Breakouts and Fakeouts: How to Outsmart Market Traps in Forex Trading

The Thrill — and the Trap — of a Breakout

Few moments in Forex trading spark more excitement than a breakout. Price pushes past resistance, momentum builds, and traders rush in — convinced they’ve caught the next big move.

But just as quickly, the market reverses, taking their stop losses with it.

Welcome to the world of breakouts and fakeouts — one of the most common traps that catch new traders off guard.

At GME Academy (Global Markets Eruditio), we often tell beginners:

“The market doesn’t punish mistakes — it punishes impatience.”

Understanding how breakouts really work (and how false ones form) can help you trade smarter, stay patient, and align your strategy with the flow of institutional money rather than chasing retail noise.

What Is a Breakout in Forex Trading?

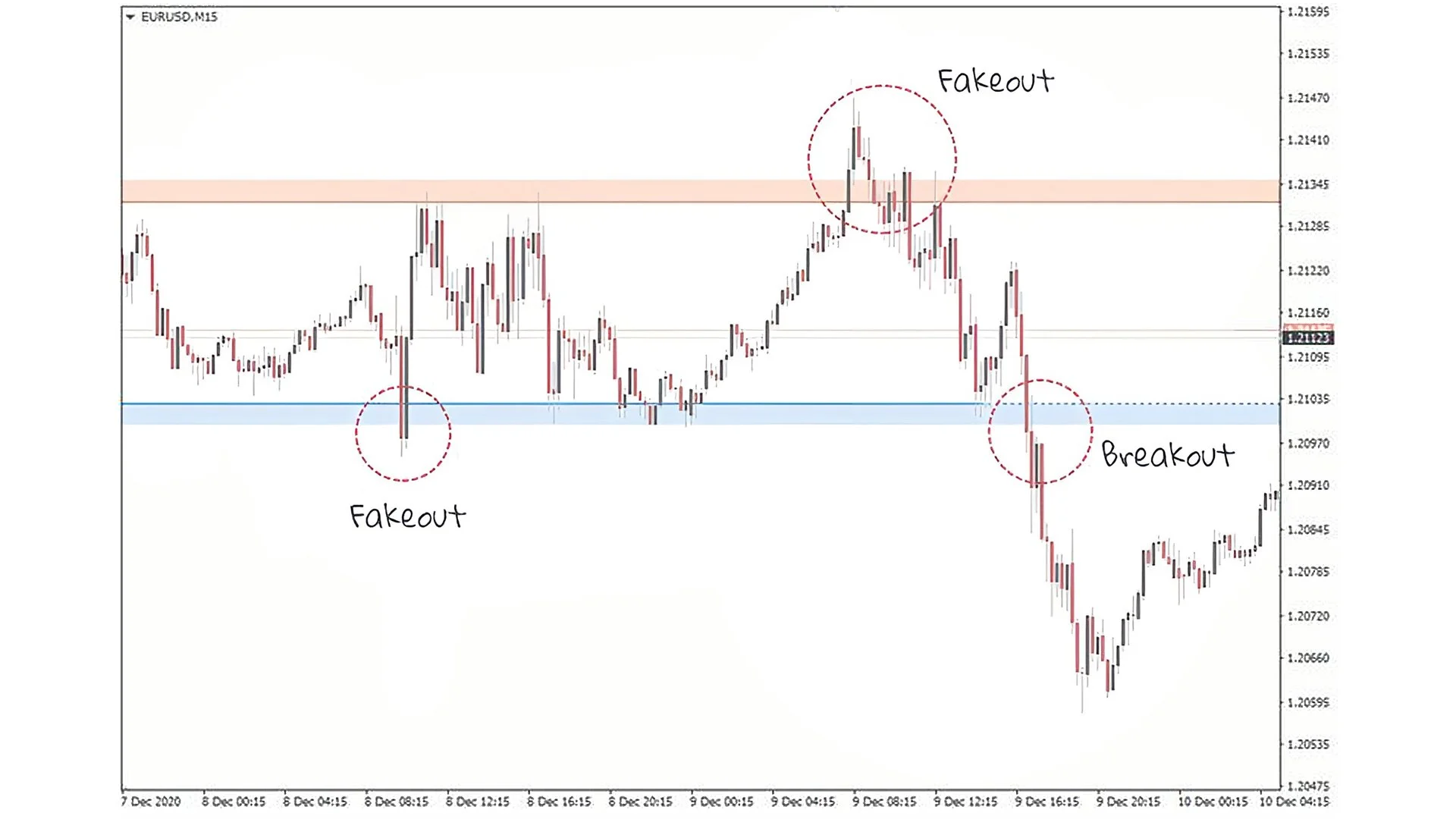

A breakout occurs when price moves beyond a key level of support or resistance — signaling potential momentum in that direction.

