Steady Hands in Frankfurt: ECB Holds Rates as Eurozone Hits a "Good Place"

At its first meeting of 2026 on February 5, the European Central Bank (ECB) Governing Council decided to keep its key interest rates unchanged for the fifth consecutive time. The decision reflects a central bank that is confident in its current trajectory, even as global trade tensions and a surging Euro introduce new variables into the inflation equation.

For the GME Academy, the ECB's "wait-and-see" stance is a textbook example of a central bank reaching its Terminal Rate—the level where policy is neither strictly stimulative nor overly restrictive.

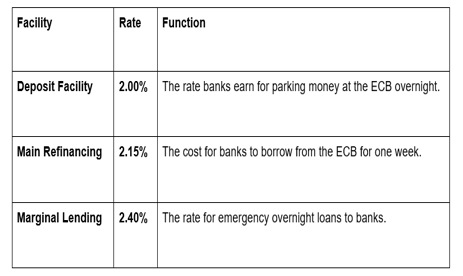

1. The Rate Freeze: Policy at a Glance

The ECB maintained its trio of benchmark rates at levels that have been in place since mid-2025.

2. The "Good Place" Narrative

ECB President Christine Lagarde reiterated that the Eurozone's monetary policy is in a "good place." This confidence stems from several stabilizing factors:

Inflation Progress: Headline inflation in the Eurozone cooled to 1.7% in January 2026, falling below the 2% target for the first time in over a year.

Economic Resilience: Despite global headwinds, the Eurozone grew by 0.3% in Q4 2025. Growth is being fueled by low unemployment and a gradual rollout of public spending on defense and infrastructure, particularly in Germany.

Private Sector Strength: Households and firms have emerged from the high-inflation era with solid balance sheets, preventing a deeper recession.

3. The New Challenges: Tariffs and the Surge of the Euro

While the internal metrics look good, the "Challenging Global Environment" mentioned in the ECB statement refers to two major external pressures:

A. The "Trump Effect" and Trade Tariffs

Renewed trade policy uncertainty from the U.S. has cast a shadow over European exporters. Higher tariffs make European goods more expensive in the American market, potentially slowing growth in the industrial heartlands of France and Italy.

B. The Strong Euro (Importing Deflation)

The Euro has recently surged to a four-year high, crossing the $1.20 mark against the U.S. Dollar.

The Benefit: A stronger Euro makes energy and imported goods cheaper, helping keep inflation low.

The Risk: If the Euro stays too strong for too long, it could push inflation dangerously low (below 1.5%), potentially forcing the ECB to restart its rate-cutting cycle later in 2026 to avoid a deflationary trap.

4. Quantitative Tightening: Shrinking the Balance Sheet

The ECB confirmed that it is continuing to shrink its massive bond portfolios (APP and PEPP). By not reinvesting the principal from maturing bonds, the Eurosystem is effectively removing liquidity from the financial system at a "measured and predictable pace." This ensures that the stimulus from the pandemic era is fully unwound.

The GME Academy Analysis: "Data-Dependent, Not Pre-Committed"

At Global Markets Eruditio, we highlight the phrase "meeting-by-meeting approach." By refusing to pre-commit to a rate path, the ECB is keeping its options open.

How to Position Your Portfolio:

EUR/USD Strategy: The Euro’s strength is currently driven more by "Dollar Weakness" than ECB policy. Traders should watch the $1.22 resistance level—if the Euro breaks higher, the ECB may have to use "verbal intervention" to talk the currency down.

European Equities: With rates stable at 2%, sectors like Construction and Real Estate are beginning to recover as mortgage costs stabilize.

The "Insurance Cut" Watch: Watch the March 19 meeting. If the Euro continues its rally, look for "Dovish" members of the Council to start pushing for an "insurance rate cut" to protect exporters.

Join our FREE ECB Strategy Session

Learn how to analyze Eurostat HICP Data before the ECB meets. We’ll show you the exact indicators that signal when the ECB is about to shift from a "Hold" to a "Cut" and how to hedge your Euro-denominated assets.