Stability in the Storm: Decoding the Bessent-Katayama Meeting

In the high-velocity world of Forex trading, a single meeting between two finance titans can set the tone for the entire quarter. On January 12, 2026, U.S. Treasury Secretary Scott Bessent met with Japanese Finance Minister Satsuki Katayama in Washington. While the official readout was professional and diplomatic, the subtext carries massive weight for anyone trading the US Dollar (USD) or the Japanese Yen (JPY).

At Global Markets Eruditio, we specialize in helping traders look past the headlines to find the "market movers." This meeting wasn't just about handshakes; it was a strategic alignment on energy security, global taxation, and, most importantly, the stability of the exchange rate.

Critical Minerals: The New Frontier of Sovereignty

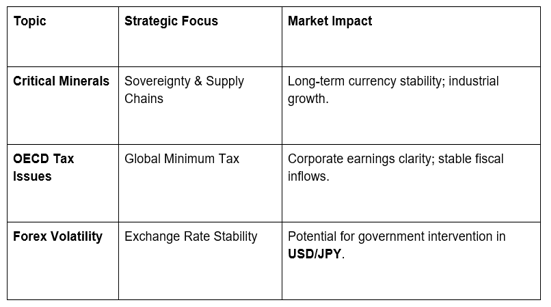

A primary focus of the meeting was the United States’ critical minerals summit. Secretary Bessent emphasized "critical minerals sovereignty"—a term that every Forex trader should keep in their vocabulary.

In the modern economy, critical minerals like lithium and cobalt are the fuel of the future. By strengthening the U.S.-Japan alliance in this sector, both nations are working to reduce dependence on external supply chains. For a trader, this signifies a long-term shift in industrial power. When these two economic giants collaborate on resource security, it strengthens the fundamental "backbone" of their respective currencies, making the USD/JPY pair a focal point for long-term investors.

Addressing the Elephant in the Room: JPY Volatility

Perhaps the most significant part of the readout for Forex trading for beginners is the discussion on exchange rates. The Secretary noted the "inherent undesirability of excess exchange rate volatility."

In late 2025 and early 2026, the Yen has faced significant pressure, recently sliding past the ¥158 mark against the US Dollar. When treasury officials talk about "excess volatility," it is often a coded warning to speculators.

The Message: The U.S. and Japan are watching the charts.

The Action: Secretary Bessent’s emphasis on "sound formulation and communication of monetary policy" is a gentle nudge to the Bank of Japan (BoJ) to ensure their plans are clear to the market to avoid "one-sided" moves.

The U.S.-Japan Alliance and Global Taxation

Secretary Bessent also expressed appreciation for Japan’s engagement on OECD global minimum tax issues. While this might seem like "boring" accounting, it is crucial for Forex traders. Global tax harmony reduces "capital flight" and creates a more predictable environment for multinational corporations.

When the USD and JPY are backed by stable, coordinated tax policies, it reduces the risk of sudden, erratic market shifts. This "positive engagement" signals that the alliance is as strong as ever, reinforcing the U.S. Dollar’s status as the world’s primary reserve currency and the Yen’s role as a vital regional anchor.

Why This Readout Matters to You

As a student of GME Academy, you know that "Fundamental Analysis" is the art of reading between the lines. The Bessent-Katayama meeting suggests that while the Yen has been weak, the U.S. Treasury is not ignoring the situation. The call for "sound communication" suggests we may see more coordinated efforts to prevent a total collapse of the Yen, which could create massive opportunities in currency pairs like EUR/JPY or GBP/JPY.

Discipline in trading means waiting for these fundamental "anchors" to provide a clear direction. Whether it's news from the US Dollar or the Canadian Dollar (CAD), your success depends on your ability to synthesize this information into a plan.

Build Your Strategy with the Experts

Are you ready to turn geopolitical news into a profitable trading plan? The world of high-level finance doesn't have to be a mystery. At Global Markets Eruditio, we take the complex and make it actionable.

Join our FREE Forex Workshop! We will dive deeper into the U.S.-Japan relationship, the impact of interest rate differentials, and how you can protect your capital during times of high volatility. Don't let the market surprise you—be the one who saw it coming.