This Christmas, Give Yourself the Gift of No Stress.

Christmas is for spending, but it can also be for growing. Discover 3 simple ways to enjoy the holidays while protecting your wallet and preparing for a brighter financial future.

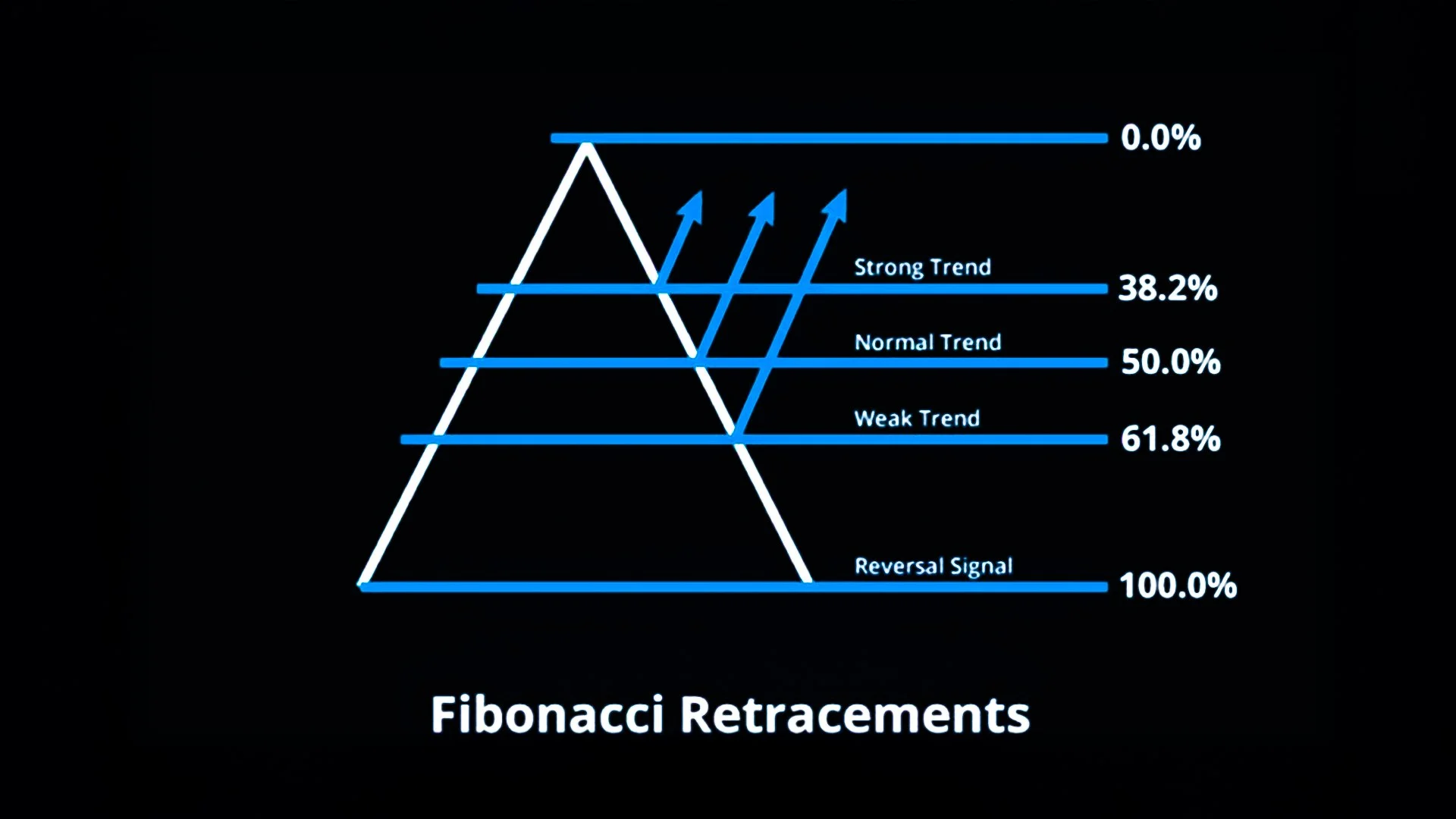

The Hidden Geometry of the Markets: How Fibonacci Retracements & Extensions Guide Smart Forex Traders

In Forex trading, price movements often look chaotic at first glance—but beneath the surface lies a rhythm that many traders rely on for clarity.

