Liquidity Pools: The Smart Money’s Hunting Grounds—Where Price is Programmed to Strike

In the world of Forex Trading, the concept of Liquidity Pools is key to understanding institutional movements. These are not just random clusters of orders; they are predictable price levels—the "Big Money Zones"—where retail traders place their stop-loss orders. Identifying these pools and anticipating the inevitable "stop hunts" is the core of sophisticated trading strategies and the key to trading with institutional flow, a discipline emphasized in programs like GME Academy.

Have you ever had a trade set up perfectly, only for the price to spike just past your stop-loss, immediately reverse, and then move exactly in your original intended direction? This common frustration for Forex Trading for Beginners is not bad luck; it’s likely the result of a liquidity sweep or stop hunt, where professional traders target easily identifiable clusters of orders—the liquidity pools—to fill their enormous positions. For institutional players dealing with billions in capital on currency pairs like EUR/USD or GBP/JPY, executing a massive order without moving the market against themselves (slippage) is paramount. They solve this problem by targeting areas that offer high, built-in liquidity.

https://images.squarespace-cdn.com/content/619b666b5842697e2af69258/a9d57b27-4fad-4532-874a-89133d6a85bc/P477.02.jpg?content-type=image%2Fjpeg

https://images.squarespace-cdn.com/content/619b666b5842697e2af69258/a9d57b27-4fad-4532-874a-89133d6a85bc/P477.02.jpg?content-type=image%2Fjpeg

Defining the Magnet: Why Price is Drawn to Clusters

Liquidity, in its simplest trading context, is the available volume of market orders waiting to be filled. For large banks and market makers, the best source of liquidity comes not from other large banks, but from the aggregated stop-loss and pending limit orders of the entire retail trading community. These clusters act as magnets for price because they offer the "smart money" the necessary counterbalance to execute huge transactions.

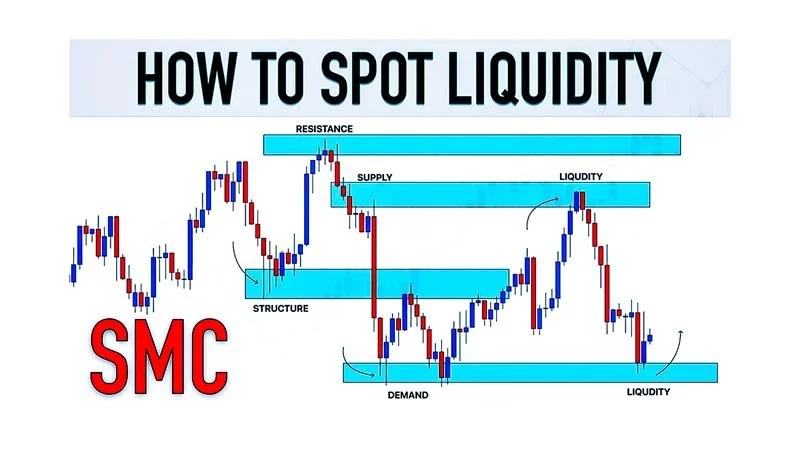

The Anatomy of a Liquidity Pool

Liquidity pools are areas on a price chart where orders, primarily stop-loss orders and pending limit orders, accumulate. They most commonly form at obvious, psychological price levels:

Major Swing Highs and Lows: These are the most obvious reference points for every technical analyst.

Equal Highs/Lows (Double or Triple Tops/Bottoms): These patterns create a "shelf" or "line in the sand" where retail traders aggressively place stops.

Round Psychological Numbers: Prices like $1.1000$ (on EUR/USD) or $1.4000$ (on CAD/USD or other major currency pairs).

The Two Sides of Liquidity:

Sell-Side Liquidity (SSL): This is the cluster of sell stop orders (and buy limit orders) located below key support levels, previous swing lows, or equal lows. When price trades through an SSL, the triggered sell stops (which turn into market sell orders) provide the ample liquidity institutions need to initiate long (buy) positions.

Buy-Side Liquidity (BSL): This is the cluster of buy stop orders (and sell limit orders) located above key resistance levels, previous swing highs, or equal highs. When price trades through a BSL, the triggered buy stops provide the liquidity institutions need to initiate short (sell) positions.

The Stop Hunt Strategy: Trading Against the Retail Crowd

Understanding the concept of the stop hunt is fundamental to achieving Global Markets Eruditio. The institutional strategy involves three precise steps:

Identification: Smart money identifies a clear liquidity pool, like a dense cluster of BSL above a key resistance line.

Manipulation (The Sweep): They push the price aggressively up to and slightly beyond that level. This price movement triggers all the clustered stop-loss orders (of traders who shorted at resistance), which immediately become market buy orders.

Accumulation & Reversal: The institutional trader steps in and sells all that sudden market buy pressure generated by the retail stops, allowing them to accumulate their desired large short position at a favorable, high price. With their position filled, the manipulative pressure is released, and the price reverses sharply, moving in the direction of the institutional trade.

This cycle of Accumulation, Manipulation, and Distribution is the engine that drives short-term price movements and is often visible through the dramatic, long wicks on candlesticks that momentarily pierce a high or low before snapping back.

Applying Liquidity Concepts to Your Forex Strategy

Incorporating liquidity concepts transforms Forex Trading from simply predicting price direction to understanding the market structure that facilitates institutional flow.

Directional Bias: If price has recently taken BSL (swept a high), the immediate objective is often to seek the next pool of SSL (a nearby low). Price tends to move from one liquidity pool to the next.

Entry Strategy: Wait for the Sweep: Instead of entering a long position before price hits an SSL (which risks being stopped out), the advanced approach is to wait for the liquidity grab. Wait for price to trade below the low (taking the liquidity) and then look for confirmation—such as a sharp reversal or a structural break back—to enter the long trade.

Risk Management: Do not place your stop-loss directly at the most obvious swing high or low. The market is designed to hunt those specific zones. Place your stop with a logical buffer beyond the clear liquidity cluster.

Mastering this requires patience and precision, ensuring you are not the liquidity that institutions are hunting, but rather the trader capitalizing on the move after the liquidity has been collected.

Are You Still Putting Your Stop-Loss Right Where Institutions Go Hunting?

The difference between being stopped out prematurely and riding the next big wave lies in understanding liquidity. Stop placing your orders where everyone else does, and start trading in anticipation of the "smart money."

Master the skill of identifying and trading liquidity pools.

Join the GME Academy community today and sign up for our FREE Forex Workshop to learn how to apply Smart Money Concepts (SMC) to predict institutional moves, securing a comprehensive understanding of the forces that move the market.