The Great Economic Elasticity: Why the Market “Returns to the Mean”

In the high-speed world of global finance, prices often behave like a stretched rubber band. They may fly to extreme highs during a "bull market" or snap down to terrifying lows during a crash, but eventually, they tend to snap back toward a central average.

How Geopolitical Risk Fuels Market Volatility: A Forex Trader’s Guide

Global events don’t just make headlines—they move markets. For Forex traders, understanding geopolitical risk is crucial because it directly impacts currency values, market sentiment, and trading strategies.

How Wars, Sanctions, and Trade Tensions Shape Currency Markets: A Forex Perspective

In the complex world of Forex trading, geopolitical events like wars, sanctions, and trade tensions can significantly impact currency values. Investors often view such events as signals of risk or uncertainty, prompting shifts in capital flows and altering the demand for various currencies.

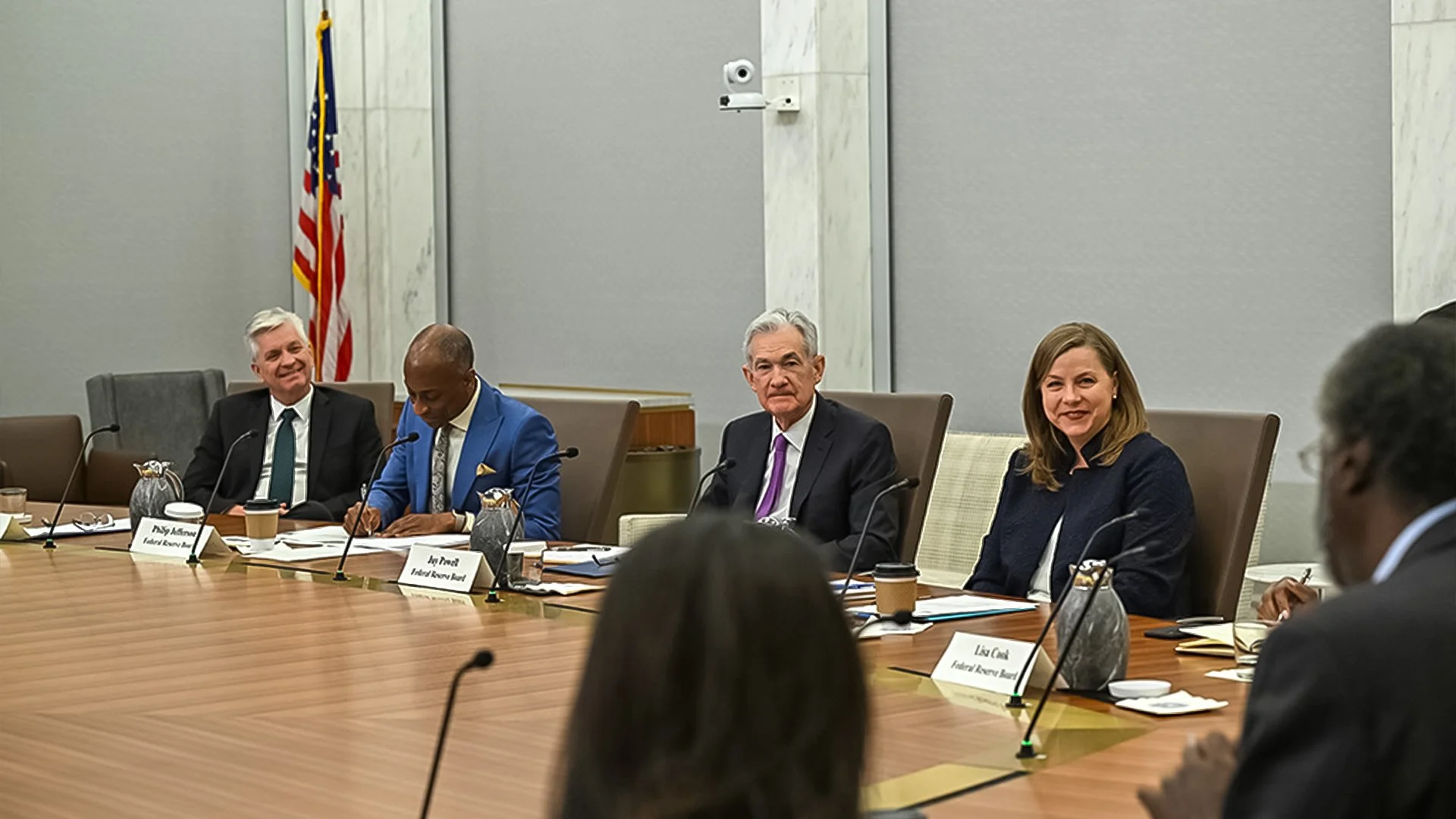

Trading Around Central Bank Announcements: FOMC, BOE, ECB, and BOJ Insights for Forex Traders

In the world of Forex trading, few events move the markets as dramatically as central bank announcements.

The Role of Institutional Traders vs. Retail Traders: Who Really Moves the Forex Market?

In the fast-moving world of Forex trading, not all players stand on equal ground. Some move billions of dollars in a single click, while others manage just a few hundred. Understanding who institutional traders are and how retail traders fit into the picture is essential for anyone serious about improving their trading strategy — especially Forex Trading beginners learning through platforms like GME Academy (Global Markets Eruditio).

Breakouts and Fakeouts: How to Outsmart Market Traps in Forex Trading

Few moments in Forex trading spark more excitement than a breakout. Price pushes past resistance, momentum builds, and traders rush in — convinced they’ve caught the next big move.

But just as quickly, the market reverses, taking their stop losses with it.

The Market’s Invisible Walls: How Support, Resistance, and Structure Reveal Forex Secrets

Every trader, whether new or seasoned, has seen the zigzags of a Forex chart — but few understand the deeper story those movements tell. Beneath every swing, rally, or pullback lies an invisible framework: support, resistance, and market structure.

