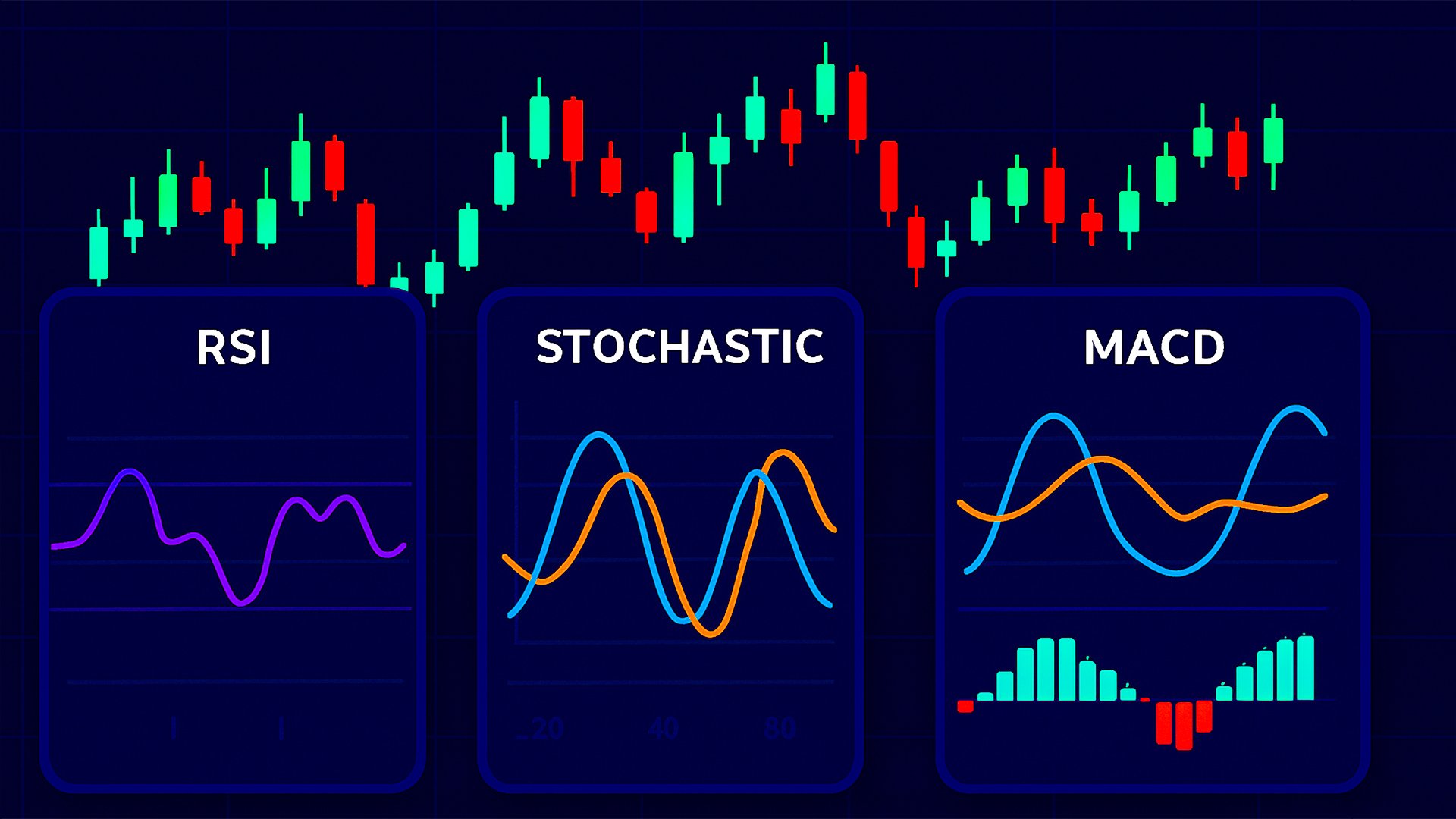

RSI, MACD, and Stochastic: Momentum Indicators Every Forex Trader Should Know

If you’re venturing into Forex trading, understanding market momentum is key to spotting opportunities before others do. Momentum indicators are technical tools that help traders gauge the strength of a currency pair’s price movement and anticipate potential reversals. Three of the most popular momentum indicators are the Relative Strength Index (RSI), the Moving Average Convergence Divergence (MACD), and the Stochastic Oscillator.

