The Microsecond War: How High-Frequency Trading Shapes the Market

In the modern financial landscape of 2026, the traditional image of traders shouting on an exchange floor has been replaced by silent, air-conditioned server rooms. Today, High-Frequency Trading (HFT)—a form of algorithmic trading that executes thousands of orders in fractions of a second—dominates global markets, accounting for a massive portion of the daily volume in equities, Forex, and futures.

At the GME Academy, we believe that understanding HFT is no longer just for institutional players. For the retail trader, HFT is the invisible current in the ocean; you might not see it, but it fundamentally determines the "weather" of the market, from the cost of your spreads to the speed of your fills.

https://images.squarespace-cdn.com/content/619b666b5842697e2af69258/a9d57b27-4fad-4532-874a-89133d6a85bc/P477.02.jpg?content-type=image%2Fjpeg

https://images.squarespace-cdn.com/content/619b666b5842697e2af69258/a9d57b27-4fad-4532-874a-89133d6a85bc/P477.02.jpg?content-type=image%2Fjpeg

1. What Defines High-Frequency Trading?

HFT isn't just about "fast computers." It is a structural evolution of market participation characterized by:

Ultra-Low Latency: Using co-location (placing servers inside an exchange's data center) and specialized hardware like FPGAs (Field-Programmable Gate Arrays) to react to data in nanoseconds.

High Turnover: Positions are held for seconds or even milliseconds. HFT firms typically end the day with "flat" (zero) positions.

Micro-Profitability: These firms don't look for 10% gains; they look for a fraction of a cent per share, repeated millions of times a day.

2. The Core Strategies Shaping the Tape

HFT firms aren't usually making "bets" on where a stock will be next week. Instead, they act as the "plumbing" of the market through two primary roles:

Market Making (Liquidity Provision)

The most common HFT strategy. Firms like Citadel or Virtu Financial provide continuous "Bid" and "Ask" quotes. They profit from the bid-ask spread.

Benefit: By constantly competing to offer the best price, they have narrowed spreads significantly, lowering the cost of entry for everyone.

Statistical & Latency Arbitrage

HFT bots scan thousands of instruments simultaneously. If gold futures in London move up, the bot will buy gold-linked ETFs in New York before the price can "sync up."

Impact: This ensures price discovery is nearly instantaneous across different global venues.

3. The Dual Impact: Liquidity vs. "Ghost Liquidity."

The debate over HFT is often split into two camps. Proponents argue that HFT has made markets more efficient and cheaper for retail investors. Critics, however, point to two major risks:

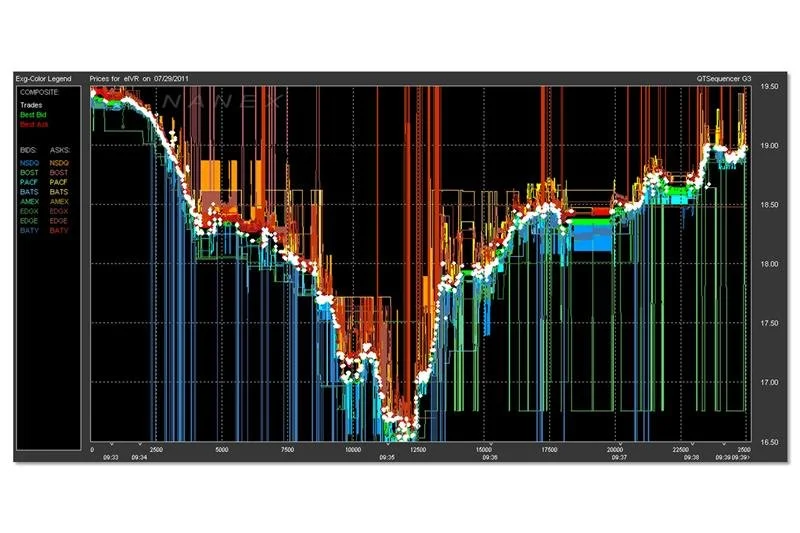

"Ghost Liquidity": In stable markets, HFT provides deep liquidity. However, during times of stress, these algorithms are programmed to withdraw instantly. This can lead to a "liquidity vacuum," exacerbating price drops.

Flash Crashes: Because HFT bots react to each other, they can create a feedback loop. The 2010 Flash Crash is the most famous example, but "mini-flashes" occur frequently in 2026, where an asset might drop 2% and recover in seconds.

4. HFT in 2026: The New Frontiers

As we move through 2026, HFT is evolving beyond simple speed.

AI & Machine Learning: Modern HFT bots now use Deep Learning to predict order flow "toxicity"—identifying when a large institutional buyer is about to move the market and adjusting their quotes ahead of time.

Cloud-Based Latency: Small and medium HFT boutiques are moving to "Cloud-Edge" architectures, allowing them to compete in emerging markets like Southeast Asia and Latin America without massive physical infrastructure.

Regulation: Following the Budget 2026 updates in various regions, increased transaction taxes on high-frequency F&O (Futures & Options) trades are forcing firms to be more selective, moving from "volume-based" to "quality-based" setups.

The GME Academy Analysis: "Survival for the Slower Trader"

At Global Markets Eruditio, we often get asked: "Can I compete with an HFT bot?" The answer is no—at least not on speed. But you don't have to.

How to navigate an HFT-dominated market:

Stop Using Market Orders: HFT algorithms thrive on "taking" market orders. Use Limit Orders to control exactly what price you pay.

Avoid the "Open" and "Close": The first and last 15 minutes of the trading day are when HFT activity is most chaotic.

Focus on Higher Timeframes: HFT bots live in the seconds and minutes. Their "edge" vanishes when you look at hourly or daily trends.

Join our FREE Forex Workshop at Global Markets Eruditio! Want to see the "hidden" order flow of the machines? We’ll show you how to use Level 2 Data and Order Book Heatmaps to spot where the big HFT players are positioning themselves and how to avoid getting caught in a "Flash" trap.