Market Manipulation or Market Mechanics? Decoding the Fine Line That Separates Illegal Swindles from Sophisticated Trading

Every sudden price spike, deep plunge, or sharp reversal in the Forex market or stock indices raises a perennial question: Is this organic market behavior, or is it a calculated move to mislead traders? Understanding the critical difference between legitimate Market Mechanics—the natural laws of supply and demand—and illegal Market Manipulation is fundamental for traders seeking to achieve Global Markets Eruditio and protect their capital.

While both result in price movement, one is the natural, legal function of the exchange, and the other is a prohibited, intentional act of deception. The line is often blurry, especially in today's high-speed electronic markets, but recognizing the key characteristics of each is paramount.

https://images.squarespace-cdn.com/content/619b666b5842697e2af69258/a9d57b27-4fad-4532-874a-89133d6a85bc/P477.02.jpg?content-type=image%2Fjpeg

https://images.squarespace-cdn.com/content/619b666b5842697e2af69258/a9d57b27-4fad-4532-874a-89133d6a85bc/P477.02.jpg?content-type=image%2Fjpeg

The Foundation: Understanding Market Mechanics

Market Mechanics refer to the core structural principles and dynamics that govern price action on an exchange. These are the legal, observable forces that translate human action (trader orders) into price movement.

The Role of Liquidity and Order Flow

At its heart, price movement is driven by the interaction of liquidity (limit orders waiting on the order book) and order flow (market orders that instantly execute against those limits).

Supply and Demand: When aggressive buy orders (market orders) consume all the waiting sell orders (liquidity) at a certain price level, the price moves up to the next available level. This is a natural, legal function.

Liquidity Pools: Large players, sometimes called "smart money," may target areas where large amounts of stop-loss orders or pending orders (liquidity) are clustered—often near major support and resistance levels. A sharp move to trigger these stops is a sophisticated, but legal, technique to gain favorable entry or exit prices by forcing other traders out of the market.

Bid-Ask Spread: The difference between the highest price a buyer is willing to pay (Bid) and the lowest price a seller is willing to accept (Ask). This spread reflects liquidity and is a core component of Forex Trading costs.

The Deception: Identifying Market Manipulation

Market Manipulation occurs when an individual or group intentionally and illegally alters the supply or demand of a security or currency pair to influence its price for personal gain, usually through deceptive practices. Intent is the key differentiator from legitimate trading.

Market manipulation is prohibited under various financial regulations globally, including the US Securities Exchange Act and the EU's Market Abuse Regulation.

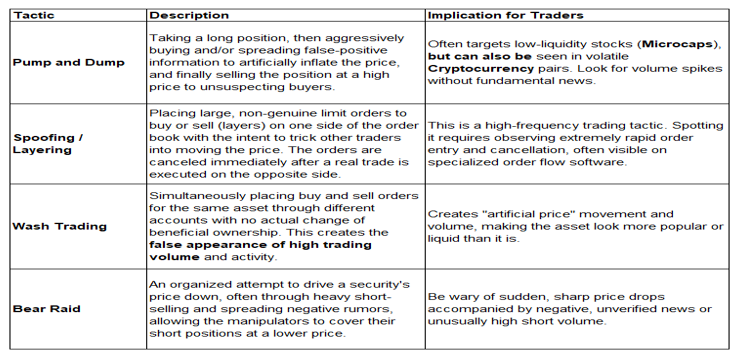

Common Manipulation Tactics

Manipulation tactics can be broadly classified as information-based (spreading false news) or transaction-based (using deceptive trading patterns).

https://images.squarespace-cdn.com/content/619b666b5842697e2af69258/a9d57b27-4fad-4532-874a-89133d6a85bc/P477.02.jpg?content-type=image%2Fjpeg

https://images.squarespace-cdn.com/content/619b666b5842697e2af69258/a9d57b27-4fad-4532-874a-89133d6a85bc/P477.02.jpg?content-type=image%2Fjpeg

Protecting Yourself: From Beginner to Expert

For Forex Trading for Beginners, distinguishing between market mechanics and manipulation is vital for long-term survival.

Context is King: A sharp move just minutes before a major central bank announcement (e.g., EUR/USD or USD/CAD movement before a Fed meeting) is likely driven by mechanics (positioning ahead of news), whereas a sharp move with no corresponding news or event is a major red flag for possible manipulation.

Volume and Price Action: Look for unusual price movement on low volume. If price sweeps liquidity with a very long wick during low-volume sessions (like the Asian session for EUR/USD), it may be an engineered move to grab stops.

Liquidity Awareness: The less liquid an asset is (like an exotic Forex pair or a microcap stock), the easier it is to manipulate. Stick to highly liquid, major currency pairs where institutional trading dominates, and manipulation is harder to execute.

By focusing on the genuine Market Mechanics of supply and demand—and remaining vigilant for the telltale signs of manipulation—traders can navigate the financial landscape with greater confidence and ethical integrity.

Are You Confident You Can Distinguish True Market Moves from Deception?

The difference between being a successful trader and becoming exit liquidity often lies in this distinction.

Master the skills to read the genuine Market Mechanics and spot manipulative patterns.

Join the GME Academy community today and sign up for our FREE Forex Workshop to learn advanced order flow and volume analysis techniques to identify the true hand driving the market, securing a comprehensive understanding of the forces that move the market.