The Hidden Geometry of the Markets: How Fibonacci Retracements & Extensions Guide Smart Forex Traders

In Forex trading, price movements often look chaotic at first glance—but beneath the surface lies a rhythm that many traders rely on for clarity. One of the most widely used tools in technical analysis is Fibonacci retracements and extensions, a method rooted in simple ratios that appear consistently in nature, architecture, and yes—even in Forex markets.

Whether you’re trading major currency pairs like EUR/USD, GBP/JPY, USD/CAD, or exotic pairs, Fibonacci levels help traders anticipate where the market might stall, reverse, or accelerate. This makes them especially valuable for Forex trading for beginners who are still building structure in their analysis process.

https://images.squarespace-cdn.com/content/619b666b5842697e2af69258/a9d57b27-4fad-4532-874a-89133d6a85bc/P477.02.jpg?content-type=image%2Fjpeg

https://images.squarespace-cdn.com/content/619b666b5842697e2af69258/a9d57b27-4fad-4532-874a-89133d6a85bc/P477.02.jpg?content-type=image%2Fjpeg

Why Fibonacci Matters in Forex: The Logic Behind the Levels

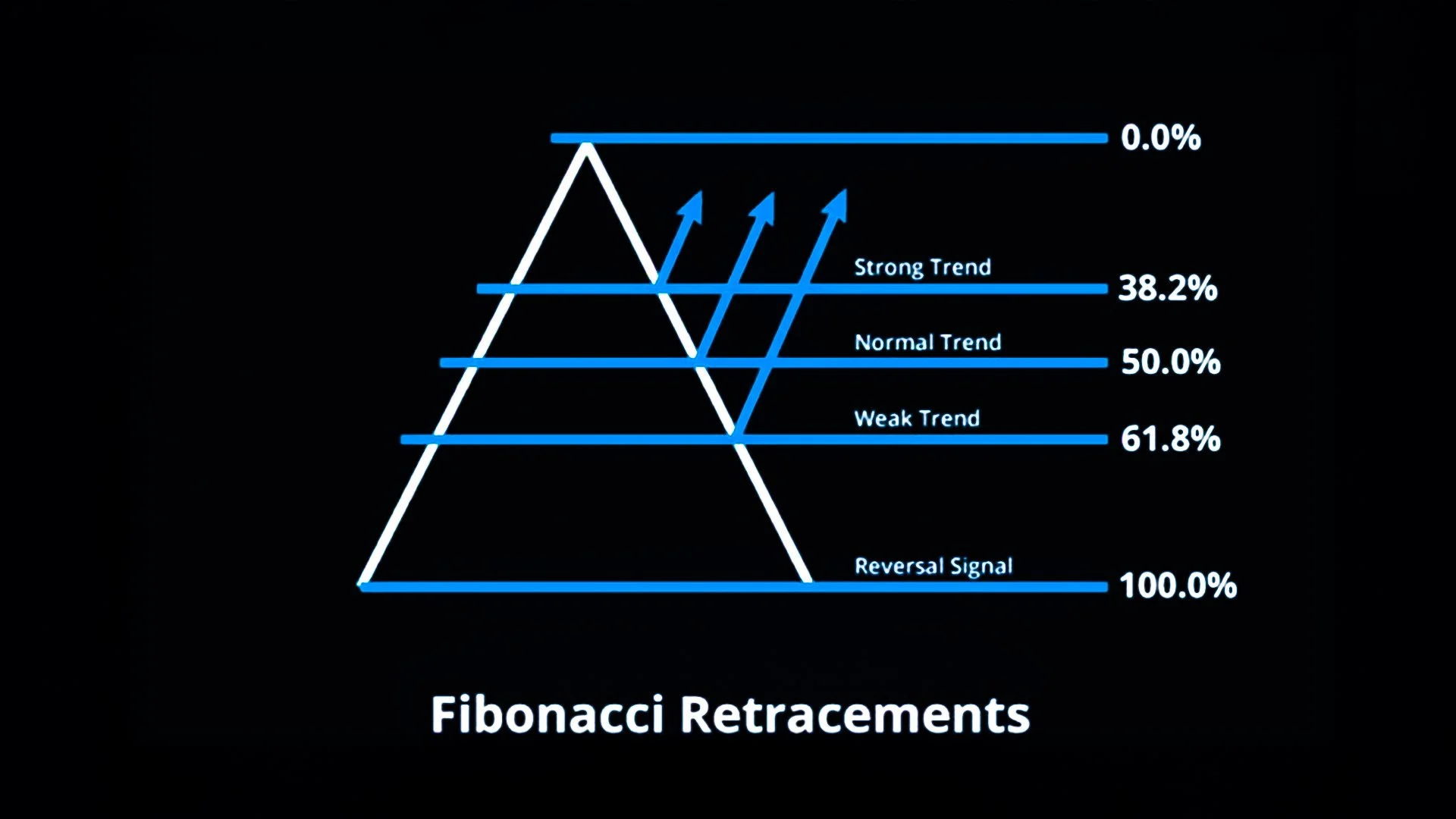

Fibonacci ratios come from the famous number sequence discovered by Leonardo Fibonacci. The sequence creates proportional relationships—such as 38.2%, 50%, and 61.8%—that seem to occur naturally in market cycles. In Forex trading, these ratios help traders pinpoint where a price correction might end during a trend.

When a currency pair trends upward or downward, it rarely moves in a straight line. Instead, it “breathes,” pulling back before continuing. Fibonacci retracements give traders a map of the most likely areas where buyers or sellers might re-enter the market.

This tool is especially relevant for volatile pairs like GBP/JPY or USD/CAD, where retracements can help catch early entries during news events, economic releases, or momentum reversals.

The Power Levels: Understanding Fibonacci Retracements

Retracements measure pullbacks during a trend. The typical levels plotted on a trading chart include:

23.6% – Shallow correction, often during strong trends

38.2% – Moderate correction where momentum remains intact

50% – Not technically Fibonacci but widely used due to market psychology

61.8% – The “Golden Ratio,” the most watched level

78.6% – Deep retracement, often hinting at a potential reversals

