The 4 PM Rush: Navigating the Month-End Fix (WM/Reuters)

If the "January Effect" is a seasonal breeze, the Month-End Fix is a recurring hurricane. In the Forex world, no single hour is more scrutinized than the 4 PM London Fix (officially the WM/Reuters Closing Spot Rate) on the last trading day of the month.

At the GME Academy, we call this "The Institutional Hour." For a few frantic minutes, the world's largest banks and asset managers flood the market with orders to reconcile trillions of dollars in global portfolios. If you’ve ever wondered why a currency pair suddenly jumps or dives at the end of a quiet Friday, you’ve likely seen the Fix in action.

1. What is the "Fix" (WM/Reuters)?

The WM/Reuters benchmark is the global standard used by pension funds, insurance companies, and index providers (like MSCI and FTSE) to value their assets.

The Methodology: The "Fix" isn't a single price point. Since 2015, it has been calculated as the median rate of actual trades captured during a 5-minute window (2.5 minutes before and after 4:00 PM GMT).

The Purpose: It allows a fund manager in New York and a treasurer in Tokyo to say, "We are using the exact same exchange rate to value our Euro-denominated bonds today." This eliminates "tracking error" in global performance reporting.

2. Why the "Month-End" Fix is Different

While there is a fix every day, the Month-End Fix is a beast of a different color. This is when institutional rebalancing hits its peak.

Portfolio Hedging: If a US-based fund owns German stocks and the Euro has risen by 5% over the month, that fund is now "over-hedged" or has a larger currency exposure than its mandate allows. They must sell EUR at the fix to bring their exposure back in line.

The "Weight of Money" Effect: Because these funds must trade at the fix to match their benchmarks, they often submit "at-best" orders to banks. This creates a massive imbalance of supply and demand. If the collective "herd" of asset managers needs to sell the Australian Dollar, the price will often trend lower in the 30 minutes leading up to 4 PM, regardless of the news.

3. The 2026 Landscape: Volatility and "Weaponized" Liquidity

In February 2026, the Fix has become even more volatile due to a "fragmented" liquidity environment.

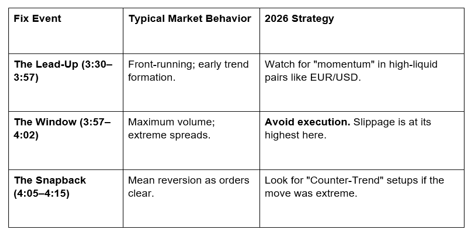

The 4 PM Spikes: Statistical analysis from Raidne and The Full FX in early 2026 shows that currency moves in the 15 minutes before the Fix fall in the 95th percentile of normal volatility.

The "Flash Reversal": A common pattern in 2026 is the Post-Fix Snapback. Because the move into the fix is driven by temporary "forced" orders, the price often snaps back to its original level by 4:15 PM once the institutional demand is satisfied.

https://images.squarespace-cdn.com/content/619b666b5842697e2af69258/a9d57b27-4fad-4532-874a-89133d6a85bc/P477.02.jpg?content-type=image%2Fjpeg

https://images.squarespace-cdn.com/content/619b666b5842697e2af69258/a9d57b27-4fad-4532-874a-89133d6a85bc/P477.02.jpg?content-type=image%2Fjpeg

4. Impact on Emerging Markets (PHP, MXN, BRL)

While the Fix is a London/New York phenomenon, its "ripples" reach the Philippines.

The USD/PHP Link: When global funds rebalance their emerging market ETFs at month-end, they often liquidate "Exotic" currencies to move back into the USD. This frequently results in a Friday afternoon surge in USD/PHP, as local liquidity thins out just as global demand for the Dollar spikes.

The GME Academy Analysis: "Don't Get Fixed by the Fix"

At Global Markets Eruditio, we treat the Month-End Fix as a period of "Maximum Danger" for retail traders.

Trader's Takeaway for 2026:

Flatten Your Book: Unless you are specifically trading a "Fix Reversal" strategy, it is often best to close your intraday positions by 3:30 PM London Time on the last day of the month.

Watch the "Wind Direction": Pay attention to equity markets during the month. If global stocks have rallied 10%, assume there will be massive USD buying (selling of foreign currencies) at the fix as funds rebalance their currency hedges.

Beware of Slippage: In the 2026 market, liquidity can vanish during the 5-minute window. If you leave a "Stop Loss" too tight during the fix, you may find yourself filled 20–30 pips away from your intended price.

Join our FREE Forex Workshop at Global Markets Eruditio!

Want to see the "Institutional Footprint" in real-time? We’ll show you how to read Time & Sales data during the March 2026 month-end and teach you the "Siren Fix" strategy to capitalize on price reversals.