The Pulse of Protectionism: High-Stakes Executive Actions and the Iran Pivot

In a whirlwind week for global markets, the White House has unleashed a series of executive maneuvers that have traders recalibrating everything from tech stocks to geopolitical risk premiums. President Donald J. Trump has moved aggressively to reshape the American industrial landscape, signing a landmark proclamation on critical minerals and a targeted tax on high-end semiconductors.

At Global Markets Eruditio, we analyze these shifts not just as political headlines, but as the fundamental triggers that move the US Dollar (USD) and influence the world's most liquid currency pairs. For the student of Forex trading, understanding the link between executive power and market volatility is essential for long-term success.

Securing the "New Oil": The Critical Minerals Proclamation

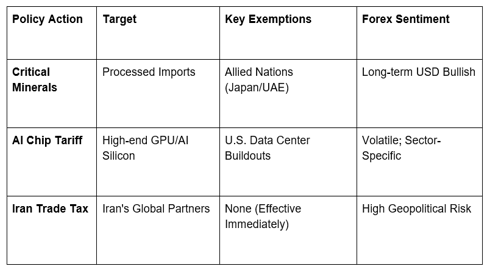

On January 14, 2026, President Trump signed a Proclamation pursuant to Section 232 of the Trade Expansion Act, targeting processed critical minerals and their derivative products (PCMDPs). This action isn't just about mining; it's about sovereignty.

The administration is now directing the U.S. Trade Representative to negotiate "price floors" and supply agreements with allies like Japan and the United Arab Emirates (UAE). By aiming to eliminate the "threat to national security" posed by reliance on foreign adversaries for minerals like lithium and cobalt, the U.S. is signaling a massive shift in industrial policy.

The 25% "Chip Tax": Precision Protectionism

In a move that sent shockwaves through the tech-heavy NASDAQ and the US Dollar index, the President also signed an action imposing a 25% tariff on high-end AI chips, specifically mentioning hardware like Nvidia’s H200 and AMD’s MI325X.

However, in true Forex trading for beginners fashion, the "devil is in the details." The action includes strategic carve-outs for chips imported to build out U.S. data centers or domestic manufacturing capacity.

The Goal: To force semiconductor giants to onshore production.

The Result: Immediate pressure on the Canadian Dollar (CAD) and other trade-dependent currencies as the U.S. signals a more "closed-loop" tech economy.

The Iran Pivot: De-escalation or Deep Breath?

Perhaps the most surprising turn came from the Oval Office late Wednesday. After days of escalating military threats and the announcement of a 25% tariff on any country doing business with Tehran, President Trump suggested a pause in hostilities.

"I’ve been told the killing in Iran is stopping," the President remarked, citing "good authority" that the planned executions of protesters have been halted. While the U.S. has yet to verify these claims, the immediate threat of a military strike appears to have cooled.

In the Forex world, this "news on Iran" provided a brief sigh of relief for the EUR/USD and GBP/JPY, which typically suffer during Middle Eastern instability. However, with the administration still "watching and seeing," the risk premium remains high. At GME Academy, we remind our traders that geopolitical "pauses" are often the calm before a new volatility storm.

Trading the Headlines with Discipline

At Global Markets Eruditio, we teach that news is the "fuel," but your strategy is the "engine." When the President signs an executive action on critical minerals, the impulsive trader gambles; the disciplined trader analyzes the long-term impact on the US Dollar and prepares for the shift.

Whether it’s the record lows of the Philippine Peso (PHP) or the sudden tariffs on AI chips, the global economy is in a state of constant flux. Your ability to maintain a consistent routine amidst this noise is what will define your career as a trader.

Master the New Economic Era

The world of 2026 is moving faster than ever. From trade wars to mineral sovereignty, the old rules of the market are being rewritten in real-time. If you want to learn how to navigate these high-stakes headlines without losing your shirt, we invite you to learn from the best.

Join our FREE Forex Workshop this weekend! We will break down the latest executive actions, the Iran situation, and how to position your portfolio for a strong USD environment. Take control of your financial education and turn global volatility into your greatest advantage.