A common strategy in Forex trading is to wait for the price to pull back to one of these levels and then look for confirmation signals—such as candlestick patterns or support/resistance confluence—before entering a trade.

Example:

If EUR/USD rallies strongly on ECB sentiment but retraces to the 38.2% or 50% level, traders often watch those zones for a continuation setup—as long as the market structure remains bullish.

Beyond Pullbacks: Fibonacci Extensions for Take-Profit Mastery

While retracements help you enter the trend, Fibonacci extensions help determine where to exit.

Extension levels such as:

127.2%

161.8%

200%

…act as potential take-profit zones during strong trending moves.

In a bullish trend, if USD/CAD retraces to the 50% level and resumes upward momentum, traders often mark the 127.2% or 161.8% extension as places where the trend might exhaust temporarily. These levels help avoid emotional exits and provide structure in trade management.

Extensions are especially powerful during major fundamental catalysts—NFP, CPI, rate decisions—where price can break through old highs or lows and run into projected Fibonacci territory.

How Beginners Can Safely Start Using Fibonacci in Forex Trading

For new traders, Fibonacci is most effective when combined with:

Market structure

Identify higher highs and higher lows (uptrend) or lower highs and lower lows (downtrend).

Support and resistance zones

Look for confluence between a Fibonacci level and historical price reactions.

Candlestick confirmation

Rejections, engulfing candles, or pin bars give added validation.

Risk management

Use stops below/above the next key Fibonacci or structure level to reduce risk.

At Global Markets Eruditio (GME Academy), we teach students how to integrate Fibonacci tools with trend analysis, market psychology, and high-probability setups—giving Forex beginners a more structured and disciplined approach to trading.

Fibonacci Isn’t Magic—It’s A Map

Fibonacci doesn’t predict the future, but it helps you understand where opportunities are likely to appear. It gives structure to market chaos, confidence in your entries, and logic to your take-profit targets.

If you want to unlock the full power of Fibonacci levels and apply them to Forex pairs like EUR/USD, USD/JPY, and GBP/JPY with precision, it’s time to level up your skills.

Ready to Become a More Confident Forex Trader?

Join our FREE Forex Workshop at GME Academy and learn how professional traders use Fibonacci and other tools to master the markets.