Winter Chill: US Jobless Claims Jump to 231,000 Amid Severe Weather

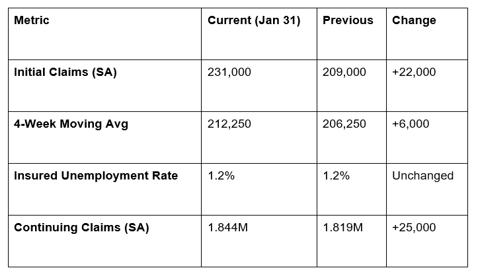

The U.S. labor market showed unexpected signs of cooling in late January, as new applications for unemployment benefits surged to their highest level in nearly two months. According to the Department of Labor, initial jobless claims reached a seasonally adjusted 231,000 for the week ending January 31, 2026—an increase of 22,000 from the previous week.

While the headline figure exceeded economists' estimates of 212,000, analysts suggest the spike may be a temporary "weather-related blip" rather than a fundamental shift in economic health.

1. The Weekly Spike: Breaking Down the Numbers

The jump to 231,000 represents the largest weekly increase since early December.

The Volatility: Heavy snow and freezing temperatures blanketed large portions of the U.S. in late January, likely causing temporary layoffs in weather-sensitive sectors like construction and outdoor retail.

4-Week Moving Average: To smooth out weekly noise, the 4-week moving average rose to 212,250, an increase of 6,000. Despite the uptick, this metric remains at levels historically consistent with a healthy labor market.

Continuing Claims: The number of people already receiving benefits (insured unemployment) rose by 25,000 to 1.844 million for the week ending January 24. Interestingly, the 4-week average for continuing claims hit its lowest level since October 2024, suggesting that while people are filing for benefits, many are finding new work relatively quickly.

2. Regional Hotspots: Where Claims Rose and Fell

The unadjusted data highlights a stark contrast between states, heavily influenced by local weather patterns and industry-specific shifts.

Largest Increases (Week ending Jan 24):

Nebraska: +2,074

New York: +1,739

Oklahoma: +938

Largest Decreases (Week ending Jan 24):

California: -12,531

Michigan: -8,197

Kentucky: -3,879

State-Level Insured Unemployment (Highest Rates):

New Jersey and Rhode Island lead the nation with a 2.8% insured unemployment rate, followed closely by Massachusetts (2.7%) and Minnesota/Washington (2.5%).

3. Market Sentiment: Low Hire, Low Fire

Economists describe the current 2026 labor market as being in a "low hire, low fire" mode. While mass layoffs remain rare, businesses have become increasingly hesitant to add new headcount due to:

Trade Policy Uncertainty: Lingering concerns over import tariffs have kept some manufacturing and logistics firms in a holding pattern.

AI Adoption: The growing popularity of artificial intelligence has led some businesses to reassess their long-term staffing needs before committing to new hires.

4. Macro Impact: Implications for the Fed

This data release comes at a sensitive time. A brief three-day federal government shutdown earlier this week has delayed the release of the "Big Three" labor reports (NFP, JOLTS, and ADP).

For the Federal Reserve, which recently kept interest rates in the 3.50%–3.75% range, this spike in claims adds a layer of complexity. If the uptick proves to be more than just a winter storm anomaly, it could encourage the Fed to lean more toward interest-rate relief later in the first half of 2026.

The GME Academy Analysis: "Noise vs. Trend"

At Global Markets Eruditio, we advise traders to ignore the "single-week noise" and focus on the Insured Unemployment Rate, which remains steady at 1.2%. A stable rate suggests the economy is absorbing the jobless quickly enough to prevent a structural rise in unemployment.

How to Trade the Jobless Claims Surprise:

USD Strength: Initial "misses" usually weaken the Dollar (DXY). However, because this was attributed to weather, the DXY remained relatively steady near 97.70.

Equities: Major indexes saw a "risk-off" move following the news, with the Dow shedding 600 points as investors weighed weak labor data against Big Tech earnings.

Join our FREE Labor Market Workshop

Learn how to differentiate between seasonal volatility and a genuine economic downturn. We’ll show you how to use Continuing Claims as a leading indicator for the USD/PHP exchange rate.