Intervention" (Japan and the US selling Dollars together) is the ultimate nightmare for Yen bears, as it can trigger a 300–500 pip move in minutes.

4. Forex Outlook: The "Line in the Sand" at 160

While the Yen has stabilized near 154, traders are increasingly testing the MOF's resolve. Analysts at MUFG and RCBC suggest that the 160.00 handle remains the psychological "line in the sand."

What to Watch This Week:

U.S. Data: With U.S. Retail Sales (Tuesday) and CPI (Friday) on the calendar, any "hot" data could push the USD higher, forcing Mimura to move from words to action.

BOJ Sentiment: Watch for any follow-up comments from Governor Kazuo Ueda. If the BOJ signals a rate hike is still on the table for March, the Yen may find organic support without intervention.

The GME Academy Analysis: "Respect the Rhetoric"

At Global Markets Eruditio, we teach our students that "you don't fight the central bank—and you certainly don't fight the Ministry of Finance." Mimura’s comments have created a temporary "ceiling" for the USD/JPY.

The Strategy for Beginners:

Beware the "intervention spike": If you are long USD/JPY, consider tightening your stop-losses or taking partial profits.

Trade the "Fades": Look for signs of Yen exhaustion near the 158.00–160.00 zone, but only enter if you see confirmed reversal patterns, as the risk of a sudden MOF "ambush" is at its highest in years.

Join our FREE Forex Workshop at Global Markets Eruditio!

Don't let a sudden 400-pip move wipe out your account. Learn how to interpret "central bank speak" and protect your capital during high-volatility intervention cycles.