Safe Haven vs. Wild West: Regulated vs. Unregulated Brokers

In the world of high-stakes trading, the most critical decision you make isn't which currency pair to buy, but which broker to trust with your capital. The divide between Regulated and Unregulated brokers is the difference between a protected investment and a legal "Wild West" where your funds have zero safety net.

At the GME Academy, we consider regulatory compliance the "First Filter" of professional trading. If a broker fails this test, no amount of low spreads or high leverage can justify the risk.

https://images.squarespace-cdn.com/content/619b666b5842697e2af69258/a9d57b27-4fad-4532-874a-89133d6a85bc/P477.02.jpg?content-type=image%2Fjpeg

https://images.squarespace-cdn.com/content/619b666b5842697e2af69258/a9d57b27-4fad-4532-874a-89133d6a85bc/P477.02.jpg?content-type=image%2Fjpeg

1. Regulated Brokers: The Shield of Oversight

A regulated broker operates under the watchful eye of a government-appointed financial authority. These bodies ensure that the broker follows strict rules regarding transparency, capital adequacy, and ethical conduct.

Segregated Accounts: This is the gold standard. Regulation requires brokers to keep your trading capital in a separate bank account from their own operational funds. If the broker goes bankrupt, your money remains safe and accessible.

Negative Balance Protection: Most top-tier regulators mandate that you cannot lose more money than you have in your account.

Dispute Resolution: If a regulated broker "manipulates" a price or refuses a withdrawal, you have a legal ombudsman to fight your case.

2. Unregulated Brokers: High Reward, Extreme Risk

Unregulated brokers operate without a license from a reputable authority. They are often based in offshore tax havens where financial oversight is nonexistent.

The "Leverage Trap": Unregulated brokers often lure traders with extreme leverage (like 1:1000 or 1:2000), which is illegal in most regulated jurisdictions. While this allows for massive gains, it leads to the instant liquidation of most retail accounts.

No Withdrawal Guarantee: Because there is no oversight, an unregulated broker can freeze your account or disappear with your funds entirely. You have no legal recourse.

Price Manipulation: In the "Wild West," brokers can use "Virtual Dealers" to create artificial price spikes that hit your stop-losses, effectively stealing your margin.

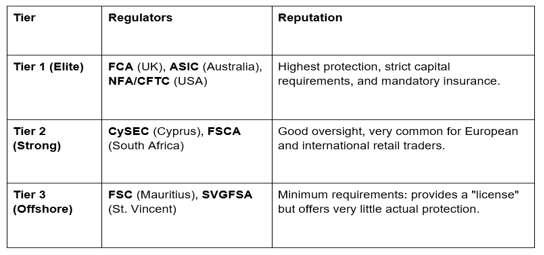

3. Key Global Regulators to Look For

Not all regulations are equal. At Global Markets Eruditio, we categorize regulators into "Tiers":

https://images.squarespace-cdn.com/content/619b666b5842697e2af69258/a9d57b27-4fad-4532-874a-89133d6a85bc/P477.02.jpg?content-type=image%2Fjpeg

https://images.squarespace-cdn.com/content/619b666b5842697e2af69258/a9d57b27-4fad-4532-874a-89133d6a85bc/P477.02.jpg?content-type=image%2Fjpeg

4. How to Verify a Broker’s Status

Scammers often lie about being regulated. Never take a broker's word for it; verify it yourself:

Check the License Number: Look at the bottom of the broker's website for their registration number.

Visit the Regulator’s Portal: Go directly to the official website (e.g., the FCA's Financial Services Register) and search for the firm name.

Check the "Domain Name": Ensure the website you are on matches the one listed in the official regulatory record to avoid "Clone Firm" scams.

The GME Academy Analysis: "Don't Gamble with the Gatekeeper"

At Global Markets Eruditio, our stance is firm: Never trade with an unregulated broker. The lure of "no taxes" or "insane leverage" is a siren song that usually ends in a total loss of capital.

The security of knowing your funds are in a segregated Tier 1 bank account allows you to focus on what matters: the strategy. When you trade with a regulated firm, you are a client with rights; with an unregulated firm, you are a target.

Is Your Current Broker Actually Regulated?

Many offshore brokers claim to be "internationally regulated," which is a meaningless term. If they aren't regulated in a major financial hub, your capital is at risk.

Join our FREE "Broker Due Diligence" Workshop

Learn how to read the fine print in a broker's Customer Agreement. We’ll show you the "Red Flags" that reveal a scam broker before you make your first deposit and provide a list of the most trusted regulated platforms for 2026.