For example:

When EUR/USD breaks above 1.0750, traders may see it as a bullish sign.

When USD/JPY drops below 149.00, it might indicate bearish continuation.

Breakouts can occur after long periods of consolidation, forming what’s known as an accumulation zone. During these times, large institutions are quietly building positions while retail traders wait for clear direction.

Once the breakout happens, volume surges — but whether that breakout continues or fails depends on what’s really happening beneath the surface.

The Fakeout: When the Market Fakes You Out

A fakeout (or false breakout) happens when price appears to break through a level, only to reverse shortly after.

Imagine GBP/USD breaking above resistance at 1.2300, drawing in buyers — then dropping sharply back below that level. The breakout buyers are trapped, and their stop losses become fuel for the next move down.

This is not random.

It’s a deliberate liquidity move.

Big institutions (smart money) need liquidity — and the easiest place to find it is where retail traders set their stops. By pushing price beyond a known level, they trigger stop orders and sweep liquidity before driving price in the true direction.

How to Identify Real vs. False Breakouts

1. Watch for Volume Confirmation

Real breakouts usually come with increased trading volume.

If price breaks a key level but volume remains flat, be cautious — it might be a fakeout.

2. Wait for a Retest

One of the simplest yet most powerful rules taught at GME Academy:

“The best breakouts often retest before running.”

If price breaks above resistance, wait for it to retest the same level as new support. A clean bounce often confirms genuine momentum.

3. Study Candle Closes

Don’t trade based on wicks alone.

A true breakout should close decisively beyond the key level. If price wicks above and closes below, that’s often your fakeout signal.

4. Understand Market Context

Breakouts that align with the overall market structure or fundamental bias (e.g., strong USD amid hawkish Fed policy) are more likely to hold.

When breakouts go against the broader trend or economic backdrop, they often fail quickly.

Examples in Action

Let’s look at EUR/USD during a volatile week with key U.S. data releases.

Suppose price consolidates between 1.0650 (support) and 1.0750 (resistance). Traders await Non-Farm Payrolls (NFP). When the data shows weaker-than-expected job numbers, the dollar drops — EUR/USD spikes above 1.0750.

But within hours, price reverses sharply as profit-taking and algorithmic trades hit the market.

The breakout becomes a fakeout, trapping emotional buyers who entered too soon.

Experienced traders, however, wait for confirmation — allowing price to pull back, observe structure, and enter once momentum confirms the true direction.

Examples in Action

Let’s look at EUR/USD during a volatile week with key U.S. data releases.

Suppose price consolidates between 1.0650 (support) and 1.0750 (resistance). Traders await Non-Farm Payrolls (NFP). When the data shows weaker-than-expected job numbers, the dollar drops — EUR/USD spikes above 1.0750.

But within hours, price reverses sharply as profit-taking and algorithmic trades hit the market.

The breakout becomes a fakeout, trapping emotional buyers who entered too soon.

Experienced traders, however, wait for confirmation — allowing price to pull back, observe structure, and enter once momentum confirms the true direction.

Trading Breakouts Safely: GME Academy’s Key Guidelines

Plan Before You Enter — Know your invalidation level (where your trade idea is proven wrong).

Use Proper Position Sizing — Never risk more than 1–2% of your account on a single setup.

Avoid Trading During High-Impact News — Unless you specialize in volatility trading, news spikes can create fakeouts easily.

Combine Technical + Fundamental Context — Align breakouts with macro trends, such as interest rate expectations or CPI data.

Learn to Read Liquidity Zones — Understanding where orders sit (above highs, below lows) gives you a powerful edge.

At Global Markets Eruditio, these concepts are core to our approach: teaching traders not just where price is moving, but why.

Forex Pairs Most Affected by Breakouts

Major pairs like EUR/USD, GBP/USD, USD/JPY, and AUD/USD are particularly prone to breakout volatility due to their deep liquidity and sensitivity to global news.

For cross pairs such as GBP/JPY, traders often face exaggerated fakeouts because of wider spreads and faster price movement.

Knowing which pairs to focus on — and which to avoid — during volatile conditions is a crucial part of successful strategy building.

Conclusion: The Patience Advantage

Trading breakouts isn’t about predicting; it’s about confirming.

The best traders wait for the market to reveal its hand before committing capital. By combining price action, volume confirmation, and market structure awareness, you can turn what used to be traps into opportunities.

Take the Next Step: Join Our FREE Forex Workshop

Don’t just trade — understand why the market moves.

Join our FREE Forex Workshop with GME Academy to learn how professionals identify breakouts, avoid fakeouts, and read institutional order flow with confidence.

Reserve your slot today and start seeing Forex with the clarity of a seasoned trader.