The Waiting Game: Why the Supreme Court’s Silence on Tariffs Matters for Traders

In the world of Forex trading, sometimes the most significant news is the news that doesn’t happen. On Wednesday, January 14, 2026, the financial world held its breath as the U.S. Supreme Court released a batch of opinions. Investors were looking for one specific verdict: the legality of the sweeping global tariffs imposed by the current administration.

However, the gavel never fell on the tariff case. The Supreme Court issued three decisions on unrelated matters but remained silent on the "National Security" trade duties that have reshaped global commerce over the last year. At Global Markets Eruditio, we understand that this prolonged uncertainty is more than just a legal footnote—it is a primary driver of market volatility.

The High Stakes of the "IEEPA" Challenge

The case before the Court, Learning Resources v. Trump, challenges the use of the 1977 International Emergency Economic Powers Act (IEEPA) to implement broad, "reciprocal" tariffs. These levies, ranging from 10% to 50% on almost all major trading partners, were enacted to address trade deficits and secure domestic supply chains.

The legal question is simple but profound: Does the President have the authority to bypass Congress and impose global taxes by declaring a national emergency? Lower courts have already ruled that the administration overstepped its bounds. If the Supreme Court agrees, the government might be forced to refund billions of dollars in collected revenue—a scenario the President has warned would be a "complete mess" and a "terrible blow" to the US economy.

Market Impact: USD and the "Petro" Currencies

For those engaged in Forex trading for beginners, it is crucial to understand how this legal delay affects currency pairs.

US Dollar (USD) Strength: The USD often acts as a safe haven during trade uncertainty. As long as the Court delays its ruling, the threat of continued or even escalated tariffs remains, which ironically can keep the Greenback strong as investors exit riskier emerging market currencies.

The Canadian Dollar (CAD) and Mexico: The "reciprocal" nature of these tariffs has hit our closest neighbors hard. The CAD has been particularly sensitive, as the President recently labeled the USMCA agreement "irrelevant" due to the new tariff regime. Until the Court rules, the USD/CAD pair will likely remain in a state of high-alert tension.

Cross-Economy News: Pairs like EUR/USD and GBP/JPY are also reacting to the silence. European exporters are operating in a "limbo" state, unsure if their current pricing models will be viable next month.

Why "No News" is a Trading Signal

At GME Academy, we teach that a lack of a ruling is a signal in itself. It tells us that the justices—who appeared skeptical of the tariffs' legal basis during November’s oral arguments—are likely engaged in a complex debate over the limits of executive power.

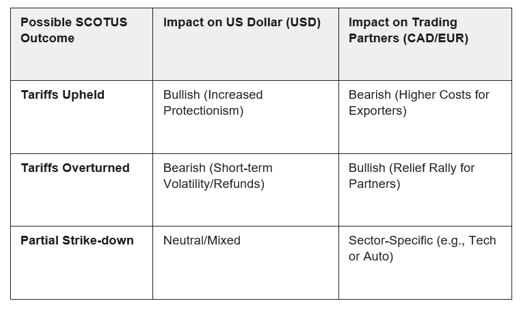

For the disciplined trader, this means maintaining strictly managed positions. Entering a heavy trade on the US Dollar right now is a gamble on a court's secret deliberations. A ruling against the tariffs could see a sharp, sudden correction in the USD, while a ruling in favor could ignite a fresh wave of trade-war sentiment.

Navigating Policy Shifts with GME Academy

The delay by the Supreme Court serves as a reminder that the markets are inextricably linked to the law. Whether you are trading the US Dollar, the Canadian Dollar, or looking at the USD/PHP record lows, you must have a plan that accounts for geopolitical "wild cards."

At Global Markets Eruditio, we don't just teach you how to read a candlestick chart; we teach you how to read the world. Our curriculum is designed to help you stay calm and profitable even when the highest court in the land remains silent.

Master the Art of Informed Trading

Are you ready to stop reacting to the news and start anticipating the market? Trade uncertainty is a risk for the unprepared, but it is an opportunity for those with the right education.

Join our FREE Forex Workshop! We will break down the potential "post-SCOTUS" scenarios and show you exactly how to position your portfolio for the coming volatility. Don't wait for the gavel to fall—get ahead of the move today.