Here’s a simple breakdown to help you trade smarter.

https://images.squarespace-cdn.com/content/619b666b5842697e2af69258/a9d57b27-4fad-4532-874a-89133d6a85bc/P477.02.jpg?content-type=image%2Fjpeg

https://images.squarespace-cdn.com/content/619b666b5842697e2af69258/a9d57b27-4fad-4532-874a-89133d6a85bc/P477.02.jpg?content-type=image%2Fjpeg

1. Relative Strength Index (RSI): Spotting Overbought and Oversold Levels

The RSI is a momentum oscillator that measures the speed and change of price movements. It ranges from 0 to 100 and is typically used to identify overbought or oversold conditions:

Overbought: RSI above 70 may indicate the currency is priced higher than its actual value and a pullback could occur.

Oversold: RSI below 30 suggests the currency may be undervalued, signaling a potential buying opportunity.

Forex example: If EUR/USD has an RSI of 75, traders might anticipate a short-term reversal downward. Conversely, if USD/JPY dips to an RSI of 25, it could hint at a bounce-back.

RSI is particularly useful for Forex trading for beginners because it’s visual, straightforward, and easy to combine with other tools like support/resistance levels.

2. MACD: Following Trend Momentum and Crossovers

The MACD (Moving Average Convergence Divergence) is a trend-following momentum indicator that shows the relationship between two moving averages of a currency’s price. It consists of:

MACD line: Difference between the 12-period and 26-period exponential moving averages (EMA).

Signal line: 9-period EMA of the MACD line.

Histogram: Shows the difference between the MACD line and the signal line.

How traders use it:

Bullish signal: MACD line crosses above the signal line, indicating upward momentum.

Bearish signal: MACD line crosses below the signal line, indicating downward momentum.

Forex example: A bullish MACD crossover on GBP/JPY may suggest it’s time to enter a long position, while a bearish crossover could hint at a sell opportunity.

MACD is ideal for spotting the strength and direction of trends, making it essential for traders analyzing currency pairs like EUR/USD or USD/CAD.

3. Stochastic Oscillator: Timing Your Entries and Exits

The Stochastic Oscillator compares a currency’s closing price to its price range over a set period, usually 14 periods. It consists of two lines:

%K line: The main line representing the current close relative to the range.

%D line: A 3-period moving average of %K.

Overbought/Oversold signals:

Above 80 = overbought

Below 20 = oversold

Traders watch for crossovers between %K and %D to time entries and exits.

Forex example: If USD/CHF falls below 20 and the %K line crosses above %D, it may be a signal to buy. Conversely, a crossover above 80 could suggest a sell.

Stochastic is valuable for identifying short-term reversals, making it particularly useful for scalpers and day traders.

Why Momentum Indicators Matter in Forex

Momentum indicators are more than just numbers on a chart—they reflect market psychology. They show how strong buyers or sellers are, helping you anticipate trend continuations or reversals.

For beginners in Forex trading:

Combine RSI with MACD to filter false signals.

Use Stochastic to fine-tune entry and exit points.

Always consider the overall market trend before making trades.

Example: Suppose USD/JPY is trending upward. RSI indicates overbought, MACD shows strong bullish momentum, and Stochastic gives a sell signal. A cautious trader might wait for confirmation before shorting, combining these indicators for safer trades.

Bottom Line

Understanding RSI, MACD, and Stochastic gives Forex traders a competitive edge. These tools are essential for identifying opportunities, managing risks, and making informed decisions across currency pairs like EUR/USD, GBP/JPY, and USD/CAD.

Stay ahead in Forex trading by mastering momentum indicators.

Join our FREE Forex workshop at GME Academy to learn practical strategies for using RSI, MACD, and Stochastic in live trading and boost your confidence in the Forex market.