Which Broker Model is Right for You? STP vs. ECN vs. Market Maker

In the Forex world, your broker is more than just a platform; they are your bridge to the global market. However, not all bridges are built the same. The way a broker executes your trades—and how they make their money—can significantly impact your profitability and trading experience.

At the GME Academy, we believe that transparency is the foundation of a professional trader. Understanding the "plumbing" of your broker helps you avoid hidden costs and conflicts of interest.

https://images.squarespace-cdn.com/content/619b666b5842697e2af69258/a9d57b27-4fad-4532-874a-89133d6a85bc/P477.02.jpg?content-type=image%2Fjpeg

https://images.squarespace-cdn.com/content/619b666b5842697e2af69258/a9d57b27-4fad-4532-874a-89133d6a85bc/P477.02.jpg?content-type=image%2Fjpeg

1. Market Maker (Dealing Desk - DD)

A Market Maker literally "makes the market" for you. When you want to buy, they sell to you; when you want to sell, they buy from you. They do not necessarily pass your orders to the interbank market.

How they profit: They earn through the spread and, most notably, from trader losses. Because they take the other side of your trade, your loss is their gain (the "B-Book" model).

Execution: Usually offers fixed spreads and guaranteed fills, but you may experience "requotes" during high volatility.

Best for: Beginners with small accounts who need stability and low minimum deposits.

2. STP (Straight Through Processing)

STP brokers are the "delivery service" of the Forex world. They take your order and pass it directly to their pool of Liquidity Providers (big banks like JP Morgan, Deutsche Bank, or other brokers).

How they profit: They add a small markup to the spread they receive from the banks. If the bank offers a spread of 0.2 pips, the STP broker might show you 0.8 pips.

Execution: Faster than Market Makers with fewer requotes. Spreads are usually variable, meaning they get tighter or wider depending on market conditions.

Best for: Intermediate traders who want market-based pricing without the complexity of a full ECN environment.

3. ECN (Electronic Communications Network)

An ECN broker provides a digital "hub" where your orders interact directly with other market participants, including banks, hedge funds, and other retail traders. You see the "Raw Spread" exactly as it exists in the interbank market.

How they profit: Because the spreads are "Raw" (sometimes as low as 0.0 pips), ECN brokers do not make money on the spread. Instead, they charge a fixed commission per trade.

Execution: The most transparent and fastest execution. There is zero conflict of interest because the broker is simply a neutral facilitator.

Best for: Professional traders, scalpers, and high-volume institutional players.

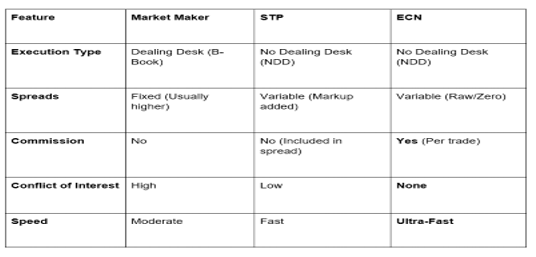

Comparison at a Glance

https://images.squarespace-cdn.com/content/619b666b5842697e2af69258/a9d57b27-4fad-4532-874a-89133d6a85bc/P477.02.jpg?content-type=image%2Fjpeg

https://images.squarespace-cdn.com/content/619b666b5842697e2af69258/a9d57b27-4fad-4532-874a-89133d6a85bc/P477.02.jpg?content-type=image%2Fjpeg

The GME Academy Analysis: "Follow the Money"

At Global Markets Eruditio, we often tell our students: If you aren't paying a commission, you are likely trading with a Market Maker. While this isn't always bad, you must be aware that a Market Maker profits when you lose.

For those serious about long-term success, moving toward an STP or ECN model is often the natural evolution. These models align the broker’s interests with yours: they want you to stay profitable so you keep trading, and they keep earning their small fee or commission.

Are You Uncertain About Your Broker's Model?

Check your trading platform. If you see "Level II" pricing or an "Order Book," you are likely in an ECN environment. If you never see a price change during a news event, you are likely with a Market Maker.

Join our FREE "Broker Transparency" Webinar

Learn how to test your broker’s execution speed and how to calculate if a "Commission" account is actually cheaper for you than a "Spread-only" account. We’ll help you find the right home for your capital.