The Hidden Currents of Forex: How Liquidity and Order Flow Drive Market Movements

Every second, trillions of dollars move through the foreign exchange market (Forex) — but what truly drives those price changes beneath the charts?

Beyond the candlesticks and indicators lies a hidden current made up of liquidity and order flow. These are the forces that shape how prices move, reverse, or even stay stable

The Truth About Forex Profits: Balancing Ambition and Risk for Long-Term Success

Many people enter Forex trading dreaming of instant wealth. The idea of turning a few hundred dollars into thousands overnight is exciting—but unrealistic. While the Forex market does offer incredible potential, it’s not a shortcut to riches. It’s a skill-based profession that rewards patience, strategy, and risk control.

Mastering Control in Chaos: How Stop-Losses and Take Profits Keep Forex Traders Ahead

In the fast-paced world of Forex trading, one rule separates beginners from consistent traders—risk management. Whether you’re analyzing EUR/USD, GBP/JPY, or USD/CAD, knowing when to exit a trade is just as important as knowing when to enter. This is where stop-losses, take profits, and position adjustments come in.

Mastering the Pound: GBP Pair Trading Strategies That Work for Every Forex Beginner

When it comes to Forex Trading, few currencies attract as much attention as the British Pound (GBP) — often called the “Cable” in trading circles. Whether it’s GBP/USD, GBP/JPY, or EUR/GBP, traders around the world watch the Pound for its volatility, strong reaction to news, and deep liquidity.

Mastering USD Pair Trading Strategies: How to Trade the World’s Most Powerful Currency

In the world of Forex, one currency stands above all — the US Dollar (USD). It’s the benchmark for global trade, the safe haven during uncertainty, and the most traded currency across all major pairs. Whether you’re watching EUR/USD, USD/JPY, or GBP/USD, the USD’s movement often drives the rest of the market.

Forex: The 24-Hour Global Market Where Money Never Sleeps

Learn how the 24-hour Forex market works, why currencies move, and how everyday Filipinos can trade from home. Forex isn’t just for experts—it’s for you.