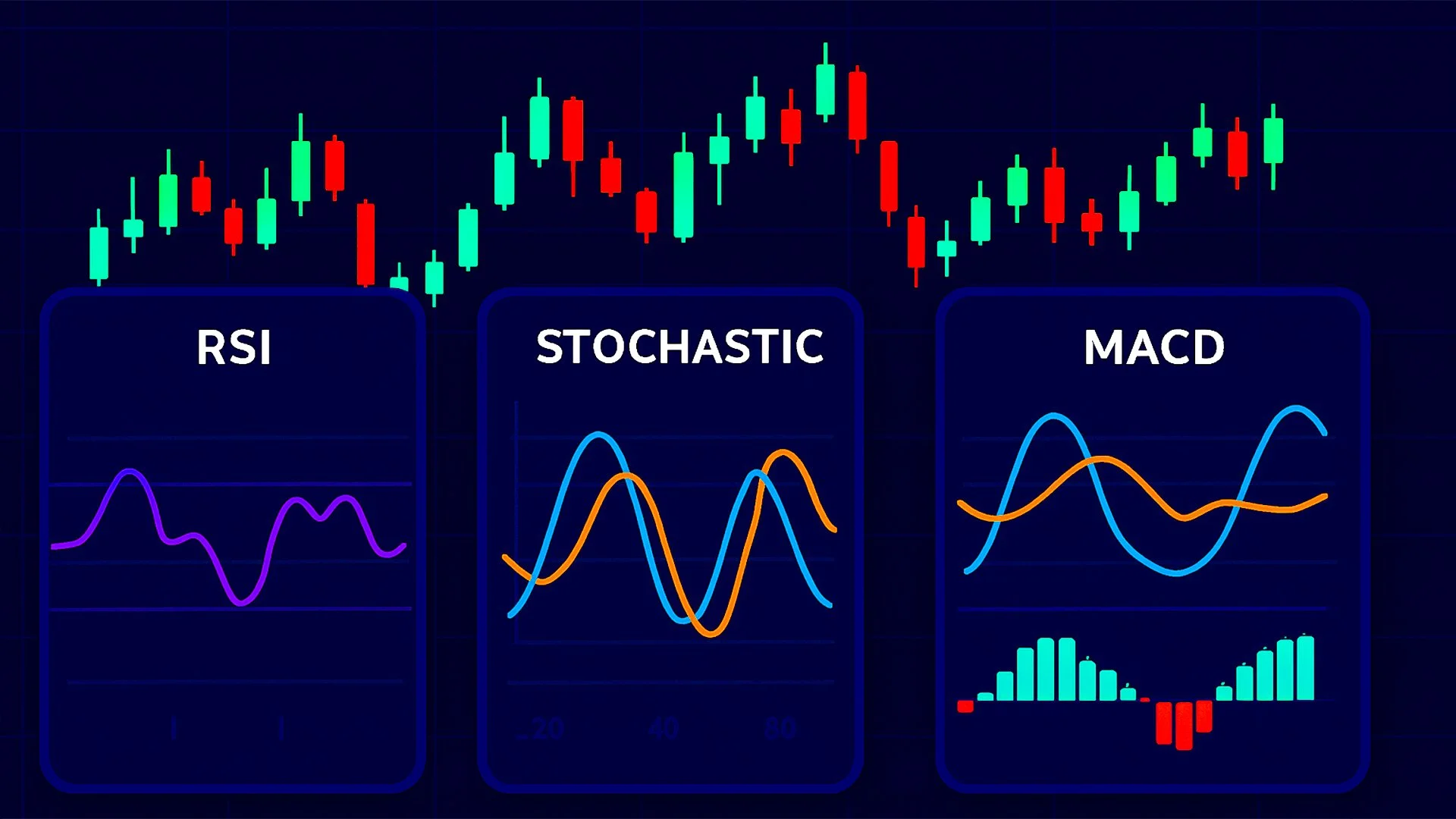

RSI, MACD, and Stochastic: Momentum Indicators Every Forex Trader Should Know

If you’re venturing into Forex trading, understanding market momentum is key to spotting opportunities before others do. Momentum indicators are technical tools that help traders gauge the strength of a currency pair’s price movement and anticipate potential reversals.

Understanding Safe Haven Currencies: How USD, JPY, CHF, and Gold Protect Traders in Volatile Markets

In the ever-changing world of Forex trading, understanding the concept of safe-haven assets is crucial. These are currencies and commodities that investors turn to in times of economic uncertainty, political tension, or global market turbulence.

