The $1.2 Trillion Rebuff: How China’s Trade Engine Outran the Tariff War

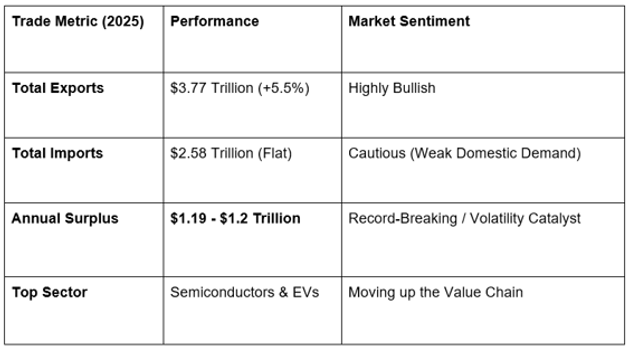

In the high-stakes chess match of global commerce, many predicted that the return of aggressive trade policies would checkmate the world’s second-largest economy. Instead, the data tells a different story. In 2025, China’s trade surplus didn't just survive—it soared to a staggering record of $1.2 trillion, proving that the "Made in China" engine is more adaptable than ever.

At Global Markets Eruditio, we analyze these seismic shifts not just as headlines, but as the fundamental forces that dictate the value of the US Dollar (USD) and the Chinese Yuan (CNY). For those engaged in Forex trading for beginners, this record-breaking surplus is a masterclass in market diversification and currency resilience.

Diversify to Defy: Bypassing the US Market

While shipments to the United States faced a deepening contraction last year due to heightened tariffs, Chinese factories successfully executed a "pivot" to the rest of the world. By making deeper inroads into Southeast Asia (ASEAN), Africa, and Europe, China effectively offset the slump in US-bound sales.

Market Agility: December saw a 6.6% jump in exports, the quickest growth in three months.

The Front-Loading Effect: Much of the year was characterized by "front-loading," where businesses rushed orders to beat potential policy changes.

Value Chain Evolution: China is no longer just the "world's factory" for toys and shoes. The surplus was driven by high-end goods like semiconductors (up 26.8%), electric vehicles (EVs), and sophisticated machinery.

The Forex Ripple: Yuan Strength and USD Dynamics

A record trade surplus of this magnitude has profound implications for the Forex market. Traditionally, a massive surplus puts upward pressure on a nation's currency because foreign buyers must purchase that currency to pay for goods.

As we move into 2026, the Offshore Yuan (CNH) has shown remarkable strength, recently breaking the psychological 7.00 barrier against the US Dollar.

USD/CNH Outlook: With the surplus reaching the size of a top-20 global economy’s GDP, the Yuan is becoming an increasingly attractive store of value.

The Deflation Dilemma: While the surplus is "bullish" for the Yuan, Beijing faces a challenge. A currency that is too strong can make exports more expensive and worsen domestic deflation.

Beyond the Border: Supply Chain Shifts

One of the most fascinating takeaways from the 2025 data is how China is exporting its industrial capacity. As Chinese firms invest in factories in Southeast Asia and Mexico to bypass tariffs, they are driving a secondary boom: the export of Chinese components and equipment to those new facilities.

For a trader, this means watching currency pairs like USD/CAD or EUR/USD isn't enough. You must understand the "triangular trade" between China, emerging markets, and the final consumer. This complexity is why Forex trading remains one of the most intellectually stimulating—and rewarding—endeavors in finance.

Navigating the New Global Order with GME

At GME Academy, we believe that the best traders are those who understand the "Why" behind the "What." China’s $1.2 trillion surplus is a signal that the global trade landscape has fundamentally changed. The old rules of US-centric trade are being rewritten by a more diversified, high-tech global network.

Whether you are looking to trade the USD, the Yen, or the Canadian Dollar, your success depends on your ability to synthesize these global shifts into a disciplined trading plan.

Ready to Trade with Global Insight?

The markets wait for no one. As China's trade dominance continues to shift the value of the US Dollar and the Yuan, are you prepared to capitalize on the volatility?

Join our FREE Forex Workshop! At Global Markets Eruditio, we bridge the gap between complex global news and actionable trading strategies. Learn how to read trade data, manage your risk, and master the world's most traded currency pairs.