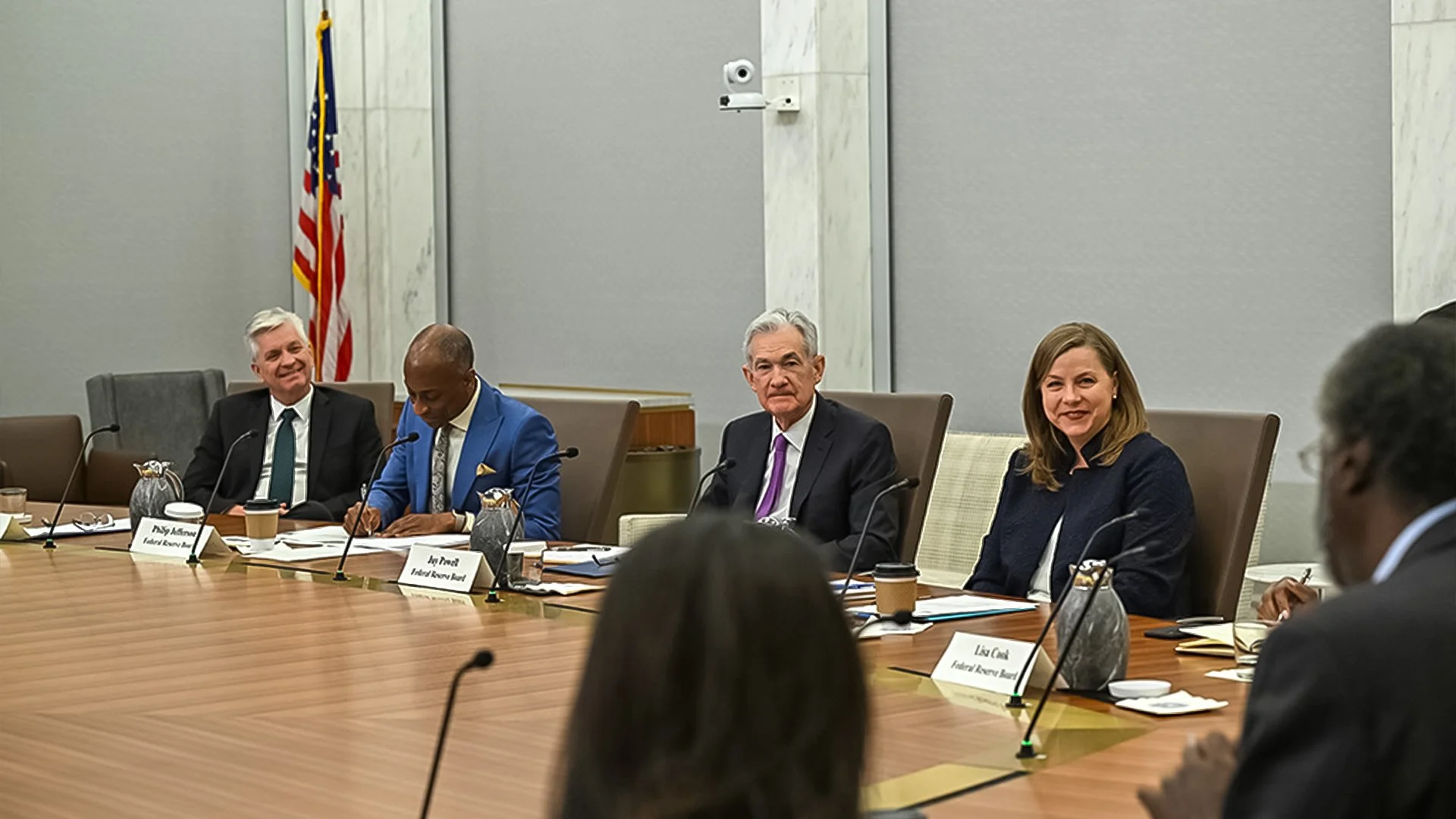

Trading Around Central Bank Announcements: FOMC, BOE, ECB, and BOJ Insights for Forex Traders

In the world of Forex trading, few events move the markets as dramatically as central bank announcements.

Elections and Forex: How Political Shifts Like Trump-Xi Meetings and Central Bank Changes Move Currency Markets

Elections are not just political milestones—they are major drivers of Forex market volatility. Traders monitor political developments closely because leadership changes and policy shifts can directly affect monetary policy, trade agreements, and international investment flows.

Never Miss a Market Move: How to Stay Updated with the Most Reliable Forex News Sources

In the fast-paced world of Forex trading, every second counts. A sudden policy shift from the U.S. Federal Reserve can send the USD soaring, while a surprise economic announcement from Japan could swing GBP/JPY in seconds.

The Trader’s Mindset: Turning Losses into Lessons

Every trader dreams of consistent profits — but the truth is, every successful Forex trader has also faced their fair share of losses.

In fact, what separates a winning trader from a losing one isn’t luck or fancy indicators — it’s mindset.

From Demo to Live: How to Master Fear and Build Discipline in Forex Trading

Transitioning from a demo account to live Forex trading is one of the biggest emotional and psychological hurdles traders face—especially for forex trading beginners.

Green Finance and Forex: How ESG and Environmental Policies Shape Global Currency Markets

In today’s evolving global economy, Environmental, Social, and Governance (ESG) standards have become a major factor influencing investor sentiment and international capital flows. What started as a framework for corporate responsibility has now become a financial driver—one that is reshaping how currencies behave in the global Forex market.

The Role of Institutional Traders vs. Retail Traders: Who Really Moves the Forex Market?

In the fast-moving world of Forex trading, not all players stand on equal ground. Some move billions of dollars in a single click, while others manage just a few hundred. Understanding who institutional traders are and how retail traders fit into the picture is essential for anyone serious about improving their trading strategy — especially Forex Trading beginners learning through platforms like GME Academy (Global Markets Eruditio).

From Practice to Profit: How to Integrate Demo Learning into Live Forex Trading

For every Forex trading beginner, the demo account is the first taste of the market. It’s where you learn how to open and close trades, read currency charts like EUR/USD or USD/JPY, and understand how leverage works—without risking real money.

The Truth About Forex Profits: Balancing Ambition and Risk for Long-Term Success

Many people enter Forex trading dreaming of instant wealth. The idea of turning a few hundred dollars into thousands overnight is exciting—but unrealistic. While the Forex market does offer incredible potential, it’s not a shortcut to riches. It’s a skill-based profession that rewards patience, strategy, and risk control.

Spot the Trap Before It Catches You: How to Avoid Common Forex Scams

The Forex market—the world’s largest financial market—is full of opportunities, but also full of traps. Every year, thousands of hopeful traders fall victim to scams that promise quick profits and guaranteed returns. For Forex trading beginners, these schemes can be devastating, wiping out savings and trust before their trading journey even begins.

Calm in the Chaos: Mastering Your Emotions in Forex Trading

In Forex trading, charts, numbers, and strategies matter—but the biggest challenge lies within yourself. Even the most skilled trader can make poor decisions when emotions take over. Fear, greed, frustration, and overconfidence are silent forces that can sabotage even the best trading plan.

Mastering Control in Chaos: How Stop-Losses and Take Profits Keep Forex Traders Ahead

In the fast-paced world of Forex trading, one rule separates beginners from consistent traders—risk management. Whether you’re analyzing EUR/USD, GBP/JPY, or USD/CAD, knowing when to exit a trade is just as important as knowing when to enter. This is where stop-losses, take profits, and position adjustments come in.

Riding the Storm: How to Handle Market Volatility Like a Smart Forex Trader

If there’s one thing every Forex trader must learn early on, it’s this: the market never stays still. Prices rise and fall every second — sometimes calmly, sometimes chaotically. This constant movement is called market volatility, and it’s both the opportunity and the risk that define Forex trading.

Day, Swing, or Long-Term? Discover Which Forex Trading Style Fits You Best

In Forex Trading, there’s no one-size-fits-all approach. Some traders thrive on fast-paced action, jumping in and out of trades within hours, while others prefer holding positions for weeks or even months. The key to long-term success lies in choosing a trading style that matches your personality, time availability, and risk tolerance.

Mastering the Pound: GBP Pair Trading Strategies That Work for Every Forex Beginner

When it comes to Forex Trading, few currencies attract as much attention as the British Pound (GBP) — often called the “Cable” in trading circles. Whether it’s GBP/USD, GBP/JPY, or EUR/GBP, traders around the world watch the Pound for its volatility, strong reaction to news, and deep liquidity.